Home ›› 08 Nov 2021 ›› Stock

Dhaka stocks lost ground on Sunday, triggered by the latest fuel price hike and transport strike.

The market moved between red and green throughout the session but last-hour selling pressure dragged the indices down, as investors were worried about some companies facing uncertainty about future sales and rising raw material costs because of the rising fuel price and value of the greenback, dealers said.

The strike called by transport owners to protest raising the petroleum products accelerated the market fall, they said.

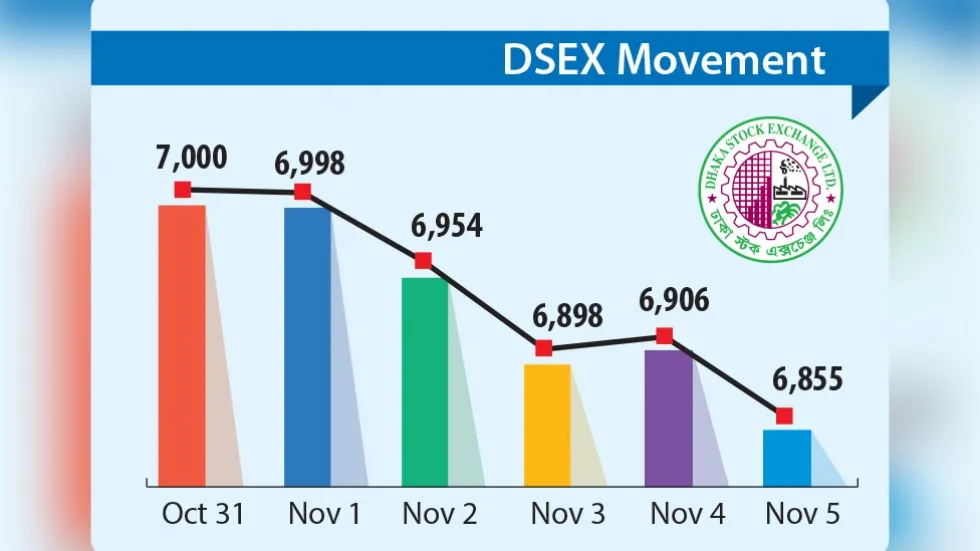

The benchmark DSEX index fell 50 points or 0.73 per cent to close at 6,855. The index was lowest since August 29, 2021, when it was 6,823.

The Shariah-based DSES index shed 17.86 points or 1.22 per cent to 1,444, while the blue-chip index DS30 lost 2.31 points or 0.08 per cent to 2,598.

On Thursday, the government raised the prices of diesel and kerosene by Tk 15 to Tk 80 per litre, citing a hike in global prices.

The government had previously fixed the prices of petroleum products in April 2016.

In Bangladesh, diesel alone accounts for more than 73 percent of domestic fuel consumption. It is used in various fields, including road and sea transport, agriculture and power generation.

Soon after the fuel price announcement, the transport owners called the strike for an indefinite period.

“The stock market nosedived after a single-day break, as the investors started to trim early losses and engaged in selloffs amidst day-long volatility in the market,” said the EBL securities in its market analysis.

The ongoing countrywide transport strike kept investors worried as they fear that export-oriented companies may observe supply chain disruption, it said.

As a result, many investors remained on the sidelines amid a lack of market direction, it added.

Participation on the bourse increased, however, driven by sell pressure as the total turnover advanced by 7.22 per cent to Tk 1,145 crore over the previous session.

The cement sector faced heavy selling pressure slumping more than 4 per cent driven by Lafarge Holcim Bangladesh slumping over 5 per cent.

The paper and printing sector came second, followed by services and real estate, jute, NBFI, general insurance, textile, travel and leisure, and fuel and power.

However, food, life insurance and miscellaneous flexed the muscle amid the selling pressure. Heavyweight sectors—bank, telecom and pharmaceuticals—closed marginally lower.