Home ›› 01 Mar 2022 ›› Special Supplement

At a time when major economic indicators are doing better and economy is growing steadily, Bangladesh’s insurance penetration meaning premiums as a share of GDP is the lowest at 0.40 per cent among the emerging Asia-Pacific nations.

According to Swiss Re data, a leading global re-insurer based in Zurich, Switzerland, Bangladesh’s overall insurance penetration (insurance premiums as a share of GDP) was 0.40 per cent in 2020, which was 0.49 per cent in 2019.

Of the penetration rate, 0.30 per cent was accomplished by life and 0.10 per cent by non-life insurance companies.

An overall insurance penetration in Bangladesh was 0.57 per cent in 2018 and 0.55 per cent 2017.

However, the Bangladesh Bureau of Statistics data shows that the sector’s contribution to GDP in Fiscal Year 2020-21 was 0.27 per cent which was 0.28 per cent in the previous year.

In 2020, insurance penetration in Thailand was 5.30 per cent followed by Malaysia 5.4 per cent, China 4.5 per cent, India 4.2 per cent, Vietnam 2.3 per cent, Indonesia 1.9 per cent, the Philippines 1.8 per cent, and Sri Lanka 1.2 per cent and Pakistan 0.80 per cent.

According to the BBS data, the insurance premium as a share of GDP at constant price stood at Tk 7,353 crore in FY 2020-21, up by 3.22 per cent, which was Tk 7,123.6 crore in the previous year.

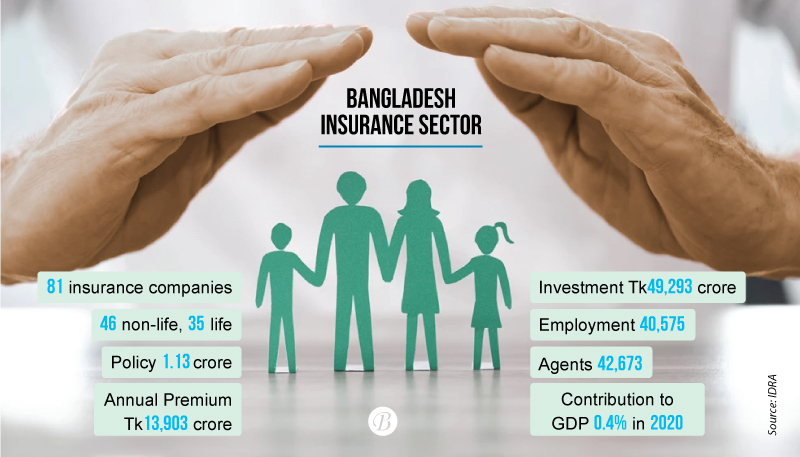

Currently, there are 81 insurance companies in the country. Of which 35 are life insurance and 46 non-life insurance. Investment in the sector stood at Tk49,293 crore as of 2020, while the sector employed 40,575 people directly. There are about 42,673 agents are working in the sector.

Factors for low penetration

Trust deficiency, limited products, lack of proper implementation of laws and monitoring to scan irregularities of the insurers are largely blamed for the low penetration.

In addition, income of mass people, which is not enough to maintain a policy, is another barrier.

“Trust deficiency is a key factor for the low penetration, which needs to be restored without any further delay,” MM Monirul Alam Tapan, Managing Director and CEO of Bengal Islami Life Insurance Limited, told The Business Post.

There is a shortage of knowledgeable and skilled manpower, which is a great challenge. In removing the barriers, institutional capacity should be developed and training is a key to this, he said.

“People employed in formal sector and government officials have an institutional system about pension. In incorporates as well as good companies, there are group insurance,” according to Professor Mustafizur Rahman, distinguished fellow of Centre for Policy Dialogue (CPD).

But most people are employed in the informal sectors and their income is not enough to maintain a policy. Financial inclusion is very low here, observed the economist.

Prof Mustafizur noted that there are not enough insurance products with a small-size premium to bring low-income people under the insurance coverage and companies are running after the big clients.

“In increasing the coverage, companies should develop affordable products for low-income grow and reach them,” suggested the CPD official.

The government initiative for universal pension scheme would be one kind of insurance for people. If the government pays a minimum amount for low-income group, it would be big option for the sector.”

