Home ›› 16 Nov 2021 ›› Stock

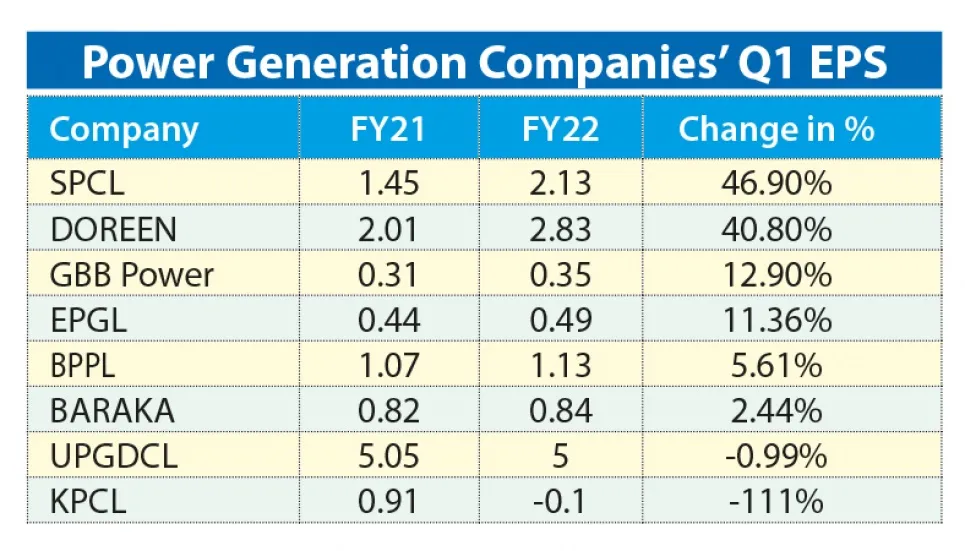

Most of the listed power generation companies have reported stellar growth in their earnings in the first quarter (July-September) of the financial year 2021-22 due to higher electricity demand triggered by factories reopening.

Shahjibazar Power Company and Doreen Power Generations and Systems turned out to be the top gainers during the period as they both reported above 40 per cent rise in earnings.

Some nine power generation companies are now listed with the stock exchanges and eight of them submitted their Q1 financial results with the Dhaka bourse as of Monday.

Six companies witnessed significant rise in earnings in the period while the remaining two – United Power and Khulna Power -- failed to retain their previous year’s earnings despite being key market players.

A senior Doreen Power executive attributed the power generation companies’ good performance to higher demand for electricity due to the reopening of factories and industries.

“The demand for electricity was high from March to October as all factories resumed their operations in the first quarter defying the third wave of coronavirus,” he said.

At the same time, the reopening of government and private offices shot up the demand for electricity, which eventually translated into the power generation companies’ production increase and good earnings,” he said.

Noting that some companies posted good earnings but saw significant fall in net operating cash flow, the

executive said those who owe bills to the power service regulator have to

spend their earnings to pay their arrears, forcing them to post lower cash flow.

Shahjibazar Power Company Limited

The power generation company registered a 46.9 per cent rise -- the highest among its peers -- in its earnings in the July-September period of the current year. Its consolidated earnings per share (EPS) stood at Tk 2.13 in the period, which was Tk 1.45 in the corresponding period a year ago.

The company also gained good profit in FY21 and recommended higher dividend comparing to that of previous year.

The SPCL recommended a 32 per cent (28 per cent cash and 4 per cent stock) dividend for its shareholders in FY21, which was 30 per cent (28 per cent cash and 2 per cent stock) in the previous financial year.

Doreen Power

The Doreen Power Generations and Systems Limited is also flying high as it registered the second highest rise -- 40.8 per cent -- in earnings in the first quarter of FY22.

The power generation company reported a consolidated EPS of Tk 2.83 for July-September period, against Tk 2.01 of the previous year’s corresponding period.

However, its consolidated net operating cash flow per share (NOCFPS) stood at negative Tk 2.36 in the period, which was negative Tk 3.69 in same period of last year.

At the same time, its consolidated net asset value (NAV) per share with revaluation stood at Tk 51.24 in the quarter.

The company has three power plants in Tangail, Feni and Narshingdi. They supply 22MW of electricity each to the BPDB (Power Development Board) and REB (Rural Electrification Board) under the power purchase agreements.

GBB Power

The earnings of GBB Power limited increased around 13 per cent in the first quarter as the company reported an EPS of Tk 0.35 for July-September period, against Tk 0.31 of same period a year ago.

Its NOCFPS stood at negative Tk 0.48 in the period while the figure was Tk 1.07 in the previous year’s July-September period.

An official of the company, who sought anonymity, attributed the NOCFPS decline to significant fall in collections from turnover and others.

GBB Power has been supplying a minimum of 21.03MW electricity to Bangladesh Power Development Board (BPDB)’s 33KV regional grid.

Energypac Power

The Energypac Power Generation Limited reported a consolidated EPS of Tk 0.49 in July-September period, which is up by 11.36 per cent from Tk 0.44 of previous year’s same period.

Its consolidated NOCFPS stood at Tk 2.73 in the first quarter, against Tk 4.68 of the FY20’s first quarter.

Baraka Patenga Power

The EPS of Baraka Patenga Power Limited (BPPL) rose 5.61 per cent to Tk 1.13 in the first quarter, comparing to 1.07 of previous year’s corresponding quarter.

Its consolidated NOCFPS stood at Tk 2.82 in July-September period this year, against Tk 0.68 of previous year’ same period. Its NAV per share was Tk 30.17 as on September 30 this year.

Baraka Power Limited

The power generation company reported a 2.44 per cent rise in its consolidated EPS to Tk 0.84 in July-September period, against Tk 0.82 of FY20’s same period.

Its consolidated NOCFPS stood at negative Tk 0.08 in July-September quarter of FY22, when the figure was negative Tk 0.38 in FY20’s same quarter. Its consolidated NAV per share was Tk 22.20 as on September 30.

United Power Generation and Distribution Company

The UPGDCL reported a consolidated EPS of Tk 5 for July-September period, down by 1 per cent from 5.05 per cent of FY20’s same quarter.

Consolidated NOCFPS was negative Tk 0.87 for July-September 2021 as against Tk 3.77 for July-September 2020. Consolidated NAV per share was Tk 61.17 as on September 30, 2021.

United Power Generation and Distribution Company Ltd (UPGCL) have 6 power plants with 484 MW capacities. The company incorporated in 2007 and listed in capital market in 2015.

Khulna Power Company

With the closure of two power plants, the Khulna Power Company has become a loss making company in the first quarter of FY22.

It reported an EPS of negative Tk 0.10 for July-September quarter, against Tk 0.91 of previous year’s same quarter.

Its NOCFPS for the quarter stood at Tk 1.42, against Tk 1.24 of previous year’s same period. Besides, its NAV per share stood at Tk 21.97.

Its company secretary attributed the losses to disruption in production.

Summit Power

The financial results of Summit Power Limited are yet to be disclosed.

However, in a disclosure made to the Dhaka Stock Exchange on Monday, the power generation company said that it closed its Chandina Power Plant-2 from Sunday midnight as its power sale agreement with the government expired.

A decision will be made regarding operation resumption once the power regulator takes a decision on renewing its agreement with private power suppliers.