Home ›› 15 Oct 2021 ›› Stock

The Dhaka Stock Exchange (DSE) has started treasury bond trading on a pilot basis after 15 years aiming to buoy up the moribund bond market.

The treasury bonds, which are long-term debt instruments of the government, would be regularly traded after two months.

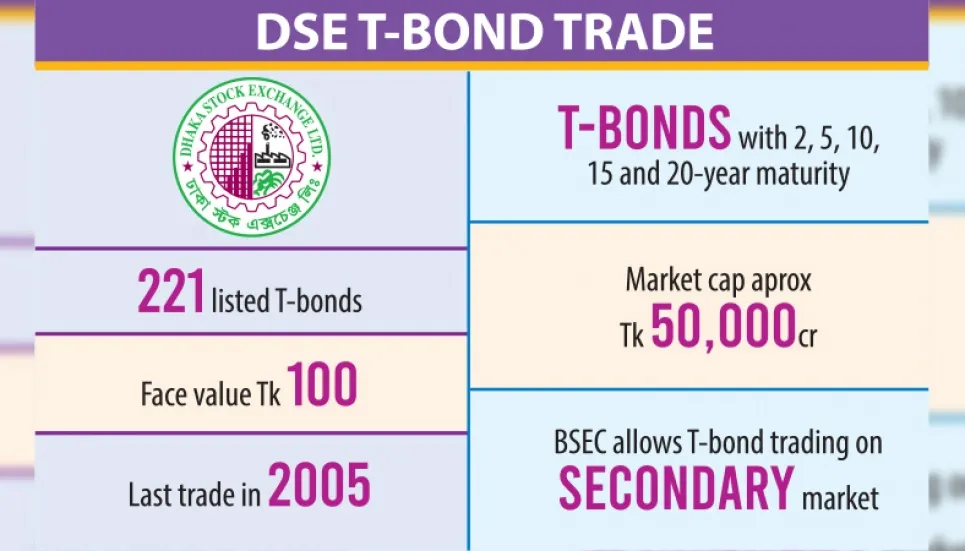

There are 221 treasury bonds listed with the DSE. But none was traded in the secondary market from 2005 when the bonds were listed on the stock exchanges.

“The country’s moribund secondary bond market got a shot in the arm to be traded through the beneficiary owner’s (BO) accounts,” said Bangladesh Securities and Exchange Commission (BSEC) Commissioner Shaikh Shamsuddin Ahmed while inaugurating the treasury bond trading on the DSE on Thursday.

The instructions have already been given to the relevant departments to resolve all technical issues during the trial trading, he said.

A treasury bond--10Y BGTB 20/01/2026—was traded on a trail basis at the stock exchange on the day. The bond price rose to Tk 110.5 from its face value of Tk 100.

The securities regulator has been trying over the last two years to get the general public involved in trading treasury bonds with 2, 5, 10, 15 and 20-year maturity and treasury bills (T-Bills) with 91, 182 and 364-day maturity in the secondary market.

T-Bills are free from credit risks and tradable in the secondary market. In fiscal 2017-18, T-Bills worth $7 billion were issued. The cut-off yield for T-Bills increased by approximately 5 per cent in fiscal 2017-18 from a year earlier.

Only the primary dealers (PDs) can submit bids in the auctions. At present, twenty banks are performing as PDs. The other institutions and individuals can submit bids in the auction but through the PDs.

Previously, banks, non-bank financial institutions, insurance companies and corporations can purchase treasury bonds. And there was no secondary market activity of the bonds.

The BSEC facilitated the trading of government securities in the secondary market of the stock exchanges in response to the 13 recommendations made by a nine-member committee headed by Bangladesh Bank General Manager (debt management department) Khurshid Alam.

Other members of the committee were from the BSEC and the DSE.

The committee suggested that the government should provide policy support to engage non-resident Bangladeshis in the country’s bond market and give financial support for the investors for the development of the secondary bond market.