Bangladesh Services Limited (BSL), the nation's only state-owned travel and leisure sector company listed on the stock exchange, suffered declining business performance throughout three quarters of fiscal year 2024.

This slump follows a trend of losses since 2019, culminating in significant financial difficulties by the year's end.

Compounding BSL's financial troubles, Hotel InterContinental Dhaka, under its management, underwent a large-scale renovation that halted operations from September 2014 to November 2018, resulting in zero income during that period.

While the hotel reopened in December 2018, any potential for recovery was thwarted by the Covid-19 pandemic, which had a significant negative impact on the hospitality industry.

According to a company official, the revenues have improved after the pandemic. However, the recent hikes in dollar prices coupled with increases in import costs have not facilitated the return towards profitability.

So far, the hospitality company the financial reports for three quarters of FY24, which shows losses have increased in both quarters compared to the previous year.

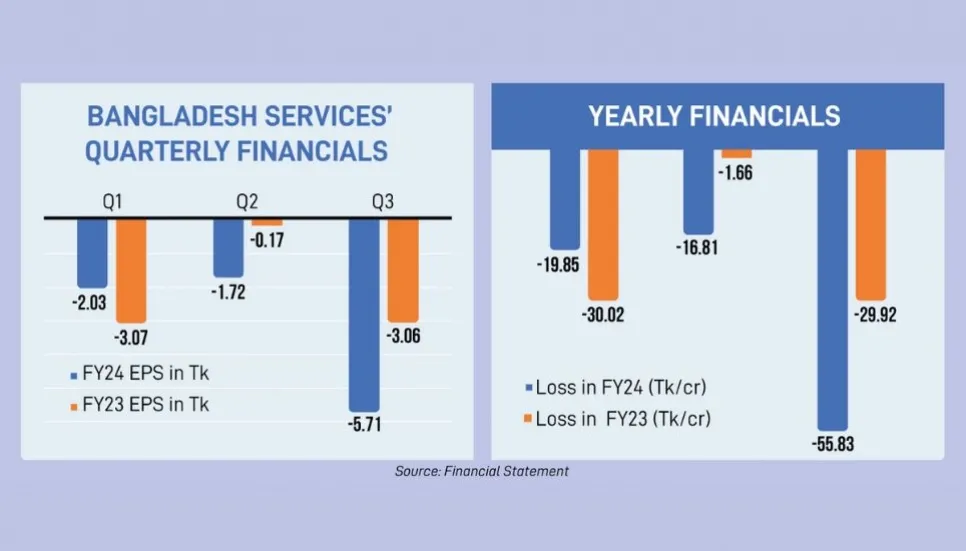

A review of the company's financial reveals that it posted a net loss of Tk 19.85 crore during the first quarter of FY24 (Jul-Sept). While that number was Tk 30.02 crore in losses at the same period of the previous year.

When compared to the same period last year, losses in Q1’24 narrowed slightly. However, the losses could not be sustained in the following two quarters.

The company's losses in the October-December quarter (Q2) increased nearly nine times compared to the same period of the previous year. The company posted a net loss of Tk 16.81 crore during that period, compared to a loss of Tk 1.66 crore in the same period a year ago.

The losses in the latest quarter (Q3’24) almost doubled from the previous year. The company posted a loss of Tk 55.83 crore in the January-March period, compared to a loss of Tk 29.92 crore in the same period of the previous financial year.

The company posted a loss per share of Tk 5.71 during the period, compared to a loss of Tk 3.06 in the same period last year.

A senior official of BSL told The Business Post, “Although some business activities have started after the Covid-19, it is not possible to reduce the losses due to the impact of the dollar price hikes.

“We have to import most of our products. So we have to make payments in US dollars. Expenditure has increased due to the upward trend in the dollar value,” the official added.

He further explained, “Although costs have increased significantly due to volatility in dollar prices since the middle of last year, the resulting losses have widened compared to the same period last year.”

The senior officer also said that even though the business was completely shut down during Covid-19 pandemic, no employees had been laid off. Instead, they have been paid in full. Hence, despite the lack of income, expenditure has increased abnormally, which has not been offset by revenues yet.

As on April 2024, the government currently holds a 99.68 per cent stake in BSL, while general investors own a meager 0.13 per cent, or 1.21 lakh shares. Foreign investors also hold 0.19 per cent of the hospitality company's total shares.

However, in February 2012, BSL had signed a management agreement with InterContinental Hotels Group (Asia Pacific) Pte Ltd for a 30-year long term for the management of its hotel in Dhaka with the option to renew the agreement for two five-year terms.

BSL also operates the Balaka Executive Lounge at Hazrat Shahjalal International Airport along with two other complexes.