Home ›› 03 Aug 2021 ›› Front

A growing demand for automotive batteries, fuelled mainly by the widespread use of unauthorised battery-run three-wheelers in rural and semi-urban areas, has led to a booming business of local battery manufacturers and traders in Bangladesh.

Besides, the arrival of hybrid and electric cars in the local market, scooters, motorbikes, instant power supply (IPS), solar panels, generators, mobile phone towers and other appliances that use battery in conjugation with fuels have further propelled the business the market which has grown three to four times over the past ten years.

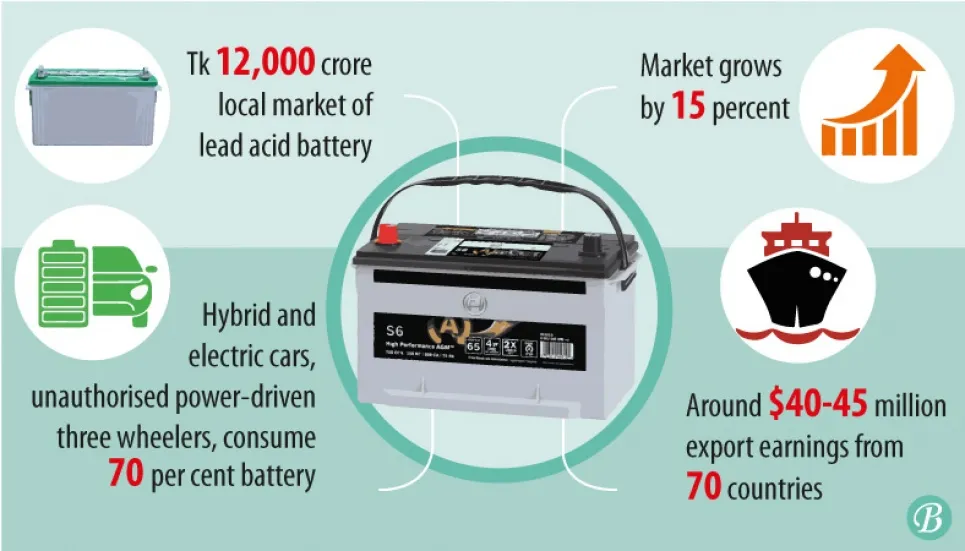

The mode of transport, mostly three-wheelers, also popularly known as easy bikes, has played an essential role in increasing manifold the demand for automotive batteries. Easy bikes, battery-run rickshaws and hybrid and electric cars consume around 70 per cent of the market, while solar panels and instant power supply consume the rest. An easy bike requires five batteries and a battery usually has 10 to 12 months of service life.

Thus, the spread of electric three-wheelers, which are yet to get any formal recognition from the government and mainly run by permissions secured from local government authorities such as municipalities, has given a big push to battery manufacturers and marketers.

Run by rechargeable batteries, the easy bikes mushroomed in the last decade in district towns and rural areas because of their rising acceptance among people of all ages.

The battery market, the size of which is around Tk 12,000 crore is growing year on year. The market ballooned three to four times in the last ten years, registering a 10 per cent to 15 per cent growth in the last one year, according to Accumulator and Battery Manufacturers and Entrepreneurs’ Association of Bangladesh (ABMEAB).

Around 1,00,000 people are directly or indirectly involved in the battery industries across the country.

The market players now meet the overall demand of more than 40 lakh (25 lakh for the local market and the remaining 15 lakh for export) various batteries though the market demand was only 18 lakh in 2014.

However, there is no government data available on the total demand for batteries and its market size in Bangladesh.

The unofficial battery market size was only Tk 8,000 crore just three years back, while it was only Tk 6,000 crore six years ago from now.

Besides, the country annually earned $40-45 million on average by exporting batteries to 70 countries, including Singapore, Australia, Russia, India, Chile and the Middle East.

Currently, the traders are supplying the batteries with the brands of Globatt, Lucas, Hamko, Volvo, Navana, Rimso, Electro, Suntec, PANNA, Volta, Confidence, J. Co, and Dongjin to meet the overall demand worth around Tk 12,000 crore.

According to an international forecast, the Bangladesh lead-acid battery market is expected to grow at a Compound Annual Growth Rate of more than 3 per cent throughout 2020-2025.

Factors such as the growing automotive sector in the country and the low cost of lead are likely to drive the lead-acid battery market during the forecast period. Over the past few years, Bangladesh witnessed tremendous growth in per capita income. This, in turn, improved the level of disposable income.

As a result, there has been a sharp increase in the sales of automobiles, particularly the two- and four-wheeler varieties. This surged the demand for SLI batteries and is expected to propel the Bangladesh lead-acid battery market. However, declining lithium-ion battery prices and increasing adoption of electric vehicles are likely to restrain the growth of the lead-acid battery market in the coming years, said Mordor Intelligence in its Bangladesh lead-acid battery market-Growth, Trends, Covid-19 Impact, and Forecasts (2021-2026).

Major Bangladeshi companies in the sector

To cater to the growing demand, currently around 25 local companies are manufacturing batteries for three-wheeler, hybrid and electric cars, scooters, commercial vehicles, cars, instant power supply (IPS), solar panels and batteries for use in various appliances, said the industry people.

According to ABMEAB, Rahimafrooz Batteries Ltd and Rahimafrooz Accumulators Ltd, both concerns of Rahimafrooz Group, Hamko Corporation, Navana Batteries Ltd of Navana Group, General Battery Company Ltd, Rimso Battery & Co Private Ltd, Abdullah Battery & Co (Pvt) Ltd, Panna Battery Ltd, Eco Batteries Ltd, White Products & Electronics Ltd of Rangs Group, Saif Powertech Ltd, Confidence Electric Ltd, Electro Battery Co Ltd, J Co Battery Engineering Works, Suntec Energy Ltd, A&P Battery Industries Ltd, Dong Jin Longevity Industry Ltd, Geli Industrial Co Ltd and Silicon Power Ltd are now playing a pivotal role in expanding in the battery market.

