Home ›› 25 Dec 2021 ›› Stock

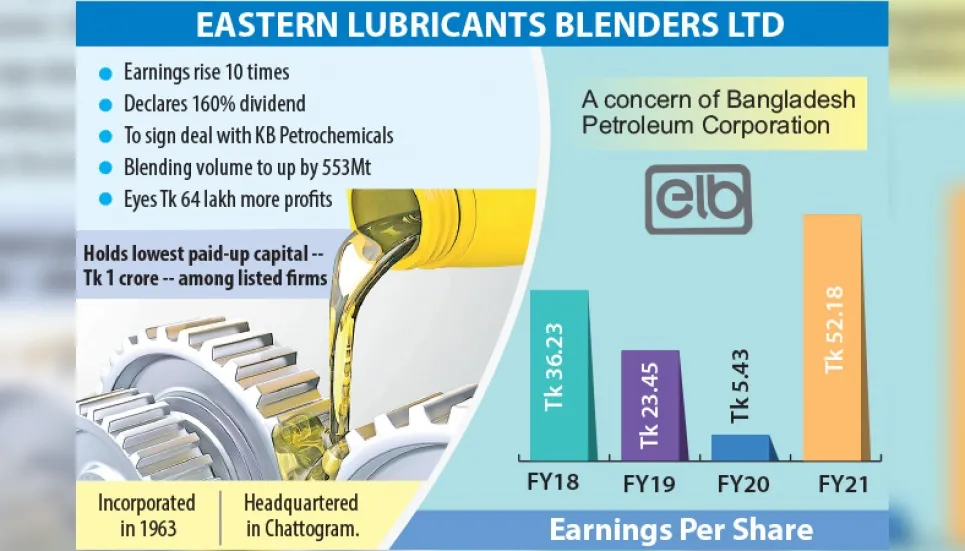

Eastern Lubricants Blenders Ltd, a listed concern of Bangladesh Petroleum Corporation, has completely recovered from the Covid-19 shock and posted an unprecedented hike in its earnings for the financial year 2020-21.

Its earnings per share, which were Tk 5.43 in the previous year, jumped 9.61 times of 860 per cent to Tk 52.18 in FY21.

Thanks to the good performance, the state-run lube oil importer and blender, in a board meeting on Thursday, decided to provide a 160 per cent dividend – 140 per cent cash and 20 per cent stock – to its investors for the year.

The Covid-19 pandemic hit the company hard as its earnings per share dropped from Tk 23.45 to Tk 5.43 in FY20. It managed to disburse only 30 per cent cash dividend to its shareholders in the year.

Talking to The Business Post, Eastern Lubricants Company Secretary Ali Absar attributed the FY21’s good performance to increased sales amid eased up pandemic-restrictions.

“Our business was really good during the last financial year, compared to the previous year. Imports and sales of blending oil rose to a significant extent,” he said, adding that the company’s bitumen oil sales also increased during the period.

However, Eastern Lubricants’ net cash flow per share declined 66.63 per cent to Tk 30.91 in FY21, which was Tk 92.63 in the previous year.

But the company’s net asset per share increased more than 27 per cent to Tk 227.63 in FY21 from Tk 178.45 of the previous year.

FY22 Q1 Performance

Eastern Lubricants witnessed a 13.5 per cent fall in its earnings in the July-September quarter of the financial year 2021-22. It reported earnings per share of Tk 1.73 in the quarter, when the figure was Tk 2 in the previous year’s corresponding quarter.

To Sign Expansion Deal

The lubricant importer is all set to sign a deal with KB Petrochemicals, a joint venture of Sena Kalyan Sangstha Bangladesh, to expand its business.

The company’s board of directors has already extended its consent regarding the deal, it said in recent price sensitive information.

Once the deal is signed, Eastern Lubricant’s annual lubricant blending volume will increase by 553.5 tonnes. Its blending volume was 1,576 tonnes in FY20.

The company hopes that its income from blending section will go up by Tk 63.65 lakh per annum thanks to the expansion, according to the PSI.

Share of Eastern Lubricants has zoomed more than 56 per cent in the 13 consecutive sessions ahead of its board meeting.

The share price rose to Tk 3,681 on the Dhaka Stock Exchange on Tuesday but declined in the following two sessions.

Lowest Cap Company

Eastern Lubricants has only Tk 1 crore in paid-up capital, which is the lowest among the listed companies.

Recently, the Bangladesh Securities and Exchange Commission (BSEC) instructed 64 companies, including Eastern Lubricants, to raise their paid-up capital to Tk 30 crore within June next year.

The companies were ordered to come up with detailed proposals in the time frame for complying with the new directive.

In this context, Company Secretary Ali Absar said they are confused whether the BSEC directive is applicable to the companies that are directly listed on the capital market.

Eastern Lubricants has been engaged in blending of lubricating oils and greases. It imports lube base oil and manufactures lube oil in combination with base oil and additives.

It is also marketing a ‘YUASA’ brand battery made in Japan for heavy vehicles including bus, truck, tank lorry, and covered vans.

The company, headquartered in Chattogram, was incorporated in 1963. It was listed in 1976 and has Tk 16.84 crore in surplus reserves.