Home ›› 05 Jun 2023 ›› Stock

The daily turnover on the premier bourse Dhaka Stock Exchange (DSE) surpassed Tk 12,00 crore-mark in the post-budget first session on Sunday, as investors kept injecting fresh funds into sector-specific shares in anticipation of quick gains.

The market turnover, according to stockbrokers and analysts, hit a fresh seven-month high yesterday, as investors’ optimism grew significantly because the government in the proposed budget for the upcoming fiscal year, did not cut any of the existing stock market facilities.

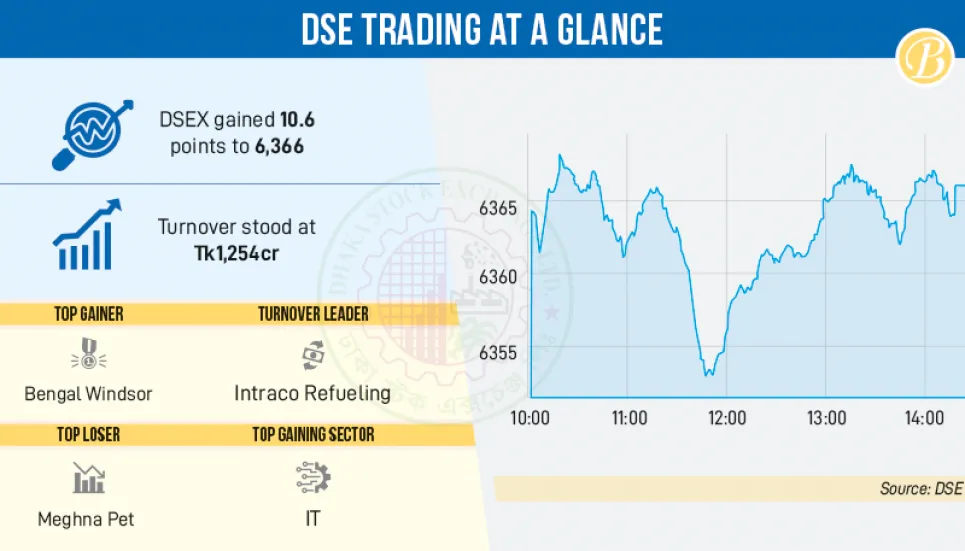

The DSE turnover stood at Tk 12,54 crore, which was 25.7 per cent higher than the tally of Tk 998 crore in the previous trading session.

Meanwhile, the key index of the market also significantly grew up owing to the growing investor confidence, with the DSEX adding 10.58 points or 0.16 per cent to settle the session at 6,366, also the highest since November 8 last year.

Among other indices, the DSES Index, the Shariah-compliant index, advanced 3.43 points to 1,383, while the DS30 Index, which comprises blue-chip companies, dropped 2.28 points to 2,199.

Finance Minister AHM Mustafa Kamal on Thursday placed a Tk 7.6 trillion national budget for the fiscal year 2023–24 before the Parliament with a focus on tackling skyrocketing inflation, employment generation, the fourth industrial revolution, and ultimately building a smart Bangladesh.

Market insiders, however, said the proposed budget has given neither good nor bad news to capital market investors.

Although stakeholders demanded some provisions in the new budget to woo investors as well as bring good firms to the market, most of their urges remained elusive in the proposed budget.

However, it is the positive thing that the government did not cut any facilities which currently prevail in the market, making investors buoyant increasingly participate in the market, analysts said.

Earlier, the National Board of Revenue had proposed the government to withdraw rebates on investments in the secondary market in the budget for the fiscal year 2023-24, but the government finally ignored the issue.

Currently, taxpayers are eligible for a 15 per cent rebate on their investments up to a maximum of 20 per cent of their taxable income in the stock market.

The life insurance sector topped the turnover chart with a contribution of 18.4 per cent of the total turnover of the DSE, followed by IT (12.2 per cent) and bank (9.8 per cent).

Intraco Refueling Station was the turnover leader, with Tk 59 crore worth of its shares changing hands, followed by Meghna Life Insurance Co Ltd, and Sea Pearl Beach Resort & Spa Limited.

Sectors displayed mixed returns yesterday, with the IT witnessing the highest gain of 3.4 per cent, followed by life insurance (2.6 per cent) and jute (1.4 per cent).

On the other hand, the travel sector faced the highest correction of 1.1 per cent, followed by general insurance (0.9 per cent) and paper (0.8 per cent).

EBL Securities, a stockbroker, said in its daily market review that the market witnessed a volatile session as investors were active on both sides of the trading fence since cautious investors preferred to remain watchful and monitor the market momentum following the national budget declaration.

Notwithstanding the sell pressure, the market, however, recovered from the early plunge, as opportunist investors continued their chase for selective scrips, causing the core index to remain afloat at the end of the session, it added.

Bengal Windsor Thermoplastics Ltd topped the gainers’ chart of the DSE yesterday with a return of 9.9 per cent, while Meghna Pet Industries Ltd was the day’s worst sufferer with a loss of 10 per cent.

Out of the issues traded, 100 declined, 77 were higher, and 173 remained unchanged on the DSE trading floor.

Stock analysts said the market optimism might sustain in the next days also, as Planning Minister MA Mannan at a programme yesterday hinted that he would speak in the parliament in favour of withdrawing advance income tax to encourage investment in the capital market.

“The issue of withdrawing the double tax policy, increasing the tax rate gap between listed and non-listed companies will be presented to the government. If you send these proposals in writing, I will forward them to the government for consideration,” the minister said.

“Bangladesh’s capital market is not getting proper attention like what usually happens in the economies of the developing nations. But this sector has the ability to become the key driver of the country’s economy,” the minister said while addressing a post-budget discussion styled ‘Discussion on Budget 2023-24: Capital Market Perspectives’.

“The stock market can become the forerunner of Bangladesh’s economic prosperity, and we are currently marching towards that path; we just need some extra monitoring to achieve this goal,” MA Mannan stated at the event, jointly hosted by Capital Market Journalists’ Forum (CMJF), and Merchant Bankers Association (BMBA).