Home ›› 23 Oct 2022 ›› Special Supplement

Bangladesh’s economy is navigating through a number of problems, and among those, inflation and foreign exchange shortage are two of the biggest ones. As these two problems are interconnected, they can pose a threat to the country’s food security if not resolved quickly.

Inflation has increased mainly due to the jump in import costs. But that does not mean we cannot do nothing. Some steps – including fiscal measures – have already been taken. As part of these steps, austerity measures have been introduced at the expenditure side.

This step can be most helpful in reducing domestic demand, curb inflation and saving USD.

As part of austerity measures, development projects are divided into four categories – A, B, C and D. Among them, import dependent development projects fall under C and D categories. The budget allocation for these two categories is supposed to be cut.

Projects will be reviewed and implemented at a slow pace or stopped. But how much is actually being implemented? Is the compliance maintained in implementation?

At the same time, as part of the government’s operating budget cuts, it was said that no new cars would be purchased. Saving fuel consumption, entertainment, travel and stationery expenses will be reduced as well.

A quarter of the current financial year has ended, but what are the results of these decisions?

How much foreign exchange has actually been saved? It needs to be assessed. Again, if the assessment shows that the savings amount is only $1 million or $2 million, then it will not meet the main objective, which the government had wanted.

If there is no compliance in the implementation of these decisions, then I am assuming there is a shortcoming. We have to find out why. Without proper implementation of those decisions, announcing new policies will not bring in any benefits.

Another major step in this regard is tax measures. Taxes on commercial imports were increased to cut down imports, and the tax on the import of daily commodities has been reduced to curb inflation.

We already have some of the data, and it shows that the opening of letters of credit (LCs) has decreased. However, this happened for two other reasons – one is the increase in the LC margin, and another is the limiting of LC openings. Besides, the price of the USD increased.

The increase in the USD rate is pushing inflation up, but there are no alternatives but to accept this, because our priority is to save the foreign currency as much as possible.

However, not only commercial imports decreased as a result of the LC limit, the move had a greater impact on the imports of capital machinery and intermediary goods. The matter will become a countereffect.

Along with reducing imports, load shedding has been introduced as a supply side measure. Its objective is to reduce LNG imports and fuel consumption, but the move is disrupting the production of agriculture, industry and services sectors.

Sri Lanka can serve as a lesson for us. They had also halted fertiliser imports while taking similar measures. They saved $400 million as a result, but later had to spend $450 million on rice imports.

So I think, even if our load shedding is helping us save diesel or gas, its consequences can become like that of Sri Lanka. Some of the Aush crop has been ruined by floods, and Aman will not meet production targets due to drought. There is a need for additional irrigation, but farmers could not do this properly due to the ongoing shortage of diesel and electricity.

Boro season is coming up. More than half of our rice demand is met during this season. Boro is dependent on more irrigation and fertilisers. Without an uninterrupted supply of electricity and diesel, the Boro crops will suffer in the coming days.

If we go back to 2008, there was a rice shortage in late 2007. Bangladesh could not import rice due to a crisis in the world market. At that time, an agreement was made to import 50,000 tonnes of rice from India, but the rice did not arrive in time.

As there was doubt as to whether the rice would be available, the then caretaker government provided all kinds of support to increase Boro production. It showed that the production was more than the target and our problem was solved.

In the end, there was no need to import rice from India at that time.

Boro production needs to be the biggest priority now. Boro is one of our greatest tools for ensuring food security. But if load shedding continues, its production will be hampered and food security will be under threat.

So, an adequate supply of diesel and electricity must be ensured to safeguard our food security.

Now let us address the foreign exchange shortage. We have heard that export orders are decreasing. At this time, if the production of the export sector is disrupted due to the shortage of electricity, then the export income will decline.

Then global causes will hit our economy harder than expected.

So electricity and gas supply should be given priority. In this case, it is necessary to decide where the gas will be used. Gas cannot be wasted to operate a 40-year-old power plant. I want to see prioritisation in the usage of gas.

We want to save foreign exchange by reducing fuel and gas imports. However, exports will be disrupted due to the inevitable power shortage. Agricultural production will suffer due to a lack of irrigation.

So, the foreign exchange that we wanted to save will later go to food imports. But there is no certainty that the food will be available, as many countries are now worried about food security.

Vietnam and Indonesia have raised taxes to discourage rice exports. They may also stop exporting this food grain if there is a food crisis. What will we do then? If there is no sufficient internal production, what is the current power saving measure actually useful for?

Is this move hurting us more? This is where we have lessons to learn from Sri Lanka. Again, the government has provided a loan programme of Tk 25,000 crore for the SME sector. But if there is no electricity, what will they do with that money? The money will be used in unproductive sectors and small traders will fall into a debt trap. They will not be able to go into production properly due to the electricity shortage. As a result, these businesses will not be able to repay the principal of the loan due to losses.

A maximum of $5 billion to $6 billion can be obtained from the International Monetary Fund (IMF), World Bank or Asian Development Bank (ADB) to meet the foreign exchange shortage. But our own remittance inflow and export income will help us the most.

However, due to the new exchange rate, we have witnessed a dip in remittance coming through formal channels. It is better for us to go back to a single rate, which we were using previously.

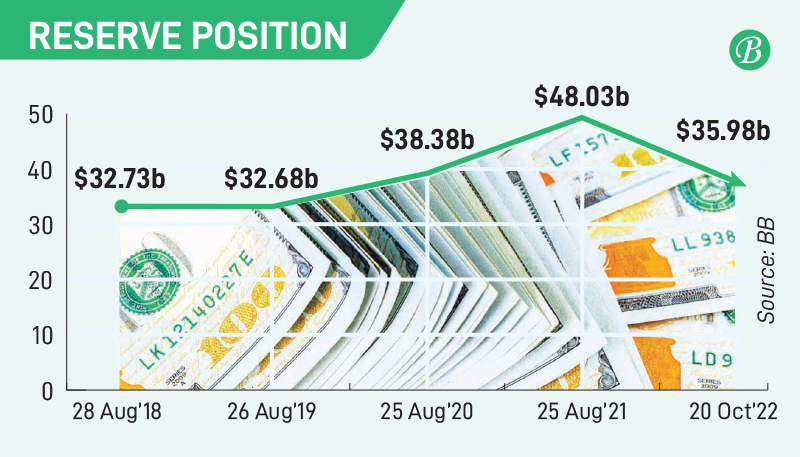

In order to keep the exchange rate stable, the Bangladesh Bank provided $7.6 billion support to the currency market in the last financial year and $4 billion in the first four months of the current financial year.

It remains to be seen whether this support is actually being used for much needed imports. Because we know that the RMG sectors imports are settled through back to back LCs, and the process does not need USD in cash. The green back is required for imports in cash. So we need to see whether these imports are our priority or not.

In the midst of so many crises, there is hope regarding the global recession.

If this recession is high, especially in China, it is very good for us. This will reduce our import costs. On the other hand, the price of the USD will also decrease. The Economist’s Big Mac Index said the USD is overvalued.

Therefore, the projection for the next six months is that the price of fuel and commodities may decrease in the world market. But we have to survive until then. If Boro production is disrupted due to load shedding before that happens, we might fall into food insecurity.

If the use of USD that is still in hand is utilised on a priority basis, then the situation can be handled. The central bank is providing the greenback support in the money market, but it needs to be clear which sectors are receiving this support.

Former lead economist, World Bank, Bangladesh

Transcripted by Talukder Farhad