Home ›› 25 Nov 2021 ›› Stock

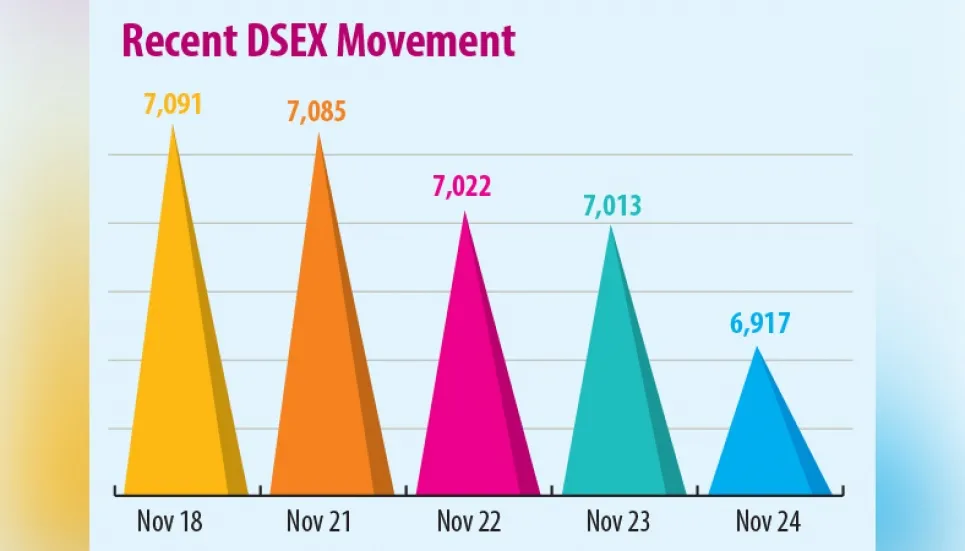

The benchmark DSEX index fell sharply lower on Wednesday, closing below the 7,000-mark, as the investors reacted to the repercussions of economic uncertainty.

Investors' sentiment was dented due to a surge in the trade deficit, inflation, and bad loans, dealers say.

Moreover, a depreciating currency and liquidity crunch in the banking sector took a toll on the investment climate and market participants opted to trade cautiously.

The market was in the positive terrain briefly in the morning but the fall accelerated as the day grew as the investors stayed on edge.

The DSEX plummeted 95 points or 1.35 per cent to close at 6,917, extending its losing streak for the fourth straight session. The index was the lowest since November 9 this year when it was 6,868 and the Wednesday’s decline was the sharpest in four sessions when the index lost a total of 174 points pulled down by the market bellwether banks

“Selling pressure continued unabated at the bourse,” said a top broker.

“The banks mainly dragged the market down as investor sentiment was weighed down by the several bad news poured in the market,” he said.

The trade deficit widened by $4.46 billion to $6.50 billion in July-September of FY22 on a year-on-year basis. The rising non-performing loans (NPLs), call money rate and liquidity crunch also sent a negative signal to the market.

The banks’ NPLs crossed Tk 1 lakh crore for the first time after 27 months despite the central bank’s policy support to stop the rot.

The call money rate skyrocketed in the money market due to increasing demand for the fund as the economy reopened after the pandemic. The interbank call money rate shot up to over Tk 4, which was around Tk 3 a week earlier.

“Equity indices on the Dhaka bourse are in the doldrums as the market momentum has weakened due to the tightening liquidity scenario in the money market while inflation spikes added worries to the downbeat mood of investors,” said EBL Securities in its market analysis.

It said investors were quite shaky and engaged in selling spree in recent market outperforming stocks while correction in bank stocks aggrieved the situation further.

The banking index witnessed the steepest fall of 2.5 per cent driven by IFIC Bank that was down almost 5 per cent. All the listed 32 banks closed in the red.

Ripple effects of selling pressure in most sectors such as insurers, financial institutions, cement, IT and engineering were observed in overall market performance.

The market fell across the board as out of 365 shares traded, 259 closed in the red, 75 in the green, and 31 remained unchanged.

The volume of trade continued to shrink. The total turnover has declined by over 14 per cent to Tk 1,130 crore over the previous session. The banking sector accounted for almost 35 per cent of the total turnover, followed by textile (10.62%) and Miscellaneous (10.33%) stocks.

The port city bourse, CSE, also settled in red terrain. The selected indices (CSCX) and All Share Price Index (CASPI) declined by 148.2 points and 246.1 points respectively.