Home ›› 20 Aug 2021 ›› Stock

LankaBangla Finance, a renowned non-bank financial institution (NBFI), has secured a massive growth in the second quarter (April-June) of the ongoing year, defying the adversities induced by the Covid-19 pandemic.

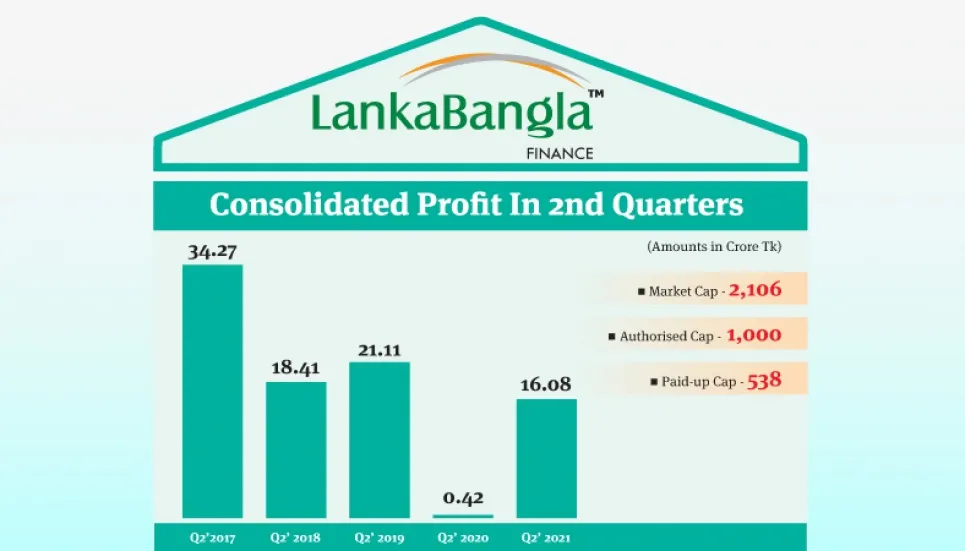

The NBFI, which was founded 24 years back, has posted a consolidated net profit of Tk 16 crore after taxes in the second quarter, which is 38 times or 3,703 per cent higher than the same period of the last year.

The publicly traded NBFI credits three factors for the winning result: cost optimisation, increase in volume of transactions in the capital market, and brokerage income.

Also, the fees income of credit cards contributed to increasing other operational income.

According to the un-audited financial statement, Lanka Bangla’s consolidated net profit after taxes soared to Tk 16.08 crore in the April-June’21 period, which was Tk 42.29 lakh in the same period of the last year.

The company said that its earnings per share (EPS) stood at Tk 0.30 for the second quarter of 2021, against Tk 0.01 for the same period of the previous year.

The company’s net asset value (NAV) per share stood at Tk 18.24 as of June 30, 2021.

On the other hand, the publicly traded company logged in Tk 38.74 crore as consolidated net profit for the Jan-Jun’21 period, which was Tk 7.29 crore in the same period of the 2020 year.

Its EPS rose by 401 per cent to Tk 0.71 for the first six months of the ongoing year, which was Tk 0.14 in the same time of the last year.

Lanka Bangla Finance said, in its official disclosure on Thursday, that utilizing bullish capital market, consolidated investment income increased by Tk 29.38 crore when provision charge for diminution in value of investments reduced by Tk 35.60 crore on June 30, 2021.

With the increase in the volume of transactions in the capital market, income of the respective brokerage increased by Tk 46 crore in June 2021.

Income from CDBL, advertisement, fees income of credit cards contributed to increasing other operational income by Tk 17.45 crore in June 2021 compared to the same period of the last year.

LankaBangla Finance’s NAV decreased by 2.62 per cent to Tk 18.24 at the end of June 2021, compared to the end of December 2020. A 12 per cent cash dividend for 2020 contributed to that reduction.

Besides, its consolidated net operating cash flow per share (NOCFPS) increased by 27.44 per cent to Tk 2.45 in June 2021 from Tk 1.92 of the same period of 2020.

Lanka Bangla provides corporate, retail, and SME financial services as well as liability management, stockbroking, corporate advisory, and wealth management service.

Its financial year ends on December 31.

At the end of 2020, the company paid 12 per cent cash dividend for the year, which is well within the 15 per cent cash dividend ceiling set by the Bangladesh Bank for the NBFIs for the year.

A year earlier, the company gave 7 per cent cash and a 5 per cent stock dividend.

The listed non-banking companies have three subsidiaries: LankaBangla Securities, LankaBangla Investments, and LankaBangla Asset Management Company.

Shares of LankaBangla, which was listed in 2006, gained 129 per cent in the last year. They closed at Tk 39.10 on Thursday.