Home ›› 12 Oct 2021 ›› Stock

The Bangladesh Securities and Exchange Commission (BSEC) has formed an inquiry committee to investigate an unusual share price hike of Anwar Galvanizing Limited over the past three months.

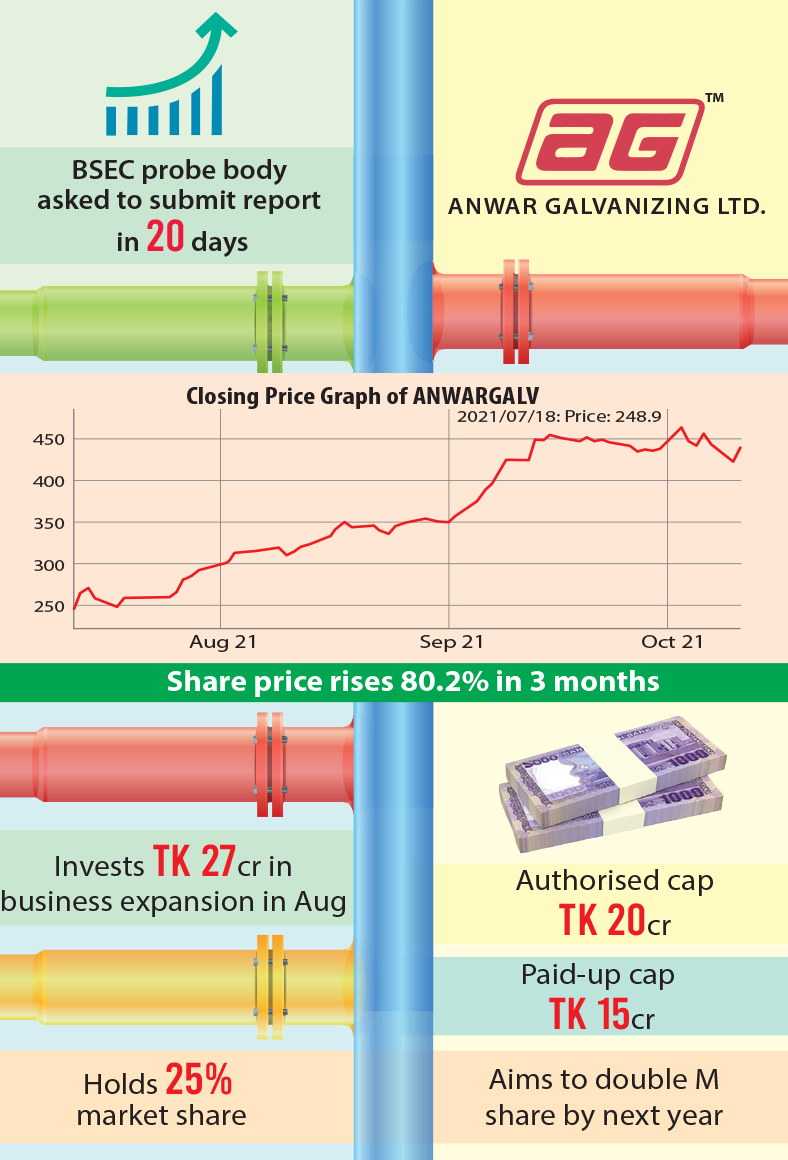

The company’s scrip shot up more than 80 per cent to Tk 439 from Tk 244 in the last 90 trading sessions.

The sharp rise of the stock has come as a surprise to the securities regulator as the company has made no price-sensitive disclosure. The two-member committee led by BSEC Deputy Director Muhammad Oarisul Hasan Rifat has been asked to report back within 20 days.

It will investigate the reasons behind the unusual increase in the prices of shares of Anwar Galvanizing, a subsidiary of Anwar Group, and will look into possible insider trading, price manipulation, and securities violations.

The company had begun the operation in the mid-1980s with the production of galvanized corrugated sheets. It is the country’s first and leading manufacturer of galvanized iron-pipe fittings (GI Fittings), and brake drums.

A senior BSCE official said that the stock price of the company witnessed a sharp rise in the last few months, prompting the regulator to launch an investigation.

On Monday, the company’s share closed at Tk 439.7, up more than 4 per cent over the previous session on the Dhaka Stock Exchange.

In August, the company declared to invest Tk 27.37 crore at its Tongi plant in Gazipur aiming to double its production and meet the domestic demands.

Upon completion of the expansion process, the company’s total manufacturing capacity will stand at 4,725 metric tonnes per annum, up from its present capacity of 2,308 metric tonnes per annum, according to the company.

The project financed by the company’s resources and loans is expected to be completed by the end of 2022.

On May 23, it received a letter from the Dhaka Electric Supply Company for an additional power supply of one megawatt to the new project.

According to the company, the additional quantity produced in the plant will directly replace the products that are now being imported. Once the new project starts production, its market share will increase from 25 per cent to 52 per cent.

The company was listed on the stock exchanges in 1996. According to the DSE, Anwar Galvanizing’s current market capitalisation is Tk 644 crore.

On Saturday, it recommended a 20 per cent cash and 10 stock dividends to its shareholders for FY21.