Home ›› 23 Nov 2021 ›› Stock

The securities regulator has moved to come down hard on companies that did not pay dividends in the last fiscal year.

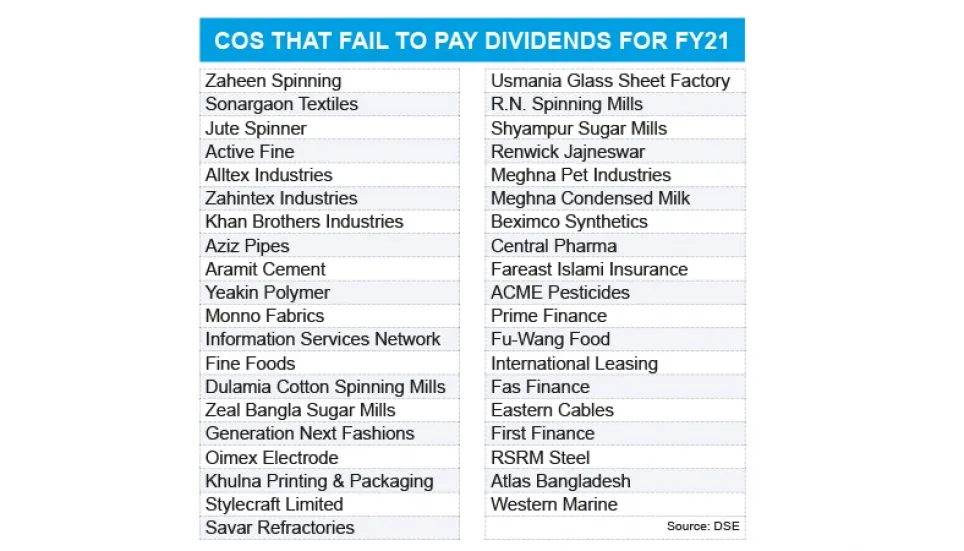

The number of no-dividend paying companies was 38, including seven profitable ones, in fiscal 2020-21. The figure was 33 in the previous fiscal year.

On Monday, the Bangladesh Securities and Exchange Commission (BSEC) asked the companies to appear in the commission to explain the reasons behind their failures to offer dividend payouts.

“The BSEC is looking to enhance the oversight to check frauds, if any, for the dividend payout failure,” BSEC Commissioner Shaikh Shamsuddin Ahmed told The Business Post. “The companies will be ordered to explain about their business situation. Tough action will be taken against those who will fail to give satisfactory answers,” he added.

Several pandemic-hit companies did not pay any dividends to their shareholders. “But some companies intentionally declared no dividends, which is not acceptable,” said a top stockbroker.

“Besides, some paid no dividends taking the future of the business into account. And again, some could not pay dividends due to the incompetence of their directors,” he added.

A company is downgraded to ‘Z’ category if it does not declare any dividend or do not hold annual general meeting regularly or is not in continuous operation for more than six months, according to securities rules. “Some listed companies lack good governance,” said Abu Ahmed, a stock market analyst.

“Companies’ sponsors and directors often trade shares anonymously, violating securities rules. They tend to make false financial reports to avoid paying dividends.”

Along with the BSEC, the stock exchanges as the primary regulators should be vigilant on the poorly performing companies, said Ahmed.

According to the Dhaka Stock Exchange listing regulation, if a company fails to declare dividends for five years from the last date of declaration of dividends or the date of listing with the exchange, it may be delisted.