Home ›› 31 Oct 2021 ›› Stock

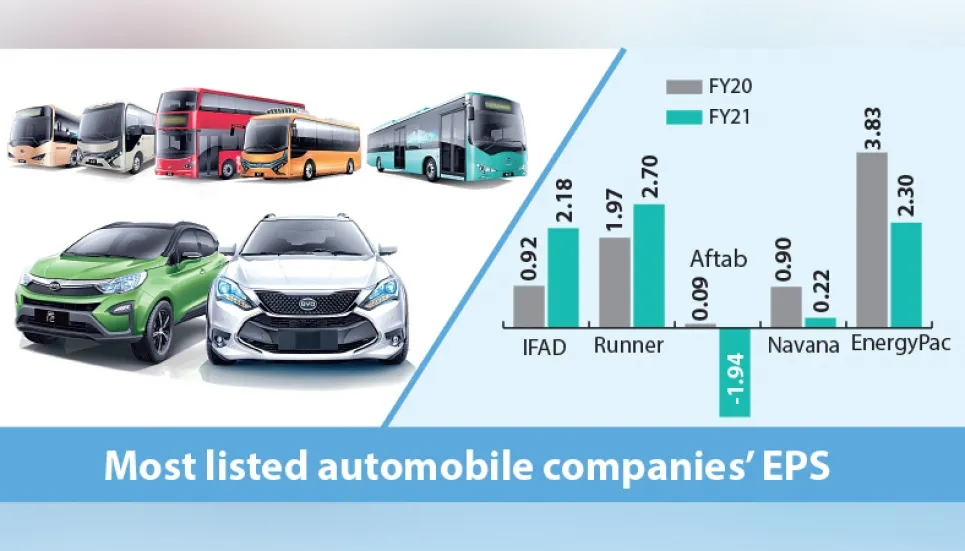

Earnings of most automobile companies were hit by poor sales volumes in fiscal 2020-21 hit harder by the pandemic.

The net sales of three major automobile companies--Aftab Automobiles, Navana CNG and Energypac– declined for the year ended on June 30, 2021, according to data the companies filed with the Dhaka Stock Exchange.

In contrast, Runner Automobiles, and Ifad Autos witnessed a rise in sales, the data showed.

Aftab Automobiles—one of the oldest and largest automobile companies in Bangladesh—was hit hardest by the Covid-19 pandemic.

It posted negative earnings-per-share (EPS) at Tk 1.94 in FY21, the sharpest drop from positive Tk 0.09 seen in the same period a year earlier.

Navana CNG, a leading CNG service provider in Bangladesh, also reported consolidated EPS at Tk 0.22, down from Tk 0.90 during the period.

The EPS of Energypac, a leading power energy company in Bangladesh, stood at Tk 2.30 for the year ended on June 30, 2021, a drop of 47 per cent from Tk 3.83 recorded in the same period a year ago.

“The slump in sales of major automobile firms was worst in decade on account of lockdowns and supply-chain constraints, which hit the earnings,” said an industry analyst.

In sharp contrast, Runner Autos, which sells its own brand of motorcycles and also markets American brand UM and Italian brands Vespa and Aprilia, saw its EPS rising.

Its consolidated EPS stood at Tk 2.70, up from Tk 1.97 during the period.

Runner Automobiles Company Secretary Mizanur Rahman said his company took some strategic moves to increase the sales and manage overall working capital more efficiently which helped increase the positive operating cash flows during the financial year.

IFAD Autos, the sole distributor of Indian commercial vehicle giant Ashok Leyland, also saw its EPS rising more than 130 per cent to Tk 2.18 from Tk 0.92 during the period.

The size of the country’s automobile industry, in particular the passenger vehicle segment, remains modest compared to other Asian peers, with only 2.5 cars per 1,000 population, according to research published by LightCastle Partners in May this year.

The market has grown multifold over the years and has become an industry worth US$1 billion. Passenger vehicle sales are dominated by the sales of imported reconditioned cars, which contribute a significant percentage of import duties for the Bangladeshi government.

Bangladesh Road Transport Authority reported a 21 per cent fall in the number of registered passenger vehicles in 2020. In fact, 2020 marked the lowest number of annual vehicle registration since 2013, said the research.

In light of the second wave of Covid-19 in the second quarter of 2021, assemblers and importers remain wary of a glut in the market until the effects of Covid-19 fully dissipate, it said.