Home ›› 05 Apr 2023 ›› Stock

IFIC Securities Limited, a subsidiary of IFIC Bank, is set to exit from drug maker Beximco Pharmaceuticals’ board through the sale of 40 lakh shares worth Tk 58.5 crore.

IFIC Securities, a corporate director of Beximco Pharmaceuticals, on Tuesday announced its intention to sell 40 lakh shares in the block market.

Meanwhile, New Dacca Industries Limited declared to purchase the same number of Beximco Pharma shares at the prevailing market price through the Dhaka Stock Exchange (DSE).

The buy and sale of the shares mentioned will be completed in the next 30 working days, according to a DSE filing posted on Tuesday.

This news comes after Absolute Construction and Engineering Ltd, a corporate director of Beximco Pharmaceuticals, along with IFIC Securities Limited completed the sale and purchase of 1.7 crore shares on March 22 through the DSE.

Why an exit from Beximco Pharma?

IFIC Securities is devoted to the development of the country’s capital market through the extension of world-class brokerage services to individual and institutional investors.

The company deals in the buying, selling, and trading of securities in the capital market. It is a TREC holder of the Dhaka Stock Exchange.

When contacted, Maksudur Rahman Khan, chief executive officer of IFIC Securities, didn’t comment concerning its departure from the Beximco Pharma board.

Beximco Pharma has been listed on the capital market since 1986 and is currently an ‘A’ category company.

Recently, Beximco Pharmaceuticals announced that it would start producing medicines in Saudi Arabia in 2024.

In the first six months of the fiscal year 2022–23, Beximco Pharma registered a net profit of Tk 265 crore, a decrease from the profit of Tk 313 crore registered in the same period of the previous fiscal year.

The company attributed the decrease in earnings to an increase in the cost of production, resulting in a decrease in gross margin.

Despite the decrease in earnings, Beximco Pharma’s total revenue increased by 16 per cent to Tk 1,968 crore at the end of the first half of the current fiscal year.

The company’s consolidated earnings per share stood at Tk 6.02 for the July-December period of FY23, which was lower than that in the corresponding period of FY22.

Beximco Pharma’s shareholders received Tk 3.5 in cash dividends per share for FY22.

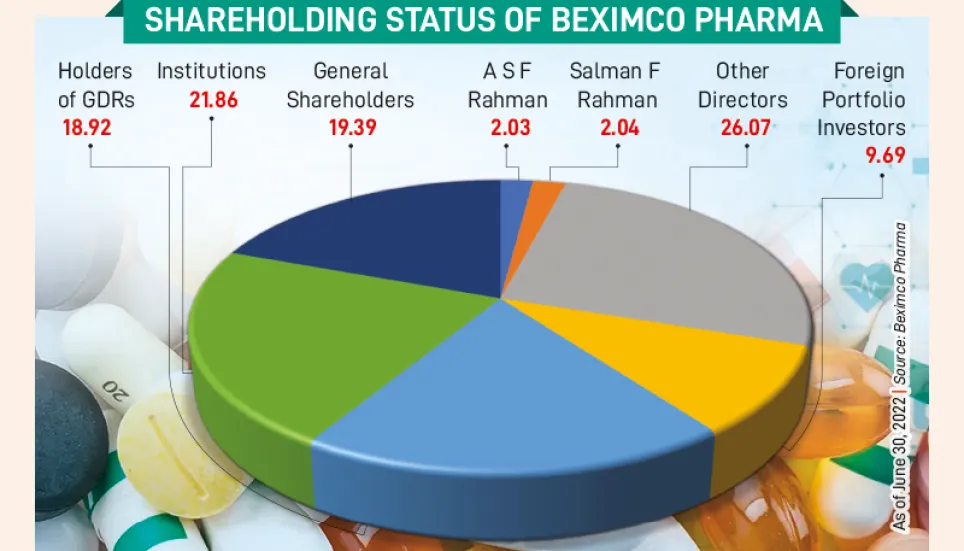

At the end of February 2023, its sponsor-directors held 30.14 per cent of stake in the company, while institutes held 23.61 per cent, foreigners 28.93 per cent, and general investors 17.32 per cent.

On Tuesday’s DSE trading floor, Beximco Pharma shares closed at Tk 146.20 per share.

Beximco Pharma witnessed a blow to its exports as the publicly traded company’s export receipts fell by 14 per cent year-on-year in the fiscal year 2021–22.

The company cited supply chain disruptions, a global economic slowdown, and eco-political issues as factors behind that export fall.

Market analysts, however, said the company’s export earnings had surged exponentially after the outbreak of the coronavirus global pandemic, riding on its massive exports of the anti-Covid-19 drug—Remdesivir.

But, as the pandemic loosened its grip last year globally, the drug maker’s Remdesivir sales had dropped significantly, playing the key role to sending its export earnings down, they added.

The listed pharma company’s net sales revenue, however, jumped by 17.5 per cent to Tk 3,466 crore in FY22 from Tk 2,949 crore in the previous fiscal.

Meanwhile, its domestic sales jumped by 21.3 per cent in the last fiscal year, predominantly due to organic growth in the business and the acquisitions of Sanofi Bangladesh Limited and Nuvista Pharma.

The drug maker’s export receipts stood at Tk 268.5 crore in the last fiscal year against Tk 312.4 crore in the previous year.