These local firms usually manufacture two types of lead-acid batteries — automotive and industrial dip bicycles. In addition, there is a huge market for valve regulated lead-acid (VRLA) batteries used in the towers of mobile phone companies.

Although some local companies can manufacture this battery, imported batteries dominate the segment as mobile phone operators opt for foreign batteries.

Besides, Chinese-made but locally assembled batteries and those locally manufactured by Chinese companies operating here have also entered the market, accounting for over 65 per cent (worth around Tk 8,000) of the demand, according to industry insiders.

Currently, there are 25 per cent import duty, 20 per cent supplementary duty and 3 per cent regulatory duty on imported batteries, according to the National Board of Revenue.

Around 50 per cent of the raw materials for producing lead-acid batteries are imported from South Korea, Singapore, Malaysia, Thailand, India and China while the rest comes from the recycling sector in the country, added the association.

“The rapid expansion of easy bikes has created a huge scope for the battery business in the country in recent years. The annual market for batteries is so far Tk 12,000 crore and easy bikes consume more than 70 per cent of the market,” said Md Nazrul Islam, who is the pioneer of the battery import business in the country.

The importers are almost reluctant to import various costlier batteries as customers are more interested to purchase cheap batteries. These batteries are often labelled with the brand name of renowned companies after being processed in some illegally-run factories due to lack of monitoring of the authorities concerned, he said.

“The demand of the battery has now doubled in the rural and semi-rural areas in the wake of widespread use of battery-run electric three-wheelers in the last six years,’’ ABMEAB President Munawar Misbah Moin told The Business Post.

The market players are currently meeting the demand for over 40 lakh (25 lakh for local market and 15 lakh for export) batteries while the market demand for batteries was only 18 lakh in 2014, he said.

As there are around 12 lakh electric three-wheelers across the country, they require nearly 20 lakh batteries annually, said Munawar Misbah Moin, a director of Rahimafrooz, which is one of the leading battery manufacturers in Bangladesh.

“Following the rising demand for batteries, dozens of ‘illegally-run’ factories are allegedly selling their recycled batteries. We have requested the government to bring those recycling factories under a legal framework to monitor the products’ quality and address the environmental issues,” he added.

“The easy-bikes are now replacing rickshaws as the main mode of transport in the rural areas. Now, very few rickshaws are seen in the country,” said Md Sazedur Rahman, chief operating officer for the battery unit of Panna Group, another leading battery manufacturer of the country.

“It appears the market would double in the next five years,” said Sazedur, adding that the market is growing by 15 per cent annually and to tap into the extended new market, existing manufacturers have also expanded their production capacity to meet both domestic and global demand as well.

Who leads the market?

Rahimafrooz Batteries Ltd is the largest lead-acid battery manufacturer in the country. The company is also one of the leading regional players, now exporting to around 70 countries. It manufactures about 200 different varieties of batteries for automobiles, IPS and other appliances in its factories located at Ishwardi in Pabna, and Birulia and Zirani Bazar of Savar in Dhaka. Its major brands are Globatt, Lucas and Spark. In 2017-18 fiscal, the country earned $40 million exporting batteries. Of the amount, only Rahimafrooz’s share was $38 million. But this was not the case seven or eight years ago. In 2009-10, the company managed to earn only $5 million exporting batteries, according to a high official of the company.

Price range

At the retail level, the price of GLOBATT ACE N50Z Battery is Tk 9,800, LUCAS Classic N50z is Tk 6,855, LUCAS classic Nx120-7 battery is Tk 9,720, and LUCAS ultima din100 battery is Tk 24,700, said Haji Mosharaf Hossain, a trader in city’s Bangshal area.

Of the Hamko IPS battery, the price of HPD 80-12 volt is Tk 7,424, HPD165-12volt is Tk 13,875 while the Volvo IPS battery-IPS50s-12volt is being sold at Tk 6,642 while IPS200s-12 Volt is at Tk 19,481, he added.

Md Kamruzzman, general manager of Jiangsu Jee Ding Storage Co Ltd which is located at Palash in Narsingdi, has ruled out the allegation of running a factory illegally saying, “We are manufacturing only easy-bike batteries with an average wholesale price between Tk 5,000 and Tk 7,000.’’

In reply to a question, Md Moniruzzaman, additional secretary (Pollution Control Wing) of the Ministry of Environment, Forest and Climate Change, told The Business Post, “We have enhanced our surveillance on the battery recycling and manufacturing factories running without necessary documents to control the environmental pollution.”

“We have already shut many illegally-run factories and served notices to some other such factories for not showing us the necessary documents,” he added.

Telecom sector expected to drive the future battery market

The country is poised to witness a surge in the expansion of the ICT industry, as the young minds of the country engage themselves more with information technology-enabled services (ITES).

Lead-acid batteries are widely used as the source of power in mobile towers and backup systems, which are likely to witness am increased usage due to the growth in the information and communications technology (ICT) industry.

In December 2018, the state-owned mobile operator Teletalk launched 4G (fourth generation) mobile data services commercially in Dhaka. To implement 4G network, the company has taken up projects worth Tk 9.87 billion. Under the fund, 550 towers were already established, as of 2018, mostly in big cities, and the process to set up another 550 in district headquarters were under implementation.

“The growth in the ICT industry is leading to augmentation in communication infrastructure. Which, in turn, is anticipated to drive the Bangladesh lead-acid battery market during the forecast period (2021-2026),” said Mordor Intelligence in its forecasts.