Home ›› 09 Oct 2021 ›› Stock

Thanks to the steady buying spree of optimistic investors, the Dhaka Stock Exchange (DSE) has ended another week in positive note with its benchmark DSEX index reaching new high and other indices gaining significantly.

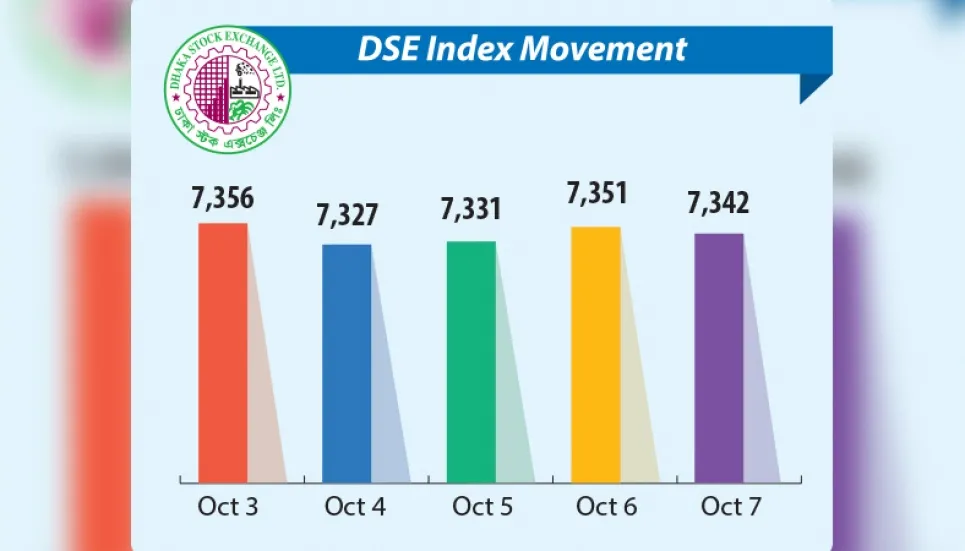

It is the third week in a row that the premier bourse ended in green. The key index opened the week in winning streak and rallied to an all-time high of 7,356 points on Sunday. It witnessed a sharp fall to 7,327 points on Monday, but returned to the gaining streak in the following session.

The index maintained positive note throughout the week, except for Monday and Thursday.

At the end of the week, the DSEX settled at 7,342, adding 14 points to that of the previous week when it went up by 74 points. Meanwhile, the average transaction at the Dhaka bourse increased 14 per cent to Tk 2,545 crore in the week. The market witnessed a mild profit-booking sale pressure from the investors during the period.

Buoyancy in tannery, engineering, cement, fuel and power, food and pharma sectors led the benchmark index to close in green despite sell pressure in general insurance, financial institution, life insurance, textile and bank sectors, observe market insiders.

The optimistic investors showed their appetite on June-closing stocks ahead of earnings and dividend declarations.

Market insiders said the capital market continued to be bullish as the economy apparently recovered from the pandemic and retained growth in exports, revenue collection and private sector credit.

At the same time, lower interest rates on savings certificates and positive forecasts from many international organizations about Bangladesh’s economy also prompted the investors to pour money in stocks.

International Leasing Securities, in its weekly market review, said the benchmark index of the premier bourse upheld its upward trend as the optimistic investors continued their buying spree amid growing confidence in the market.

The market maintained the bullish momentum riding on news that credit flow to the private sector was growing gradually as demand for loans had increased amid reopening of businesses. The government also lowered the interest rates in the national savings instruments, it said.

Besides, the news of soaring revenue collection in the July-August period of the current fiscal year powered by a recovery in economic activities and the country’s single month record export growth riding on the largest shipments of apparel goods has also positively tempted the bargain hunters, added the brokerage firm.

The global rating agency Fitch Solutions, on September 30, disclosed its revised growth forecast for Bangladesh. It scaled up the growth forecast to 6.3 per cent from the previous 5.5 per cent for the current 2021-22 fiscal year as vaccinations improved economic recovery.

Meanwhile, the World Bank also projected Bangladesh’s economy to grow at 6.4 per cent in FY22, which is 1.3 percentage points up from the global lender’s previous forecast.

Earlier in June, the projection was 5.1 per cent for the current fiscal year.

Another market review by EBL securities mentioned that the bench mark index of the DSE witnessed mixed sessions and volatility through out the week as a section of investors focused on profit booking after the index reached to record high.

Investors were active on both sides of the market throughout the week and certain investors took cautious stances as a result of conservative policies by the money market regulator, it said.

Investors were mostly active in pharmaceuticals & chemical (16.6 per cent), fuel & power (12.1 per cent) and engineering (12.1 per cent) sectors. Majority of the sectors observed correction, out of which tannery (5.5 per cent), paper (5.1 per cent) and ceramic (4.2 per cent) experienced positive performance while jute (-8.3 per cent), general insurance (-6.8 per cent) and travel (-4.5 per cent) witnessed price correction.

Point to point estimate revealed that DSEX, DSES and DS30 added 13.9 points, 3.7 points and 56.9 points respectively to their previous week’s indices.

At the port city bourse, CSE30, CSCX and CASPI added 23.2 points, 47.7 points and 64.2 points respectively to the figures of last week.