Home ›› 05 Feb 2022 ›› Stock

Having no other option in hand, GQ Ball Pen, the manufacturer of once popular Econo ballpoint pen, is planning to change its business strategy in an effort to survive the mounting losses.

Instead of gearing up its core pen business, the company has now decided to rent out its commercial establishments to other businesses to pull up the constantly declining revenue to some extent.

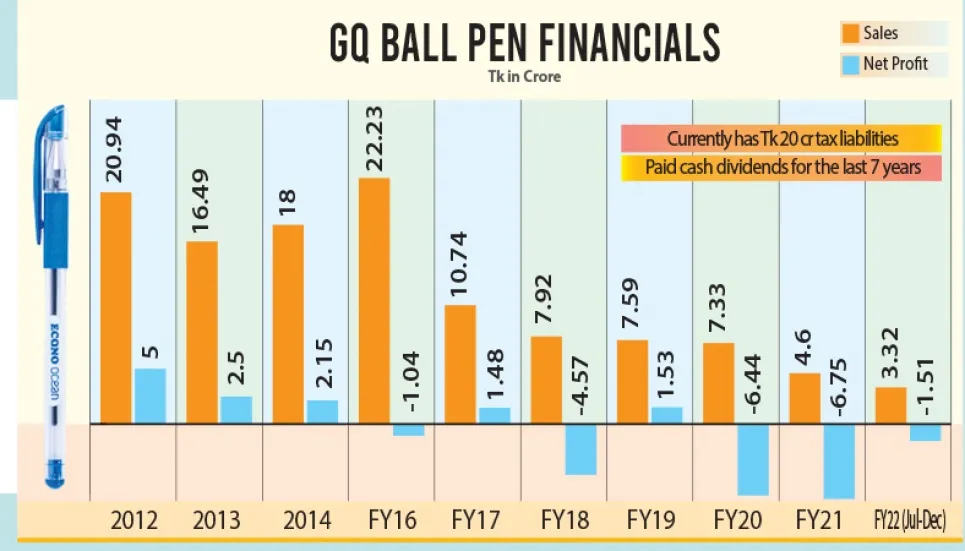

Its consolidated losses in the financial year 2019-20 and 2020-21 stood at over Tk 13 crore. The company extended the losing streak in the current fiscal year and reported a loss of Tk 1.51 crore in July-December period of FY22.

The ballpoint pen brand has been hit hard by Covid-19 pandemic as the closure of educational institutions dragged its pen sales down to a historic low. Its plastic units also failed to make good profit during the period.

Even, the company now sees difficulties in returning to ball pen production if the pandemic lingers.

“If the pandemic continues, unfortunately we will not see much improvement to our sales in near future and it will be difficult to continue with the normal operation of producing and selling ball pens,” the company said in its annual report for FY21.

However, GQ Ball Pen is still determined to complete the ongoing construction of a commercial building in the capital’s Uttara, thinking that it might help the investors get good return.

“Construction of our 14-storey commercial building in Uttara is progressing smoothly. Once completed, it will generate good revenue from rent. The revenue will be sufficient to provide adequate returns to the shareholders,” said the company in its annual report.

Business Scenario

GQ Ball Pen’s financial accounts show that its business started to collapse in 2013, when its owner and former BNP leader Kazi Salimul Haq Kamal was accused in Zia Orphanage Trust graft case.

The company failed to bounce back in the following years and then the pandemic appeared in the scene adding more to its woes.

GQ Ball Pen operates two industrial units for manufacturing and marketing of various types of ballpoint pens and plastic goods. The company is now utilising only 65 per cent of its ball pen production capacity due to the decreased market demand amid pandemic.

Its plastic manufacturing unit has not been running in the full swing since 2016 when it sustained a massive fire accident. The unit produced 2.69 crore pieces of disposable plastic spoon, glass, and comb in FY21.

Despite the sluggish business, GQ Ball Pen paid dividends to its shareholders regularly.

Retained earnings decline

GQ Ball Pen’s retained earnings are declining gradually as it had paid cash dividends in the last seven years despite being in losses.

Its retained earnings declined to Tk 20 crore in FY21 from Tk 40 crore in FY17.

Retained earnings are the amount of profit a company has left over after paying all its direct costs, indirect costs, income taxes and its dividends to shareholders.

Generally a company uses retained earnings for working capital or new investment expenditure. When a company insures losses, it distributes cash dividend from the fund.

When retained earnings decline, generally enterprises take bank loan. GQ Ball Pen’s bank loan increased 16 per cent to around Tk 5 crore in FY21.

Huge tax liabilities

The company had deferred tax liabilities of Tk 20.84 crore as on June 30, 2021.

Its total liabilities stood at Tk 32.91 crore in FY21 when it has assets worth Tk 60 crore.

Stock Investment

The company has invested Tk 9.56 crore in stocks in FY21 and gained Tk 14.16 lakh out of the investment.

Along with the capital market investment, its total investment in FY21 was worth Tk 13.79 crore, where Tk 4.23 crore was fixed deposit in bank.