Home ›› 27 Oct 2022 ›› Stock

Sonali Paper and Board Mills, a publicly traded company, posted a 48.06 per cent surge in profit in the financial year 2021-22, riding on whopping sales and other income.

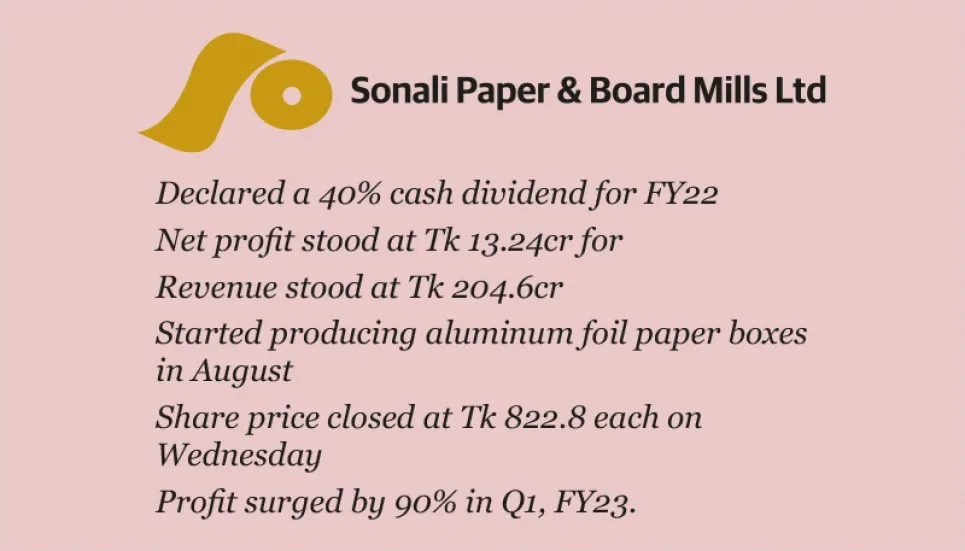

The paper boards and writing papers manufacturer posted a net profit of Tk 13.24 crore in FY22 versus Tk 8.94 crore in the previous fiscal.

The company’s revenue stood at Tk 204.6 crore in the fiscal year 2021-22, which was Tk 141.47 crore in FY21.

The listed firm’s earnings per share (EPS) stood at Tk 6.03 for FY22 against Tk 4.07 for the previous fiscal year.

Talking to The Business Post, Md Rashedul Hossin, company secretary of Sonali Paper said, “Our sales and other income surged exponentially in the fiscal year 2021-22 helping secure a year-on-year rise in profit and earnings per share too.”

“In FY22, the company purchased an increased volume of raw materials for the manufacturing of finished goods. Therefore, the net operating cash flows per share (NOCFPS) fell compared to the previous year,” Rashedul Hossin added.

Meanwhile, the board of directors of the paper board producer decided to recommend a 40 per cent cash dividend to its shareholders for the year ended in June 2022.

The recommended dividend is expected to get the investors’ approval at the company’s annual general meeting (AGM) slated to be held on December 15.

The company disbursed 20 per cent cash and 20 per cent stock dividends for FY21, and the dividend payout for FY20 was 15 per cent (5 per cent cash and 10 per cent stock).

The company reported a net asset value (NAV) per share of Tk 241.30 for the year that ended on June 30 this year.

On the other hand, the Narayanganj-based finished paper goods producer posted an 89.85 per cent year-on-year jump in its profit in the first quarter (July-September) of the current fiscal year (2022-23) , according to a company disclosure revealed on Wednesday

The company logged a net profit of Tk 23.14 crore in July-September of FY23, versus Tk 12.18 crore in the same period of FY22.

The company’s earnings per share also jumped to Tk 7.02 in the third quarter of this fiscal from Tk 3.7 for the Q3 of the last fiscal.

Moreover, it reported a net asset value (NAV) per share of Tk 171.23 as on September 2022.

The company’s net operating cash flow per share, however, declined to negative Tk 4.27 for July-September of FY23 from Tk1.36 for the same period of FY22.

The share trading of Sonali Paper, a subsidiary of the business conglomerate Yunus Group, was back to the DSE main board in July 2020 after trading at the over-the-counter (OTC) market for 11 years.

The company is mainly a producer of white and printing papers, simplex papers, and duplex papers.Its share price closed at Tk 822.8 per share on the trading floor of the DSE on Wednesday.

Incorporated in 1977, the company and got listed on the stock exchanges in 1985.Earlier in August this year, Sonali Paper and Board extended its manufacturing line by starting the production of aluminum foil paper boxes.