Home ›› 30 Aug 2021 ›› Stock

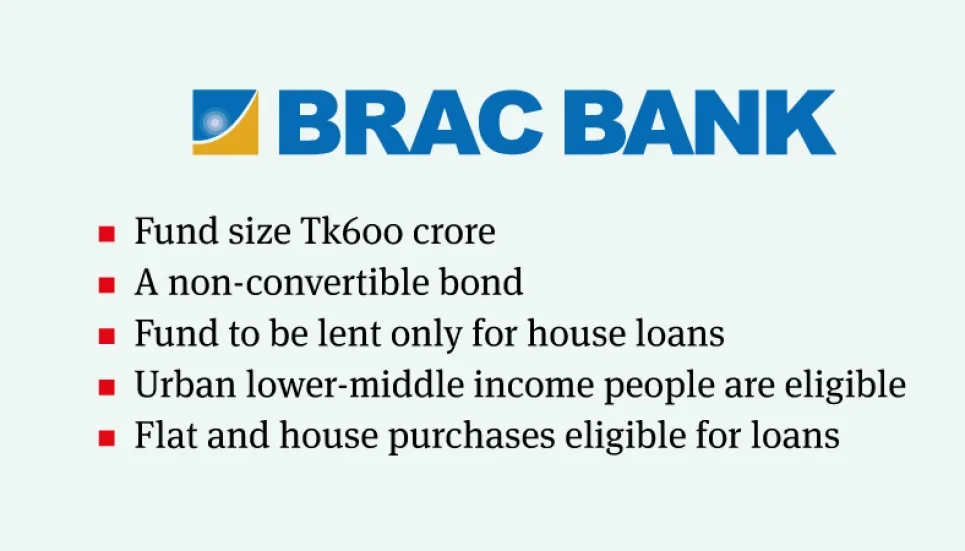

Private commercial BRAC Bank will issue non-convertible bond to provide loan of Tk 600 crore, on a pilot basis in the initial phase, to resolve the housing crisis of lower and middle-income people living in urban areas.

The bank made the announcement in a corporate declaration through the Dhaka Stock Exchange on Sunday, which is subject to approval of the regulatory authorities.

The nature of the bond will be non-convertible, private placed, redeemable, unsecured, fixed coupon bearing. However, the coupon and the housing loan rate have not been fixed yet.

BRAC Bank Chairman Dr Ahsan H Mansur told The Business Post, “We are going to start it as a pilot project. If we become successful, BRAC Bank will take more initiatives for the housing sector.”

The lower-and middle-income people living in the city do not have housing loan facilities. BRAC Bank wants to come forward to help the underprivileged city dwellers, he said.

Mentioning BRAC’s principle is to work for the lower-and middle-income people, Ahsan Mansur said BRAC Bank has chosen this project as part of its regular service.

At present 30 to 40 per cent of the country’s population live in cities areas, which will rise to 50 per cent in future. So, BRAC Bank will bring housing facilities for the low-and middle-income people living in any small or big city in the country, he added.

He also said the term of the bond will be 5 years.

“Long-term bonds are not issued in Bangladesh. However, in line with other countries in the world, the term of the bond should be extended to 10 years. The coupon rate of the proposed bond has not been fixed yet,” he added.

Fund raised from the bond would be used only to buy flats and buildings. No loan will be given for buying any type of land.

Ahsan Mansur also said that nothing has been decided yet regarding the interest rate of the loan. However, he assured that the rate would be lower considering the needs of the customers.

The terms of the loan have also not been decided yet.

As an economist, he thinks the term should be at least 15 years.

Real Estate and Housing Association of Bangladesh (REHAB) President Alamgir Shamsul Alamin (Kajal) welcomed the BRAC Bank initiative.

Shamsul Alamin, also the managing director of Shamsul Alamin Real Estate told The Business Post, that he believes such small initiatives will not resolve the housing problem of the low-and middle-income people.

He thinks that without a special master plan by the government, it is not possible to solve the housing crisis of low-income people. In this case, the government will have to take initiative to reduce the price of land. Then, the low-income people can be ensured housing for less money.

Alamin also said it would not be possible for housing companies to build small flats at low prices in line with the initiatives that BRAC Bank wants to take. Because, the cost of construction materials such as iron, cement, brick, among others, is much higher.

As a result, customers will not be able to buy flats with the loan they get from the bank. Then, they have to sit with money.

“BRAC Bank’s business may also be in crisis then,” opined the REHAB leader.

BRAC Bank is one of the top performing banks in the country’s banking industry. The bank was listed in the stock market in 2007.