Home ›› 11 Dec 2021 ›› Stock

Dhaka Stock Exchange passed volatile week ended on Thursday due to conflicting news related to policy issues.

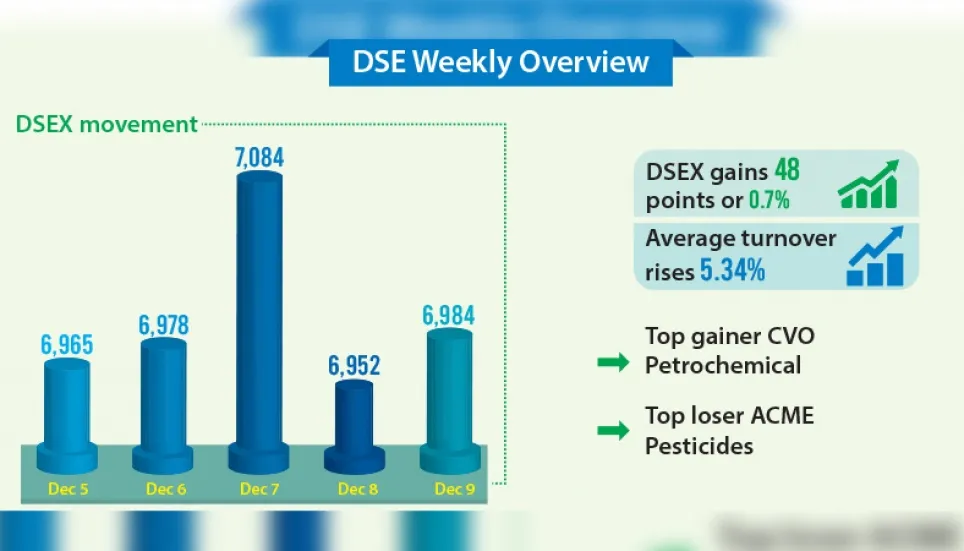

The benchmark DSEX index settled at 6,985, marginally up 48 points or 0.7 per cent.

However, the bluechip comprising DS30 index lost 3.75 points to stand at 2,632 while the Shariah-based DSES index gained 16.54 points 1,475.

The average turnover increased slightly 5.34 per cent to Tk 1,062 crore with the bank sector contributing 17.47 per cent of the total turnover.

Out of the 384 issues traded, 278 advanced, 79 declined, and 23 remained unchanged.

Besides, market capitalization at the Dhaka bourse rose by Tk 1,020 crore to Tk 5,57,190 crore in the week, which was Tk 5,56,170 crore in the previous week.

Market capitalization, or market cap, is calculated by multiplying the total number of a company’s outstanding shares with the current market price of shares.

Among major sectors, textile, IT and food and allied sectors experienced price appreciation while life insurance, bank and miscellaneous sectors faced correction.

EBL Securities in its weekly market review said that the investors mostly remained cautious after the regulatory meeting resulted in no immediate policy support for the capital market.

In the week, the investors were eagerly looking forward to hearing some positive decisions in the meeting between the finance ministry and stock market regulatory authority which took place on December 7.

The convener of the Stock Exchange Coordination and Monitoring Committee gave assurance to come up with a visible and positive decision by the end of this month or beginning of January, after the meeting between the finance ministry and stock market regulator and the National Board of Revenue.

Meanwhile, the Dhaka bourse took an initiative to encourage top 100 firms to enter share trading. It will hold a conference to this end on December 21.

Apart from that, the Bangladesh Securities and Exchange Commission (BSEC) issued ultimatum to 25 firms to maintain 30 per cent shareholding rules.

Financial sectors posted mixed performance this week. NBFI booked the highest gain of 2.79 per cent followed by bank 0.55 per cent, and mutual fund 0.53 per cent.

Life insurance experienced the highest loss of 0.57 per cent followed by general insurance fall 0.08 per cent.

All the non-financial sectors posted positive performance this week. Food and allied booked the highest gain of 2.85 per cent followed by fuel and power 1.81 per cent, engineering 1.73 per cent, pharmaceutical 1.31 per cent, and telecommunication 0.52 per cent.

Top 10 gainer companies by closing price of all companies are: CVO Petrochemical Refinery, Fine Foods, Agricultural Marketing Company, Gemini Sea Food, Information Services Network, Fu Wang Food, Metro Spinning, Appollo Ispat Complex, Shurwid Industries, and Anlima Yarn Dyeing Limited.

Top 10 loser companies by closing price of all companies are: ACME Pesticides, Vanguard AML BD Finance Mutual, Aman Feed, First Security Islami Bank, Delta Life Insurance, Fortune Shoes, Mercantile Bank, Paramount Textile, Bangladesh Submarine Cable, and One Bank Limited.

The Chittagong Stock Exchange’s CSCX and CASPI advanced by 114.1 and 207.3 points respectively in the past week.