Home ›› 01 Jun 2022 ›› Stock

The Dhaka Stock Exchange (DSE) is set to launch the country’s first-ever Exchange Traded Fund (ETF) and Alternative Trading Board (ATB) in September this year.

The bourse, post-demutualization, has been working in tandem with several international exchanges to bring new financial instruments to the stock market.

“The ETF and ATB will be launched by September this year,” said DSE Managing Director Tarique Amin Bhuiyan at a news conference at the DSE in Dhaka on Tuesday.

The first ETF will be formed with blue-chip companies in a bid to popularise the DS30 index, he said.

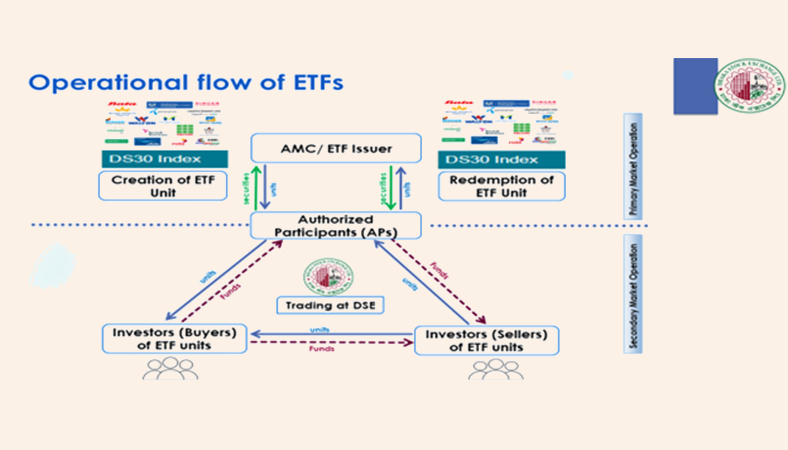

The ETFs are investment products combining the returns offered by the stock market with the diversity offered by a mutual fund. In recent times, ETFs have gained a wider acceptance as financial instruments whose unique advantages over mutual funds have caught the eye of many an investor.

“ETFs have several advantages over the traditional open-end funds. The most prominent advantages include trading flexibility, portfolio diversification and risk management, lower costs, and tax benefits,” said the DSE managing director.

On ATB, he said eighteen companies from the over-the-counter (OTC) market would be transferred to the ATB board and would be traded with shares of non-listed companies.

Apart from the 18 companies, 15 debt securities are ready to enlist with the ATB, according to the DSE.

In 2019, the BSEC approved the ATB rules to facilitate the entry of new products like non-listed securities, bonds, debentures and open-end mutual funds into the country’s stock market.

As per rules, all kinds of non-listed securities like non-listed company shares, any kind of bond, debenture, Sukuk, open-end mutual funds, and alternative investment funds may be enlisted on the ATB.

Recently, LankaBangla Asset Management Company, Shanta Asset Management, and Green Delta Dragon Asset Management Company have shown their interest as sponsors of ETFs.

The BSEC already gave consent in principle to introduce ETF in the capital market in exchange for a waiver of certain clauses of the Bangladesh Securities and Exchange Commission (Exchange Traded Fund) Rules, 2016.

Recently, LankaBangla Asset Management Company, Shanta Asset Management, and Green Delta Dragon Asset Management Company have shown their interest as sponsors of ETFs.