Home ›› 26 Sep 2022 ›› Stock

The domestic capital market remains small and underdeveloped, hindering longer term financing for infrastructure, housing, and climate adaptation, says the World Bank in a report.

Developing capital markets should be among the top policy priorities to unlock long-term finance for infrastructure and green investments, it said in the report titled ‘Change of Fabric: Bangladesh Country Economic Memorandum’ released recently.

“Due to lack of investors’ confidence as well as the poor market infrastructure, the growth of equity and debt market instruments has been very limited,” said the report.

Small size of domestic institutional investors such as insurance and pension companies, and undue competition from the National Saving Certificate programme pose further challenges for the capital market development, it pointed out.

The global lender suggested that for the equity market, a thorough review of initial public offering (IPO) pricing and closer monitoring of post-trading activities by the stock market regulator, BSEC, are needed to reduce volatility and enhance confidence.

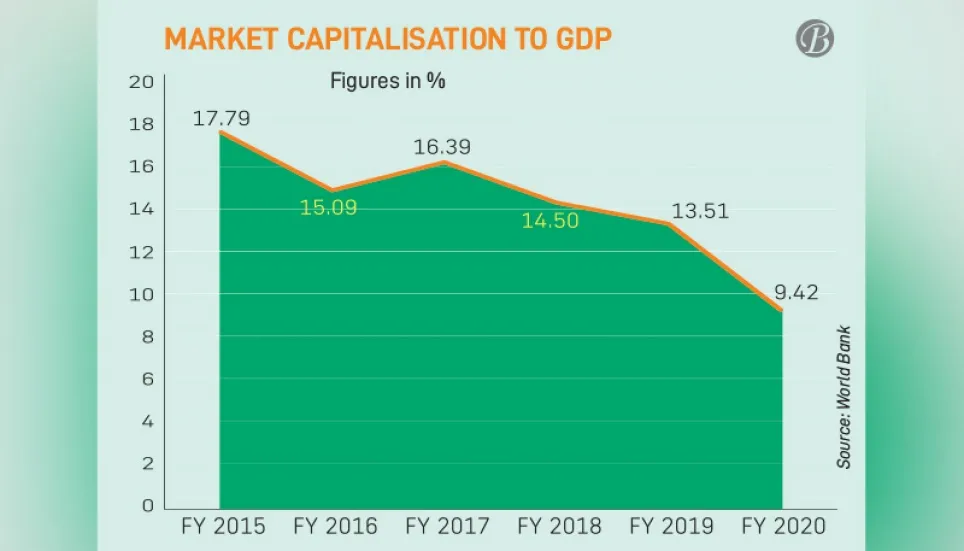

The Dhaka Stock Exchange’s market capitalization-to-GDP ratio is 11.6 per cent as of 2022, while it climbed to its peak of more than 50 per cent in just two years ahead of the market crash in 2010. The market size is considered small among its peers.

The World Bank said the government securities yield curve, which should serve as a benchmark for corporate bond issuance, is one of the key missing fundamentals in the capital market landscape.

Major restructuring and deepening of the financial system, including increasing the efficiency and sophistication of the banking sector, and developing a long-term capital market, should be the top policy priorities, it said.

For that reason, corporate debt securities and equity markets can be boosted by streamlining issuance procedures while ensuring sound disclosure and market conduct practices.

On Mutual Funds—an instrument of the capital market, the report said mutual funds exist, but they mainly invest in equity, while life insurance funds invest only in bank deposits and government instruments. As of July 2022, the assets under management (AUM) of Bangladesh’s mutual fund (MF) industry stood at $1.6 billion, according to IDLC, an investment bank.

Deeper capital markets would allow for raising much-needed long-term finance, including from external sources, particularly for infrastructure and climate adaptation projects, according to the report.

It found that the market-making role of primary dealers (currently 21 banks) is also muted, as evidenced by the frequent devolvement to Bangladesh Bank of primary issues instead of allocating them among primary dealers.

Corporate debt securities and equity markets can be boosted by the enhancement of market practices.

“For the corporate debt market, the stock market regulator, BSEC, needs to shorten the review time and simplify the approval process for bond applications,” said the report.

In addition to regulatory changes, the market would benefit from a long-term strategy from the regulator as well as rationalization of the tax regime, it said.

Emphasizing investments in the technology, the report said, the market’s information and communications technology infrastructure must be upgraded to allow for more efficient interactions between exchanges, brokers, and clearinghouses, as well as to allow smaller brokers access.

The credit rating industry needs to be more disciplined to produce reliable investment information, it said.

This can be achieved through regulatory reforms and stronger oversight by the BSEC to ensure the quality of the ratings produced and encourage consolidation of the industry, it added.