Impacts of Covid-19 pandemic

As the Covid-19 pandemic hit people’s income hard caused by unemployment and salary cut, the insurance sector saw a negative growth in premium earning too. On the other hand, travel restrictions put a bar to adding new policy holders to the existing ones as the agents and company’s employees could not move amid the pandemic.

The assets of both life and non-life insurance companies went down by Tk 7,985 crore in 2020 when compared year-on-year, triggered by the sector’s diminishing income against the rising expenses amid the Covid-19 crisis, according to the data of Insurance Development and Regulatory Authority (IDRA).

It reveals that the firms had assets totaling Tk 45,388.68 crore at the end of 2020, a sharp drop from Tk 53,374.01 crore in 2019.

The gross premium from both life and non-life segments declined by 2.83 per cent to Tk 13,903.36 crore in 2020, which was Tk 14,308.21 crore in 2019. Premium collection from 33 life insurers was Tk 9501.30 crore in 2020,

The number of policies declined by 12.14 per cent to 1.13 crore compared to 1.29 crore in the previous year.

Scope of growth

The rising awareness of health and mortality risks caused by the ongoing Covid-19 pandemic and a perception of being under-insured will give the sector a lift.

On the other hand, economic growth and rise in people’s income will create opportunity for growth in the coming year.

In Fiscal Year 2020-21, Bangladesh recorded 6.94 per cent GDP growth while the per capita income rose to $ 2,591.

“With the outbreak of Covid-19 and rising health expenses induced by the pandemic-related complexity made people aware about the importance of life insurance coverage in bearing the cost of treatment,” Pragati Life Insurance CEO Jalalul Azim told The Business Post.

In the days to come, people will be very interested in opening policy, which would help bring more people under the insurance coverage, said Azim.

“We are positive on the outlook of global insurance premiums and expecting above-trend growth of 3.3 per cent in 2022 and 3.1 per cent in 2023. This forecast is underpinned by rising risk awareness in both the life and non-life segments, as consumers and businesses alike seek protection following the shock of the Covid-19 pandemic,” said Swiss Re Institute in its Insurance Market Outlook 2022-23. In the Asia–Pacific region it is expected to grow by 3.2 per cent in 2022-23, said the report.

As per the projections, the global insurance market should exceed $ 7 trillion in premium terms for the first time by mid-2022, sooner than previously estimated in July, it added.

How to boost business

“There are many tools to increase the insurance sector’s contribution, but we need to focus on two things first. We have to expand the distribution channel, which we want to do by introducing bank assurance. Second, we need to expand online distribution,” M Mosharraf Hossain, chairman of IDRA, told the Business Post.

“If we can do these two things fast, the insurance sector’s contribution to GDP will go up.” “We do not have brokers and corporate agents in our country, but we need them. In short, the distribution channel has to be diversified. People need to be approached with insurance products so that they are not deceived,” according to Mosharraf.

New schemes have to be launched as per the clients’ needs. There have to be measures for skill development at the regulatory agency and all companies, he suggested, adding that if skilled manpower can be created by passing the Bangabandhu National Institute Act 2022 on the occasion of Bangabandhu’s birth centenary, the insurance sector will grow, and if it cannot be done, the insurance will lag further behind.

“Customers’ satisfaction is the key to retaining their confidence. The companies should keep their commitment offered to policy holders,” said MM Monirul Alam.

Activities of insurers must be monitored in line with the laws and regulation. While auditors and international operation of the companies should be transparent and there will be no compromise to this end, he added.

If a company fails to keep the commitment or commits misdeed, it affects the whole sector negatively. So, the full-fledged implementation of laws is a must, suggested the insurer.

Meanwhile, the regulator is working to introduce bank assurance to increase the contribution of the sector to the country’s economy as well as bring more people under coverage.

“To boost the insurance sector’s contribution to the GDP and to reach more people across the country, it is essential to raise awareness among people about the benefits of insurance coverage,” Bangladesh Insurance Association’s president Sheikh Kabir Hossain told The Business Post.

He put emphasis on modernising insurance academy, developing new products to meet the country’s demand, and build skilled manpower.

On top of that, companies have to be more sincere and transparent in operation and meet commitment to repay the clients after the maturity of their insurance policies and settle claims in due manner, he added.

Besides, the sector people called for steps to make health insurance mandatory for government officials instead of providing medical allowances.

The government should also take necessary measures for making insurance mandatory for all, they added.