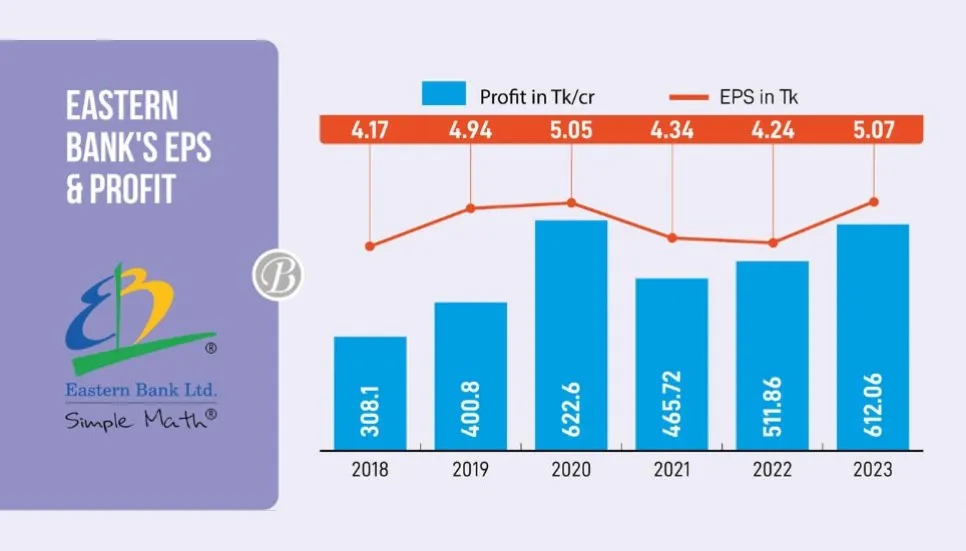

Eastern Bank Limited (EBL), a listed private commercial bank, posted net profits of Tk 612.06 crore in 2023, up by 19.57 per cent compared to the previous year.

The lender showed net profits of Tk 511.86 crore in the previous year, according to the bank’s annual financial report.

The company’s non-performing loan (NPL) ratio also increased from 2.78 per cent in 2022 to 3.10 per cent in 2023. And its NPL ratio was 3.70 per cent in 2021.

Abdullah Al Mamun, the bank's company secretary, declined to make any comment as to why the NPL ratio increased. But he said that the ratio between company's bad loans and total loans in 2023 was lower than any other banks.

Besides, he could not mention the amount of NPL in monetary terms. “After a few days, our complete financial report will be published which will reveal the information about it.”

The lender's non-performing loan (NPL) amounted to Tk 858 crore in 2022 while it was Tk 997.7 crore in 2021. The amount of bank's non-performing loan in 2020 was Tk 622.6 crore.

The EBL management became more prudent in loan disbursement and collection due to which profits increased compared to the previous year. And efforts are made to keep the NPL ratio competitive.

The bank made a net profit of Tk 465.72 crore in 2021, Tk 410.3 crore in 2020, and Tk 400.8 crore in 2019.

The private commercial lender reported earnings per share (EPS) of Tk 5.07 for 2023, which was Tk 4.24 for 2022.

The consolidated net asset value (NAV) per share of EBL rose to Tk 33.37 last year from Tk 29.62 a year ago, while its consolidated net operating cash flow per share (NOCFPS) turned to Tk 7.91 in 2023 from Tk 10.30 in 2022.

The board of directors of the bank recommended 12.50 per cent cash and 12.50 per cent stock dividend for the year ending on December 2023. The bank paid the same dividend for 2022.

Abdullah Al Mamun said that although its profits surged in 2022, it could not announce higher dividend due to a regulatory complication.

According to the central bank's guidelines, if a bank's capital adequacy ratio (CAR) is less than 15 per cent, that bank cannot pay more than 25 per cent dividend.

In a filing posted on the Dhaka Stock Exchange (DSE) website, EBL said that the stock dividend has been recommended to strengthen the capital base in order to support projected business growth and improve certain regulatory ratios.

Incorporated in 1992, the bank got listed in 1993.

The lender will hold its AGM virtually on May 29. For the dividend splits, the record date has been fixed as April 02, 2024.

With an authorised capital of Tk 2,500 crore, the company has a paid-up capital base of Tk 1,207 crore with Tk 120 crore of securities.

Its sponsor-directors owned a 30.67 per cent stake in the company, while institutional investors held 47.05 per cent, foreign investors 0.08 per cent, and the general public 22.20 per cent till February 2024, according to the DSE data.