Home ›› 16 Sep 2021 ›› Stock

Walton Hi-Tech Industries on Wednesday applied for a time extension from the stock market regulator Bangladesh Securities and Exchange Commission to offload its more shares gradually.

The second-largest market cap company of the Dhaka bourse currently has 0.97 per cent free-float shares in the market. The company wants to offload more 4.03 per cent shares in the next three years taking Walton’s tradable share in the secondary market to 5 per cent.

After that, the company will decide to offload another 5 per cent shares to the market. Company Secretary of the Walton, Rafiqul Islam confirmed the information to the Business Post.

He said that the company has decided to offload more shares in the stock market protecting the interests of the general investors.

The sponsors-directors of Walton are planning to invest money they will receive from shares offload in new industries, he added.

Earlier on Sunday, the stock market regulator asked Walton, Berger Paints, and ICB to offload more shares to meet the regulatory requirement.

As per Bangladesh Securities and Exchange Commission (Public Issue) Rules, 2015, a company has to offer shares at least equivalent to 10 per cent of its paid-up capital to be listed in the stock market.

In separate letters to the managing directors of Walton, Berger, and ICB, BSEC directed them to offload more shares to meet the requirement.

These companies have to offload the required shares within a year starting from the issuance of its letter.

However, these companies cannot offload more than 1 per cent shares in a month. Following the move, the share market witnessed a negative impact, declining all the price indexes on both the Dhaka and Chittagong Stock Exchanges.

Following this, Managing Director of Walton, Golam Murshed, has called on Bangladesh Securities and Exchange Commission Chairman Prof Shibli Rubayat-Ul Islam on Tuesday.

Golam Murshed in this connection said Walton is conducting its overall activities including business operations in accordance with the rules and regulations of the capital market.

“We met the BSEC chairman for the interest of general investors and the overall development of the market and the country. The sponsors-directors of Walton had a request to increase the free-float shares to 5 per cent within the next 3 years. The BSEC chairman has assured to consider it for the sake of investors and the stock market,” he said.

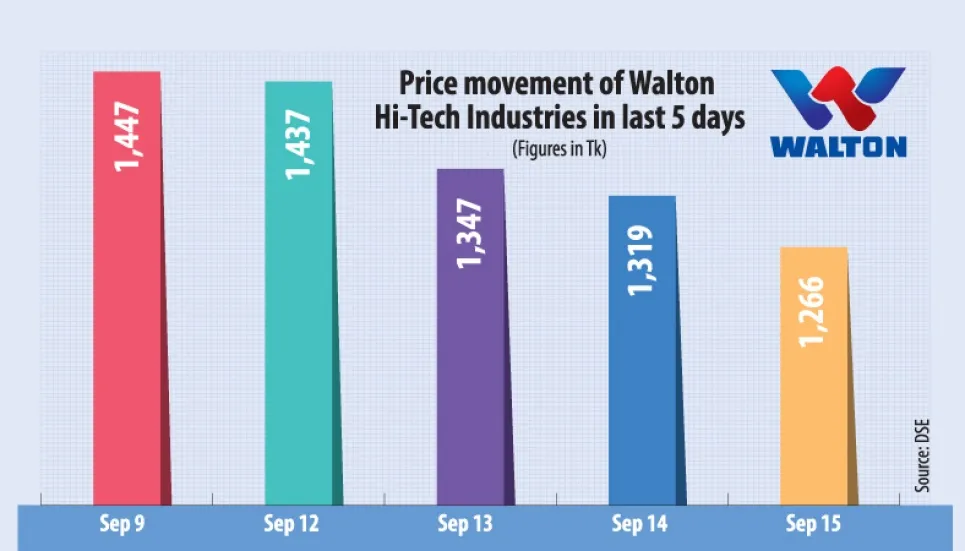

Walton’s sponsor-directors will have to offload 2.73 crore or 9.03 per cent share of the company to meet the regulatory requirement, whose market price stood on Monday at Tk 3,687 crore. Its share price also fell 4.05 per cent on Wednesday in the Dhaka bourse.

Walton, a local electronics giant, made its debut on the stock exchange on September 23, 2020. After getting listed, its market capitalisation reached Tk 43,552 crore.

The dearth of floating shares benefitted Walton to reach the landmark within a short time, said stock market analysts preferring anonymity.

As per the bidding price, Walton issued 2.8 million shares, or only 0.92 per cent of its pre-IPO paid-up capital, to raise Tk 100 crore from the capital market.

The authorized capital of the company is Tk 600 crore, while its paid-up capital is Tk 303 crore.