Home ›› 19 Aug 2022 ›› Stock

Net foreign portfolio investments in companies listed with the Dhaka Stock Exchange (DSE) hit the lowest in seven years in June 2022.

According to the IDLC Finance’s monthly business review published in August, foreign ownership stood at 3.9 per cent of the total equity market capitalisation on DSE at the end of June this year, dipping below a mark that has not been recorded since 2015.

In the seven-year period, total foreign ownership of equity market capitalisation had reached its peak at 6.8 per cent in 2019.

The DSE market cap stood at Tk 5,08,109 crore on Wednesday. Market capitalisation is calculated by multiplying the total number of a company’s outstanding shares with the current market price of its shares.

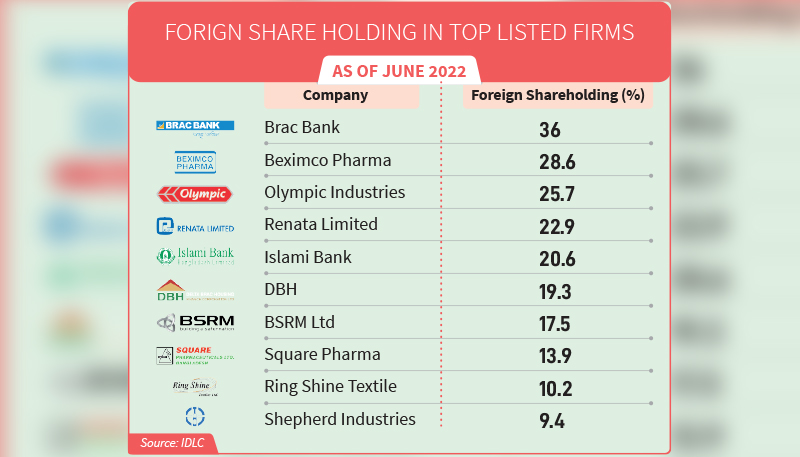

Among all the listed companies with foreign ownership, Brac Bank had the highest foreign shareholding of 36.1 per cent until June 2022, followed by Beximco Pharma with 28.6 per cent.

Olympic Industries ranks third with 25.7 per cent foreign ownership, followed by Renata Ltd with 22.9 per cent, Islami Bank with 20.6 per cent, Delta Brac Housing Finance Corporation (DBH) with 19.3 per cent, BSRM Ltd with 17.5 per cent, Square Pharma with 13.9 per cent, Ring Shine Textile with 10.2 per cent, and Shepherd Industries with 9.4 per cent.

The capital market remained volatile in recent months, with low investor participation amid frequent policy changes and currency pressure, insiders told The Business Post.

Market operators added that foreign investment turned negative as a section of overseas investors might have gone for profit booking share sales after notable investment in the previous two months.

They also said that the volatility in the financial sector, as well as in the capital market, could be a major reason for the share sales.

In recent times, investors have been struggling with various issues, including the Covid-19 pandemic, rising inflation, the continued depreciation of the Taka against the USD, concerns over external debts, and global supply chain disruption on account of the Russia-Ukraine war.

Meanwhile, foreign portfolio investors at the Dhaka bourse withdrew a record Tk 1,780 crore in the FY22.

As per DSE data, the net foreign investment has become negative since FY19 – when it was at Tk 183.7 crore negative. It was Tk 1,399 crore in FY20 and Tk 3,513 crore in FY21.

The net foreign investment had become negative in FY19 for the first time since FY11.

Market operators also noted that a series of banking scandals, along with a lack of good governance in the capital markets, had also discouraged portfolio investment.

On the issue, a top stock broker told The Business Post, “Companies with good fundamentals do not want to be listed in the stock market due to a lack of transparency in the IPO process, and overall market operations.

“There are very few (seven to eight) companies listed on the country’s stock market where foreign investors are eager to invest.”

On condition of anonymity, another stockbroker said, “A lack of confidence on the part of investors in the market resulted in continued share sales by local and foreign investors alike.”

Quoting foreign investors, he said there was a lack of transparency and accountability in the markets, which was a major barrier to making the market vibrant.

Abu Ahmed, a stock market analyst and an honorary professor at Dhaka University’s economics department, said, “Most of the listed companies are suffering from a lack of good governance. These companies’ sponsor directors often traded shares anonymously, violating securities laws.

“They tend to make false financial reports. In such cases, foreign investors will not invest in the capital market. Attracting good companies, simplifying the listing process, and bringing in government and multinational companies will help the market grow.”

Net investment by foreign investors in the country’s premier bourse was at an all-time high of Tk 2,494 crore in the FY14.

Overseas investors’ turnover at the bourse was negative Tk 52 crore in FY10, negative Tk 404 crore in FY11, Tk 529 crore in FY12, Tk 1,230 crore in FY13, Tk 2,494 crore in FY14, and Tk 1,299 crore in FY15, Tk 2,268 crore in FY17, and Tk 72 crore in FY18.

The net foreign investment has become negative since FY 19 when it was at Tk 183.7 crore.