Home ›› 16 Oct 2021 ›› Stock

The Dhaka Stock Exchange has witnessed profit-booking in the past week, ending its rally for the third week in a row.

Cautious investors preferred taking profits from the surges seen in the previous weeks, dealers said.

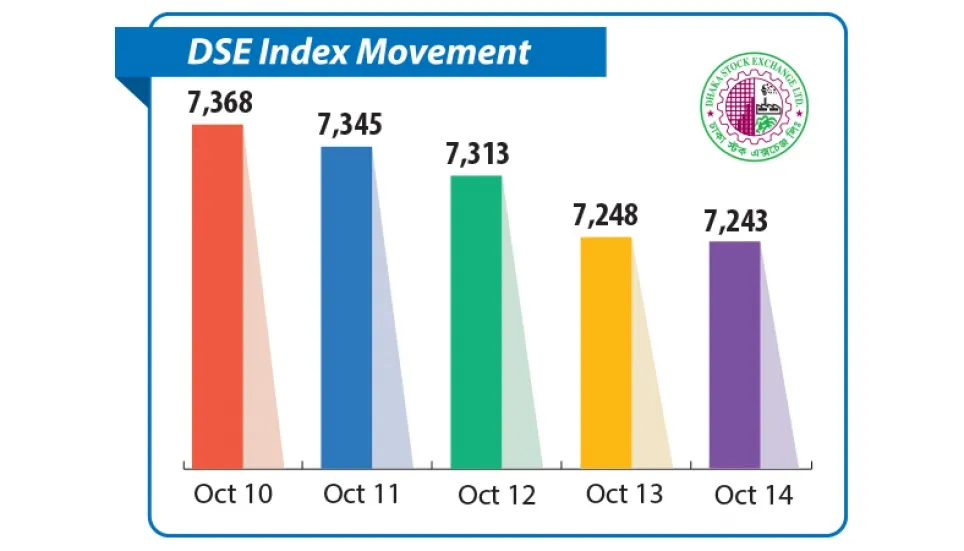

During the week that ended on Thursday, the benchmark DSEX index declined about 100 points or 1.4 per cent to close at 7,243.27. The DSEX Shariah index was down 28 points or 1.78 per cent to 1,567 and the blue-chip comprising index DS30 lost 48 points or 1.74 per cent to 2,719.

The week’s daily average turnover plunged by 28.8 per cent over the last week as the investors remained cautious to observe the market movement as the key index hovering around the highest level since its inception, said International Leasing Securities in its weekly market review.

Investors were quick to book profit on the news that the International Monetary Fund cut the economic growth forecast for Bangladesh to 6.5 per cent for the current fiscal year from its April projection of 7.5 per cent and skyrocketing prices of industrial raw materials in the international market are going to cause a severe strain for the country’s industries, it said.

The investors booked profit in large cap sectors especially travel and leisure, services and real estate and ceramic sectors.

However, the bargain hunters showed their buying appetite especially in the mutual fund sector.

Among the sectors, tannery, life insurance, and food and allied shined while travel and leisure, services and real estate and ceramic sectors witnessed price correction during this week.

The investors’ activity was mostly focused on pharmaceuticals and chemicals, textile and energy sectors.

Lafarge Holcim Bangladesh was the top turnover leader by value, followed by Orion Pharma, IFIC Bank, Fortune Shoes, Beximco, Power Grid and British American Tobacco Bangladesh Company (BATBC).

NRB Commercial Bank was the week’s top gainer soaring 29.51 per cent to Tk34.58 while Daffodil Computers was the worst loser falling around 13 per cent to Tk15.08.

BATBC was the market puller on the DSE in the last week, contributing 21.2 points to the DSEX. On the other hand, Beximco Pharmaceuticals was the market dragger, deducting 14.6 points from the index.

There was one of the significant issues in the last week that the DSE started treasury bond trading on a pilot basis after 15 years aiming to buoy up the moribund bond market.

EBL Securities, in its weekly market review said continuous corrections and declining turnovers have compelled investors to continue a wait and see approach.

Investors have also continued portfolio restructuring to take positions in the fundamentally sound stocks based on ongoing earnings and dividends declarations, it added.

According to data gathered by the brokerage house, market participation declined this week and the average turnover decreased by 28.78 per cent to stand at Tk 18.12 billion. Investors were mostly active in pharmaceuticals and chemical (15.6 per cent), textile (12.1 per cent) and fuel and power (10.3 per cent) sectors.

Majority of the sectors observed correction, out of which tannery (5.2 per cent), paper (3.7 per cent) and food and allied (3.6 per cent) experienced positive performance while travel (-9.1 per cent), services and real estate (-7.0 per cent) and ceramic (-5.7 per cent) witnessed price correction.

The port city bourse, CSE also registered losses in the last week. CSCX and CASPI declined by 196.2 and 324.6 points respectively.