Home ›› 30 Sep 2021 ›› Stock

The Dhaka Stock Exchange is set to launch the operation of its SME platform today with the first listing ceremony of six companies.

Market regulator Bangladesh Securities and Exchange Commission (BSEC) had granted permission to the DSE about three years back to launch the SME platform to offer a trading board to small and medium companies to raise capital.

BSEC Commissioner Mizanur Rahman is expected to open the trading at an event to be attended by SME Foundation Chairman Masudur Rahman.

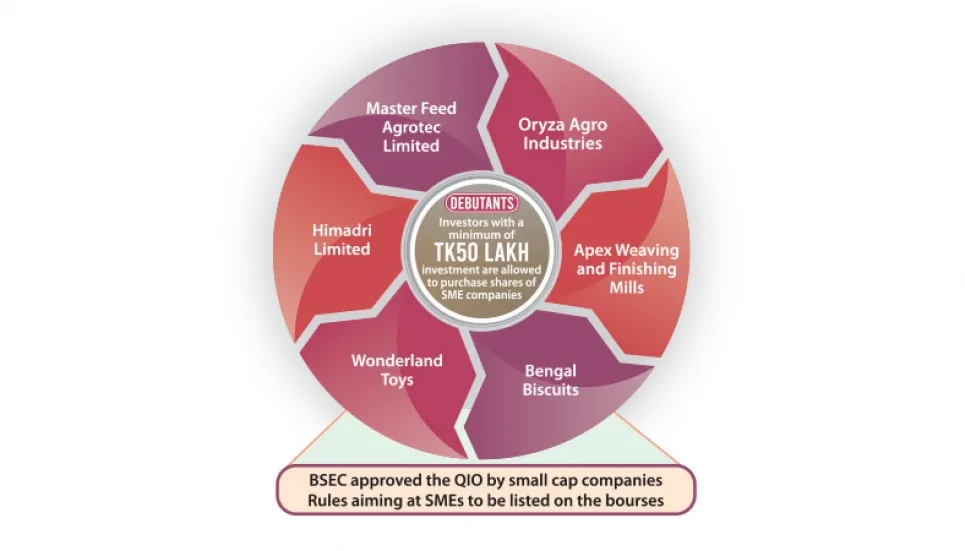

The six companies are Master Feed Agrotec Limited, Oryza Agro Industries, Apex Weaving and Finishing Mills, Bengal Biscuits, Wonderland Toys and Himadri Limited, according to the DSE website.

Of the companies, the four were shifted to the SME platform from the Over-the-Counter (OTC) market, which was abolished early this month.

“This is a big contribution to the country where SMEs play a key role but face difficulties in raising capital for their promising businesses. This is an effective way to improve the SME companies’ financial health,” said a DSE official.

The two new companies — Master Feed and Oryza Agro— recently raised funds worth Tk10 crore each through the qualified investor offer (QIO).

The qualified investor, who has a minimum of Tk50 lakh investment in the capital market, will be allowed to purchase shares of the SME companies. Investors are also allowed to take margin loans against the purchase of their shares on the SME platform.

The Chittagong Stock Exchange, the country’s second bourse, launched the SME platform on June 10, 2021, with the first listing of Nialco Alloy.

Nialco, which raised Tk7.5 crore through the QIO, was the country’s first SME listed with the CSE.

In November 2018, the BSEC approved the (Qualified Investors Offer by Small Capital Companies) Rules aiming at SMEs to be listed on the bourses.

According to the new rules, with the introduction of the Small Capital Board, a company can apply for QIO if it has a minimum existing paid-up capital of Tk5 crore, and plans to raise its paid-up capital by at least Tk5 crore through the QIO, and if after QIO its paid-up capital stands below Tk30 crore.

Furthermore, in case of the paid-up capital of the company crossing Tk30 crore, the company must apply for listing with the mainboard.

The board of directors of the small companies will also be exempted from holding a mandatory 2 per cent and jointly 30 per cent shares. There will be a lock-in period for shareholders.

In 2016, following proposals from the two bourses, the commission approved the BSEC (Qualified Investor Offer by Small Capital Companies) Rules, which were published on its website seeking public opinion.