Home ›› 29 Aug 2021 ›› Stock

Share prices of 16 companies’ soar abnormally in recent times despite no undisclosed price-sensitive information.

Following the ‘abnormal’ price hike, the Dhaka Stock Exchange (DSE) authorities served a show-cause notice on the companies in the last week.

Analysts and stock market insiders said that this is not a good sign for the stock market. The trend, if it continues unabated, will pose a threat to the stability of the market.

Manipulators usually target small-cap stocks as their prices can easily be manipulated and demands inflated artificially, they said.

The companies, however, in a knee-jerk response, informed the Dhaka bourse that there is no undisclosed price-sensitive information for the recent unusual price hike.

The companies are -- The Dacca Dyeing, Janata Insurance, South Bangla Agriculture & Commerce Bank, United Finance, Maksons Spinning Mills, Regent Textile Mills, Shahjibazar Power, Salvo Chemical Industry, Mithun Knitting, Metro Spinning, Paper Processing & Packaging, Meghna Pet Industries, Meghna Condensed Milk Industries, Ring Shine Textiles, Fareast Finance & Investment, and Anlima Yarn Dyeing Limited.

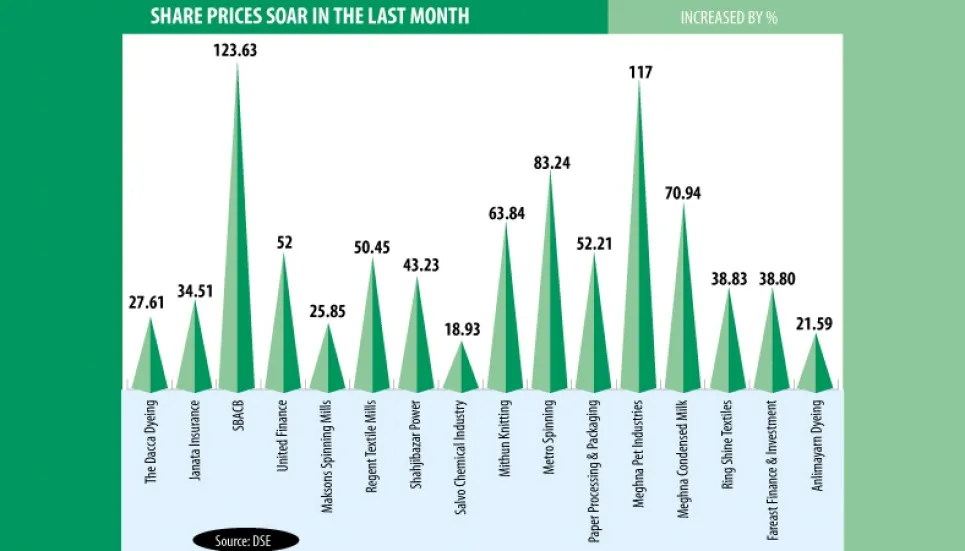

South Bangla Agriculture & Commerce Bank — a newly-listed company saw the highest hike in its share price by 123.63 per cent.

It was followed by Janata Insurance 34.51 per cent, United Finance 52 per cent, Maksons Spinning Mills 25.85 per cent, Regent Textile Mills 50.45 per cent, Shahjibazar Power 43.23 per cent, Salvo Chemical Industry 18.93 per cent, Mithun Knitting 63.84 per cent, Metro Spinning 83.24 per cent and Anlima Yarn Dyeing 21.59 per cent.

Former Finance Adviser to the Caretaker Government AB Mirza Azizul Islam told The Business Post, “This is not a good sign for the capital market. Those who buy the shares of such companies should be examined.”

Stock market regulators with stock exchanges should take legal action against price manipulators, he said.

Policy Research Institute (PRI) Executive Director Ahsan H Mansur warned that general investors should be careful about buying these shares of the companies as their prices can plummet as fast as they soared.

The share price of the Dacca Dyeing, which is being traded under ‘Z’ category, has been on the rise since June.

The price, which was Tk 21 on July 29, rose by 27.61 per cent to settle at Tk 26.80 at the Dhaka bourse on Thursday.

The share price of Meghna Pet Industries, another ‘Z’ category company, increased 117 per cent in the last month. Share price of the company was Tk 15.3 on July 29 but it shot up to Tk 33.2 on Thursday.

Meghna Condensed Milk Industries, a concern of Megha Group, witnessed a 70.94 per cent hike in its share price in the last month. The share price, which was Tk 14.8 on July 29, rose to Tk 25.3 on the last trading day.

Apart from that, Ring Shine Textiles, an ‘A’ category company, posted a 38.83 per cent increase in share price for the last month. Its share price stood at Tk 14.3 on Thursday, which was Tk 10.3 on July 29.

Besides, Fareast Finance & Investment, a non-bank financial institute, posted a 38.80 per cent hike in share price for the last month. Each share of the NBFI was traded at Tk 9.5 at the Dhaka bourse in the last session, which was Tk 7.1 on July 29.

The share price of Paper Processing & Packaging, which carries out trades under ‘Z’ category, has been on the rise since June.

Share price of the company was Tk 121.4 on July 29 and rose by 52.21 per cent to settle at Tk 186 at the DSE.

Though the company was in the main market, it was sent to Over The Counter (OTC) market on June 13. The company disbursed 11 per cent cash and 11 per cent stock dividends to the shareholders last year after a five-year gap.

According to its annual report, the company’s profit declined 53 per cent to stand at Tk 2.38 crore in FY20, which was Tk 5.09 crore in the previous year.

The Bangladesh Securities and Exchange Commission (BSEC) Executive and Spokesperson Mohammad Rezaul Karim told The Business Post, “The commission has always been working to stop any irregularities and protect the interests of investors. We believe that we will be able to identify the people involved in any manipulation before taking action against them.

Earlier this month, the stock market regulator formed an inquiry committee to investigate the unusual price hike in shares of nine listed companies.

The companies under the regulators’ lens are -- Emerald Oil Industries, Anwar Galvanizing, GBB Power, Bangladesh National Insurance, National Feed, Paper Processing and Packaging, Dacca Dyeing, Fu-Wang Ceramic, and Beacon Pharmaceuticals.

The BSEC Director Sheikh Mahbubur Rahman will lead the four-member committee which will comprise BSEC Assistant Director Ziaur Rahman, DGM of DSE Mohammad Shafikul Islam Bhuiya, and CDBL officer Md Moinul Haque are as members.