Home ›› 02 Apr 2022 ›› Stock

The SME stocks flexed muscles after the securities regulator tweaked investment rules on small and medium companies traded on the SME board launched six months back.

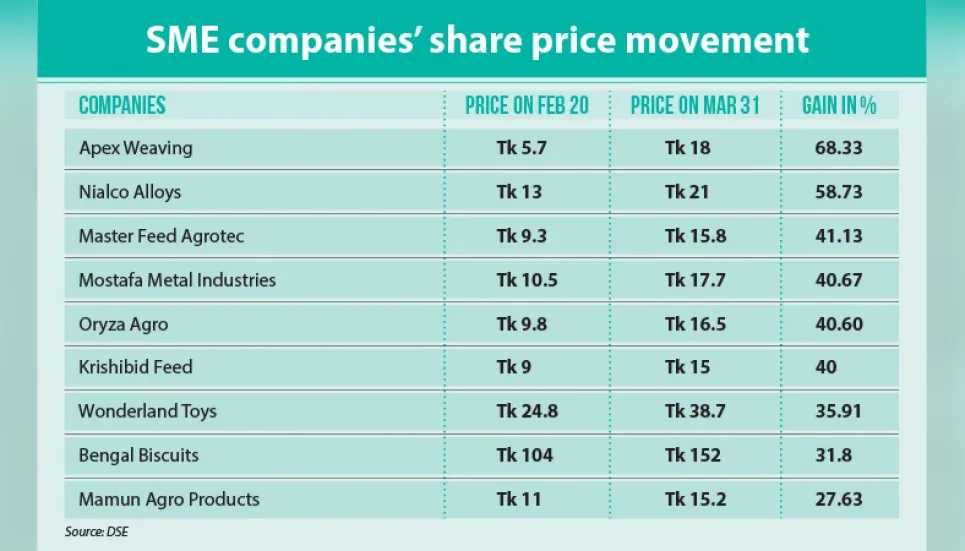

In a month, the share prices of nine SME companies rallied from 27 per cent to around 60 per cent, according to the Dhaka Stock Exchange.

On February 17, 2022, the Bangladesh Securities and Exchange Commission (BSEC) lowered the minimum investment limit to Tk 20 lakh from Tk 50 lakh for an investor to be qualified for trading on the SME board.

Before bringing changes to the rules, the SME stocks received a tepid response from the investors since September 30, 2021, when the SME board was launched.

To bring impetus to the trading of SME companies, the BSEC also cancelled the registration required for beginning for an investor the trade on the board.

According to the BSEC directive, investors registered with the electronic subscription system of the exchanges at the time of qualified investor offers (QIOs) will automatically be eligible as qualified investors for trading on the SME platform.

The Central Depository Bangladesh will provide detailed information on eligible investors on the basis of the conditions to stock exchanges on a quarterly basis and will register and update such a list of eligible investors accordingly.

“There was a doubt of the effectiveness of the SME board before. But now the BSEC’s steps created interest among investors in the SME stocks,” stock market expert Abu Ahmed told The Business Post.

On Thursday, Apex Weaving and Finishing Mills Ltd hit the upper limit circuit at 20 per cent. In a month, it rallied 68.33 per cent.

Among other companies, Krishibid Feed’s share was also frozen at 20 per cent, and in a month, its share rose 40 per cent.