Home ›› 16 May 2022 ›› Stock

Total consolidated capital market investment from 42 banks stood at Tk 22,335 crore until March 10 this year, according to the securities regulator.

The figure was 4.39 per cent down from February when it was Tk 23,365 crore in line with the market prices, said Bangladesh Securities and Exchange Commission (BSEC) in a report compiled recently.

On the other hand, the banks’ total solo capital market exposure was Tk 14,019 crore, 6.23 per cent down during the period as per the market prices.

The total core capital of the banks was Tk 78,801 crore until March 10, which was more than Tk 82,129 crore at the end of February.

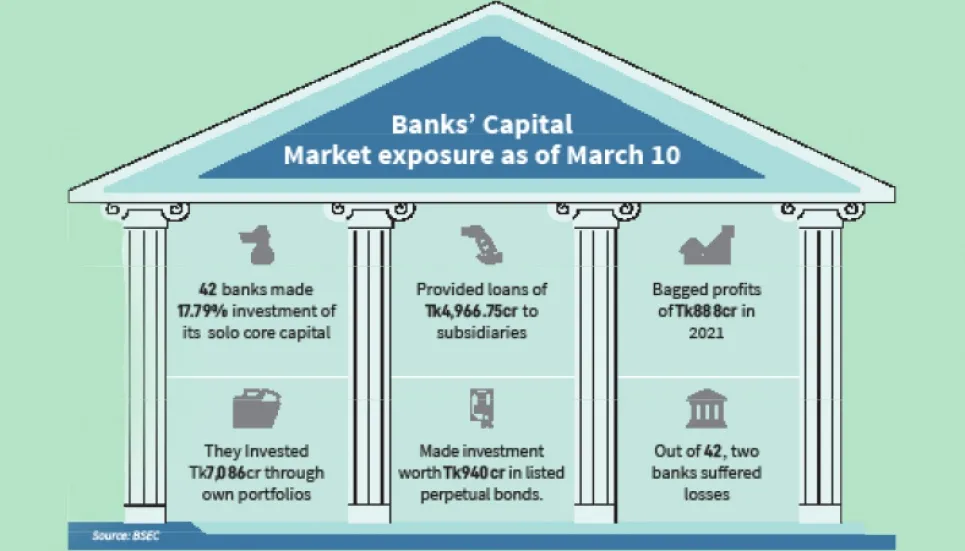

In 2021, forty-banks logged Tk 888.36 crore in profits from investing in the capital market, while two banks suffered losses. IFIC Bank was the top bank that made the highest profits during the year, said the report.

The 42 banks invested Tk 7,086 crore through their own portfolios, provided Tk 4,966.75 crore in loans to their subsidiaries, invested Tk 940.12 crore in listed perpetual bonds and invested Tk 1,846.64 crore in mutual fund and any other mode as of March 10, 2022.

The available cash in BO accounts of the banks was Tk 313.98 crore during the period. The available cash and perpetual bond investment were excluded from the banks’ capital market exposure, said the report.

Bengal Commercial Bank, Dutch Bangla Bank, Meghna Bank and Shimanto Bank has capital market exposure well below 10 per cent while five banks--Citizen Bank, Habib BANK, Standard Chartered Bank, State Bank of India, and Woori Bank--don’t have any capital market exposure, it added.

All banks together created a provision of Tk 431.46 crore against investment in the capital market during the year of 2021.

On March 9, the BSEC sought the latest positions of banks’ exposure to the capital market and asked all banks to make fresh investments to support the dwindling stock market.

It also directed the banks having exposure to the stock market below 25 per cent to raise their exposures by 2 per cent through fresh investments. And it also instructed the banks that have not yet formed a special fund to speed up the process to mobilise funds and invest in the market.

On March 9, 2020, banks were allowed to form a Tk 200-crore special fund each by taking soft loans from the central bank to invest in the stock market. The fund will remain valid until February 2025, and the banks can take advantage of the loans until January 13, 2025.