Home ›› 14 Sep 2021 ›› Stock

Walton Hi-Tech Industries, Berger Paints Bangladesh, and Investment Corporation of Bangladesh (ICB) will have to offload a total of 8.45 crore shares, worth Tk 4,816 crore, to meet the regulatory requirement.

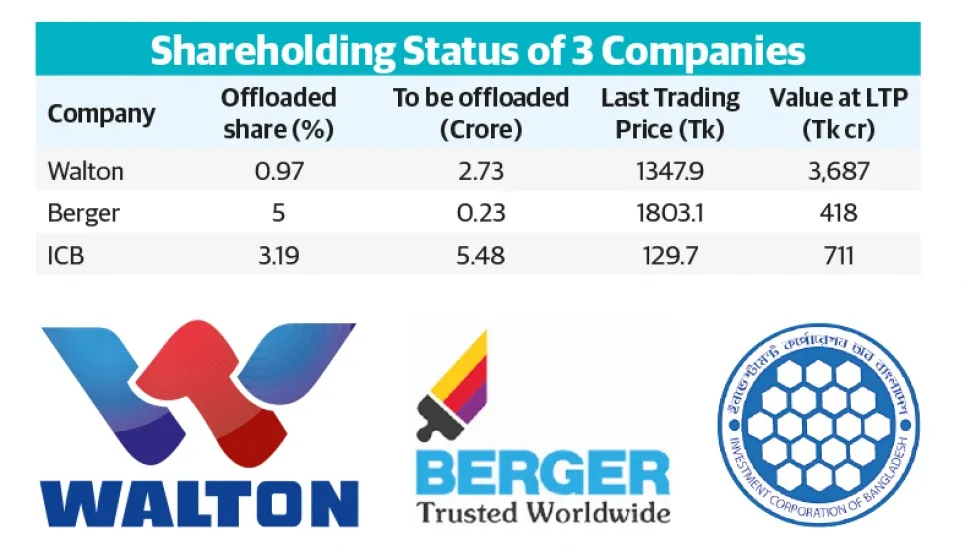

According to data from the Dhaka Stock Exchange (DSE), till now, Walton had only offloaded 0.97 per cent shares, while ICB floated 3.19 per cent and Berger Paint 5 per cent.

Walton’s sponsor-directors will have to offload 2.73 crore more shares, which amounts to Tk 3,687 crore as per the prevailing market price.

Besides, Berger Paints’ sponsor-directors will have to offload 23.18 lakh shares or 5 per cent shares of the company’s total shares. As per Monday’s trading price, the consolidated price of the shares amounted to Tk 418 crore.

At the same time, the state-owned investment company, ICB, will have to offload 6.81 per cent or 5.48 crore shares, which amounts to Tk 711 crore.

The three companies were among the top ten loser companies at the DSE on Monday.

Share price of the ICB plunged 8.66 per cent to close at Tk 129.7 share on Monday, making it the day’s top loser.

Walton, the second largest market cap company of the Dhaka bourse, saw 6.24 per cent decline in its share price to close at Tk 1347.9 on Monday. It was the day’s second highest loser.

Berger Paints also registered a 6.13 per cent price correction. The company was the third top loser on the day at Dhaka bourse.

Earlier on Sunday, stock market regulator Bangladesh Securities and Exchange Commission asked Walton, Berger Paints, and ICB to offload more shares to meet the regulatory requirement.

As per Bangladesh Securities and Exchange Commission (Public Issue) Rules, 2015, a company has to offer shares at least equivalent to 10 per cent of its paid-up capital to be listed in the stock market.

In separate letters to the managing directors of Walton, Berger and ICB, the stock market regulator directed them to offload more shares to meet the requirement.

These companies have to offload the required shares within a year starting from issuance of the BSEC letter.

However, these companies cannot offload more than 1 per cent shares in a month.

Stock market analysts have said enhanced share offloading by the large capital and sound companies will add value to the capital market as well as improve supply of quality stocks.

Walton, a local electronics giant, the company made its debut on the stock exchange on September 23, 2020. After getting listed, its market capitalisation reached Tk 43,552 crore.

The dearth of floating shares benefitted Walton to reach the landmark within a short time, said stock market analysts preferring anonymity.

As per the bidding price, Walton issued 2.8 million shares, or only 0.92 per cent of its pre-IPO paid-up capital, to raise Tk 100 crore from the capital market.

The authorized capital of the company is Tk 600 crore, while its paid-up capital is Tk 303 crore.