Home ›› 12 Apr 2022 ›› Stock

The Chittagong Stock Exchange (CSE) is set to launch the country’s first commodity exchange platform for gold and agricultural products trading initially.

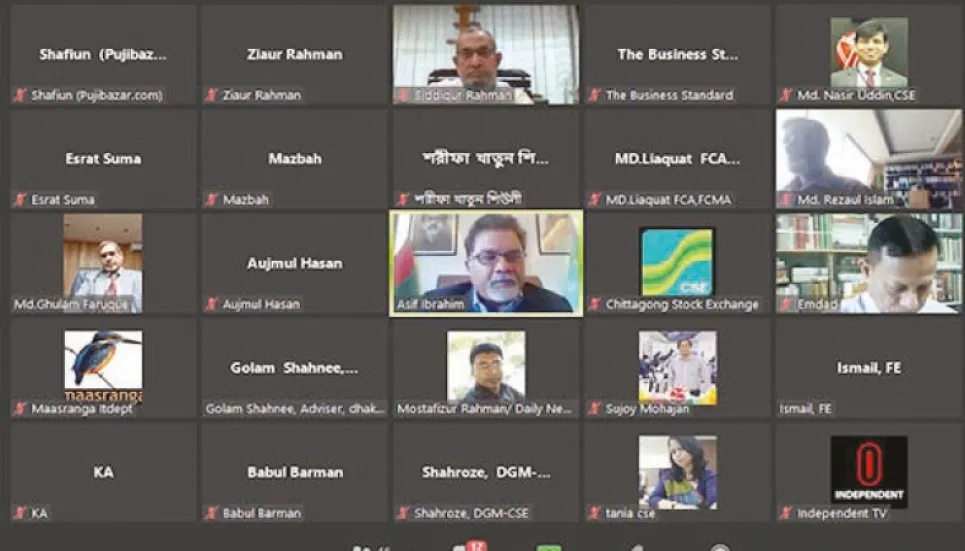

To this end, it will sign with India’s Multi Commodity Exchange of India Ltd (MCX) in Dhaka today, said CSE Chairman Asif Ibrahim at a news conference on Monday.

Under the agreement, MCX will facilitate the CSE to establish the commodity exchange marketplace.

“The commodity market first will start its trading with gold and agricultural products,” said the CSE chairman.

A commodity exchange is an exchange where various commodities, derivative products, agricultural products and other raw materials are traded.

Most of the commodity markets across the world trade in commodities such as wheat, barley, sugar, maize, cotton, cocoa, coffee, milk products, pork bellies, oil, metals, etc. Commodities exchanges usually trade futures contracts on commodities.

Commerce Minister Tipu Munshi is expected to present during the contract-signing ceremony. Bangladesh Securities and Exchange Commission (BSEC) Chairman Prof Shibli Rubayat Ul Islam and Indian High Commissioner Vikram K Doraiswami will also attend the event.

Among the South Asian countries, Pakistan, India, and Nepal have already established commodity exchanges.

Earlier, CSE appointed MCX as a consultant to establish the platform after receiving primary consent from the securities regulator in October 2021.

The BSEC instructed CSE to ensure quality assurance measures and warehouse facilities for commodities before starting operations of the exchange.

The use of commodity exchange in the global marketplace has been boosted in recent years by the growing need for the adoption of a technique to mitigate the risks faced by the producers of agricultural commodities.

Experts believe that the establishment of commodity exchange markets in Bangladesh also might be an effective tool to address the problems like the poor state of rural market infrastructure; market imperfections, and the absence of risk-minimizing instruments.