Home ›› 12 Sep 2021 ›› Stock

With an average six per cent growth, market capitalization at the Dhaka Stock Exchange, posted a 67 per cent growth in total in the last 11 years.

However, the market cap’s contribution to the country’s gross domestic product (GDP) fell sharply as it came down under 10 per cent in June last year. It was 50.67 per cent in 2010 before the biggest market crash in the capital market’s history,

The GDP ratio stood at 17.2 per cent in August this year as investors continued pouring funds hoping for a better return from the investment even amid the ongoing pandemic.

The current market cap to GDP ratio of the DSE is now the lowest among the emerging Asian-Pacific countries.

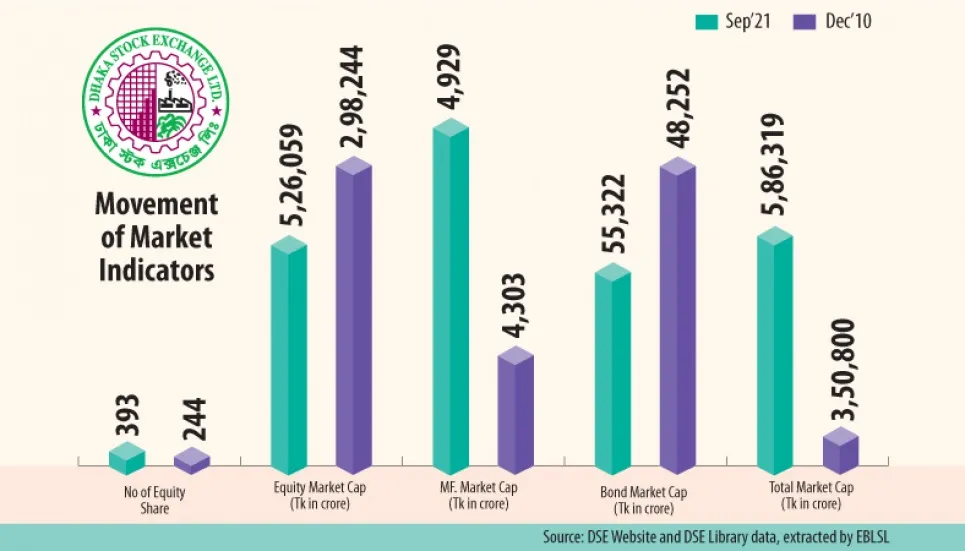

On Thursday, the market capitalisation of the Dhaka bourse hit a fresh all-time high of Tk 5,86,319 crore, which was Tk 3,50,800 crore in December, 2010.

The market cap rose by Tk 2,35,519 crore or 67 per cent in the last 11 years.

Market capitalization, or market cap, is calculated by multiplying the total number of a company’s outstanding shares with the current market price of shares.

Meanwhile, the key index of the Dhaka Stock Exchange – DSEX - crossed the 7,200-mark and settled at 7,258 points, the highest ever since the index’s inception in 2013.

Capital market analysts believe that the market has been on the rising trend due to various initiatives of regulators, including raising quotas for general investors in IPOs.

Many new investors are bringing in idle money to the capital market as the alternative fields for investment shrunk amid the ongoing pandemic. Besides, the dominance of junk stocks in the market has been increasing.

Recently, the stock market regulator, Bangladesh Securities and Exchange Commission (BSEC), asked the DSE to look into the unprecedented rise of indices.

It directed the premier bourse to scrutinise the rise of stocks with poor earnings.

Now, the DSE will investigate if any intermediary had lent money to clients to buy stocks with PE ratios of over 40.

Analysts and market insiders said that investors regained confidence after the Bangladesh Securities and Exchange Commission (BSEC) took some punitive and reformative actions to bring discipline to the market.

Besides, a number of large capitalised companies, including Robi Axiata Ltd and Walton Hi-Tech Industries Ltd, have recently entered the capital market.

They also said that investors’ buying rush continued as they are expecting better returns from the bullish market against the low bank deposit rates.

At the same time, investors’ positive expectations towards the capital market remained persistent, primarily backed by favorable macroeconomic outlook and continuous efforts by the BSEC, which translated into rising market participation and much-needed confidence, the market insiders added.

“In the last 10 years, the stock market was not allowed to run normally. The regulatory body previously controlled the index, causing damage to the confidence of investors,” said a stockbroker, requesting anonymity.

Regarding the issue, Dhaka Stock Exchange Director Shakil Rizvi told The Business Post, “A few years ago, our stock market was in a liquidity crisis, but now the scene is totally different. The market has become bigger as a result of various initiatives taken by the present regulatory body.”

Rizvi, also a former president of Dhaka Stock Exchange Brokers’ Association (DBA), also added that ensuring accuracy in financial statements, good governance in firm operations, and automation are prerequisites in making the stock market vibrant.

The stock market is a good source of funds. But its true potential is still untapped. To attract entrepreneurs, the government has to set an example by offloading shares of state-owned companies, he added.