Home ›› 11 Sep 2021 ›› Stock

Golden Harvest Agro Industries Limited, a publicly traded frozen food manufacturing company, has incurred massive losses amid the Covid-19 pandemic despite holding the largest market share in the country.

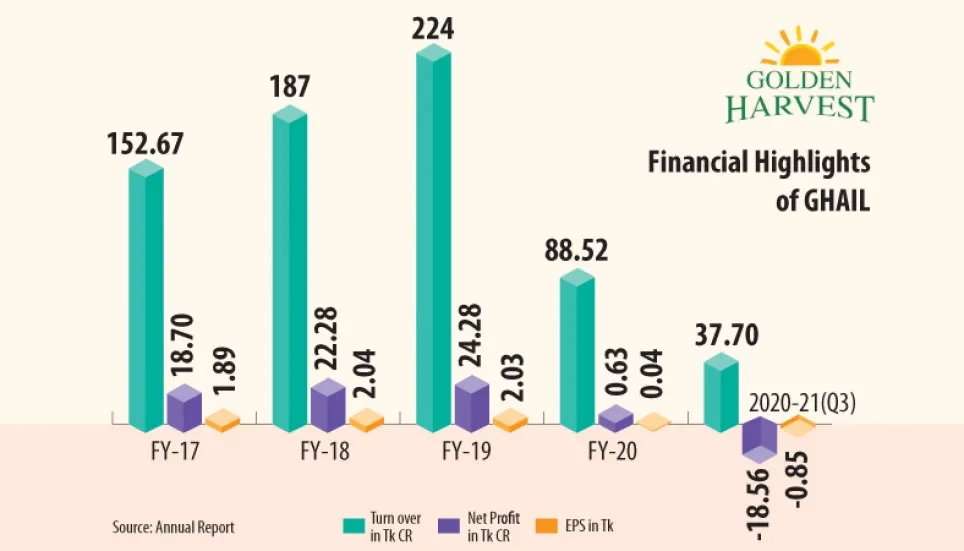

Its net profit, which was Tk 24 crore in the previous year, came down to Tk 63 lakh in financial year 2019-20 as businesses remained completely shut for months due to restrictions imposed by the pandemic.

Adding to the woes, the publicly traded company reported a loss of Tk 18 crore in the first three quarters of financial year 2020-21.

The scenario was obtained analysing the recent financial reports of the company.

According to its latest annual report, the company, which carries out stock business at the Dhaka Stock Exchange with trading code GHAIL, holds 29 per cent - worth Tk 170 crore - of the total market of frozen food.

Its closest market competitor is AG Food, which holds only 10 per cent share of market.

In its financial report for FY20, the company attributed its strong market position to innovation and development of new products and employment of latest machinery and equipment.

Contacted, a senior official of Golden Harvest, who sought anonymity, told The Business Post that they retained the market share in FY21 too, but incurred a massive loss – Tk 18 crore – in the first nine months.

According the company sources, the Golden Harvest Agro reported a steep decline in revenue in July-March’21 period.

It earned Tk 37.7 crore in revenue in the first nine months of FY21, down by 50 per cent from Tk 74 crore for the same period in the previous year.

It reported a loss of Tk 18.56 crore and loss per share of Tk 0.85 during the period.

During the same period of previous year, the company reported a profit of Tk 13 crore, while the earnings per share were Tk 0.60.

Responding to a query by The Business Post, the Golden Harvest official said their sales dropped to a great extent amid the pandemic.

“A good number of people either lost their jobs or saw decline in incomes during the pandemic. As a result, they changed their food habits, which affected the sale of frozen foods in the country,” he said.

He also attributed the poor sale to the closure of educational institutions as students were major buyers of frozen foods.

The official particularly mentioned the decreased sale of ice creams as it almost came to zero when the viral disease peaked in Bangladesh.

However, he expressed optimism that the scenario will change soon.

Thanks to eased up restrictions, the company has recently started to export products and received positive response from the foreign buyers, he revealed.

According to the unaudited financial statement of Q3 for the FY21, the company now has a long term loan of Tk 88.45 crore.

Its net asset value (NAV) per share slightly declined in the quarter due to total asset decline.

The NAV was Tk 14.15 for Q3 of FY21, against Tk 15.01 of FY20’s same quarter.

However, the company witnessed unusual hike – 29 per cent - in its share price form July despite being in the losing streak.

Its share price, which was Tk 18 on July 18, stood at Tk 23.2 on August 9. Later, the share price dropped to Tk 22.5 on September 7.

Responding to a query made by the DSE, the company informed that it had no price sensitive information (PSI) regarding the recent unusual price hike.

Throughout last year, the company’s share price movement remained between Tk 13.7 and Tk 24.5. Its market capitalisation was more than Tk 472.68 crore on September 7.

Recently, the company made fresh investment in Golden Harvest Servus, an e-commerce company, and launched SERVUS FOODS mobile app.

The e-commerce platform will sell food, grocery and medicine and will also provide ticket booking and purchasing service.

Golden Harvest will own 45 per cent of the venture equivalent to Tk 5 crore. Primarily, the company has been focusing on food delivery service.

The paid-up capital of the newly launched company is around Tk 216 crore, whereas the authorised capital is Tk 250 crore. Its reserve is Tk 108 crore.

Golden Harvest distributes dividends regularly to its shareholder. Except for FY19 and FY14, it provided the shareholders with stock dividends.

According to the audited financial statement, the company’s price earnings ratio (P/E) was very high throughout the period.

The P/E was 562.5 per cent on September 7, while the average market P/E was 18 per cent.

Golden Harvest Agro Industries Ltd is a one of the pioneers of Bangladesh’s frozen food manufacturing industry.

The brand is popular, in both home and abroad, for its wide range of ready-to-cook frozen products.

It got listed with the Dhaka bourse in 2013.

Throughout the last several years, the company remained the market leader in ready-to-cook frozen food industry, with a stable supply chain engaging 156 distributors and over 35,000 retailers.

It is a sister concern of Golden Harvest Group, which has different business like information technology, commodities, logistics, food processing, agriculture, dairy, aviation, infrastructure development and real estate.