Home ›› 16 Oct 2021 ›› Stock

Mostafa Metal Industries is all set to make its debut on the SME Board of Dhaka Stock Exchange (DSE) on Sunday.

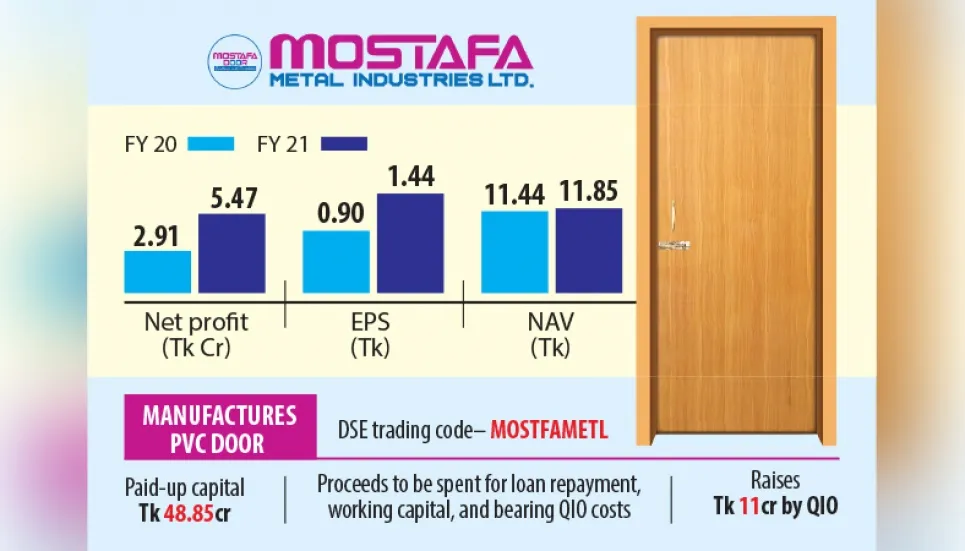

The trading code of the PVC door manufacturer will be "MOSTFAMETL" while the company code 73002.

The DSE SME Board commenced its journey with six companies on board on September 30. Mostafa Metal is now joining it as the 7th company.

The small-cap company raised Tk 11 crore through Qualified Investor Offer (QIO) by issuing 1.10 crore shares at face value of Tk 10 each.

It will spend the proceeds for bank loan repayment, working capital, and bearing QIO costs.

At the 780th meeting of Bangladesh Securities and Exchange Commission (BSEC) on June 30, the commission cleared way for the company to raise funds through QIO.

Mostafa Metal’s share subscription by the qualified investors began on September 26 through electronic systems and continued till September 30.

The QIO offer garnered huge response from the investors and was oversubscribed by 40.83 times.

The shares have already been allotted among the applicants on a pro-rata basis.

Currently, the company has a paid-up capital of Tk 48.85 crore.

The company posted a handsome profit for the last financial year.

According to its audited annual financial statements, Mostafa Metal’s profit after tax stood at Tk 5.47 crore in the financial year 2020-21, which is almost double from the previous financial year.

It posted a profit of Tk 2.91 crore in the fiscal year 2019-20.

Established in 2009, Mostafa Metal Industries Limited manufactures PVC door and window at its factory in Rajbari. It has now become a leading PVC products manufacturing company of the country.

PVC doors are not so expensive when compared with aluminium or wood. There is a growing fascination for PVC windows and doors, so getting more popular in Bangladesh.

Considering the issues, Mostafa Metal has taken initiative to reap capital market potentials and is now eying a better business in the coming days.