Home ›› 25 Nov 2021 ›› Front

The amount of default loans in state-owned banks continue to rise at a steady pace, and eight government banks now account for 47 per cent of Bangladesh’s total defaulted loans.

According to a latest Bangladesh Bank report, the country’s banking sector recorded default loans amounting to Tk 1,01,150 crore at the end of September this year, and of that figure, Tk 47,632 crore are from the eight state-owned banks.

This is an increase from Tk 47,520 crore in default loans recorded last June.

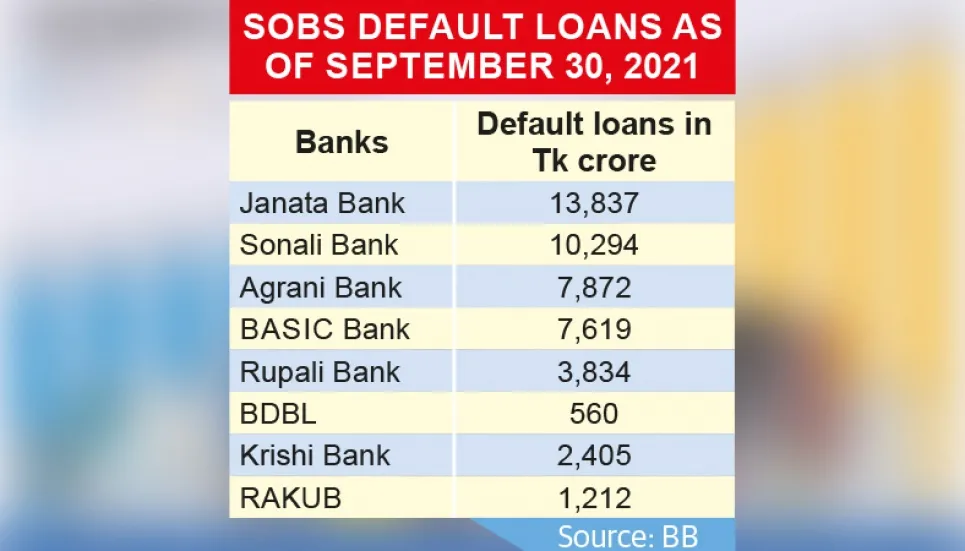

The report further shows that Janata Bank is at the top of this list among six state-owned commercial banks with Tk 13,837.17 crore in default loans as of September this year, which is 22.29 per cent of its total loans.

Sonali Bank comes next, showing Tk 10,293.85 crore in default loans, which is 18 per cent of its total loans. Agrani Bank is at the third position with Tk 7,871.83 crore in default loans, which is 15.37 per cent of its total loans.

Similarly, Basic Bank and Rupali Bank recorded Tk 7,619.26 crore and Tk 3,834.65 crore in default loans respectively. The Bangladesh Development Bank recorded Tk 559.92 crore in default loans, which is 28.07 per cent of its total loans.

According to the central bank report, Bangladesh Krishi Bank recorded the highest amount of default loans among the state-owned specialised banks, reaching Tk 2,405 crore as of September this year, which is 10 per cent of its total loans.

Rajshahi Krishi Unnayan Bank recorded Tk 1,211.88 crore in default loans in the same period, which is 19.29 per cent of the bank’s total loans.

The Business Post reached out to the managing directors of Sonali, Janata and Agrani banks for comments on the rising default loans, but all three officials declined to address the issue.

A Bangladesh Bank official, on condition of anonymity, said, “In most cases, the state-owned banks disburse loans under political consideration. This has been done a lot in the past, and such debtors have a tendency to default on their loans.

“This is why the volume of defaulted loans is high in the state-owned banks.”

Addressing the issue, Bangladesh Bank’s Executive Director and Spokesperson Serajul Islam said, “Special directives have been issued to slash the number of excessive default loans, and deficits in capital and provision.

“The central bank has also directed the banks to disburse loans after thorough scrutiny.

The state-owned banks have also been directed to disburse smaller loans instead of bigger ones.”

Former governor of the central bank Dr Saleh Uddin Ahmed blamed the bank’s boards of directors for the uptick in default loans.

“Management committees in these state-owned banks do not think the increase in default loans as a challenge. So, the boards of directors show little concern about this issue.

“The central bank shows flexibility towards these banks, because the government uses them to provide different services.” Dr Ahmed added.