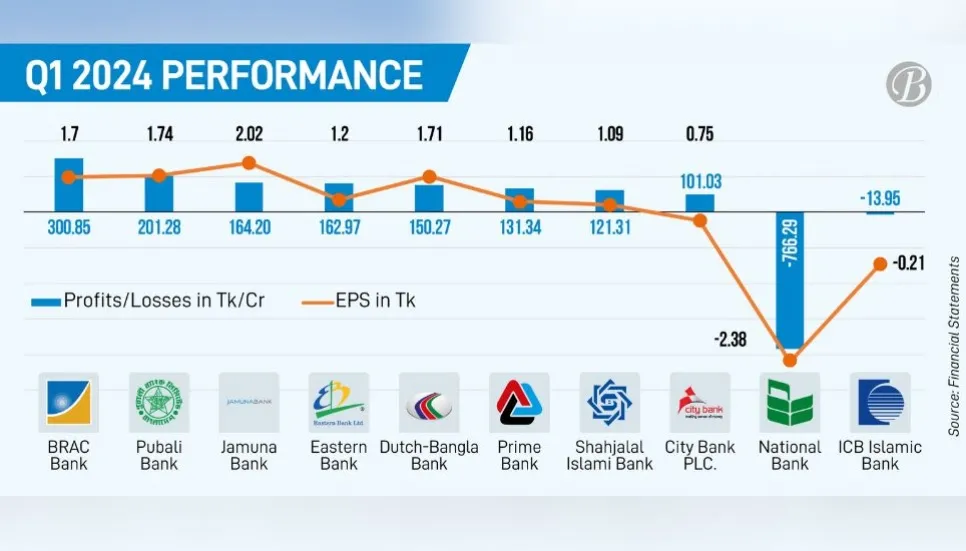

Profits of eight banks listed in the capital market exceeded the Tk 100 crore mark in the first quarter (January – March) of 2024, despite a significant decline in their share prices.

The recently published unaudited financial reports of banks listed in the capital market show that out of 36 banks, only eight banks made a profit of more than Tk 100 crore during this period.

These banks are City Bank PLC, Shahjalal Islami Bank PLC, Prime Bank PLC, Dutch-Bangla Bank PLC, Eastern Bank PLC, Jamuna Bank PLC, Pubali Bank PLC, and BRAC Bank PLC.

Although the above-mentioned banks’ profits have increased compared to the same period previous year, their share prices have decreased significantly.

Market insiders say the investors’ interest in bank shares is low because the overall financial condition of banks has not been good recently. At the same time, investors have lost interest in bank shares due to the central bank’s tendency to merge bad banks with good banks.

BRAC Bank

BRAC Bank PLC profits stood at Tk 300.85 crore during the first quarter of 2024, compared to Tk 157.50 crore recorded in the same period last year.

This listed bank posted the highest profit among the listed banks in Q1 this year.

BRAC Bank earnings per share (EPS) for the first quarter of 2024 rise to Tk 1.7, compared to Tk 0.89 for the first quarter of 2023.However, its net asset value (NAV) per share increased to Tk 42.98 at the end of March this year from Tk 41.36 at the end of December 2023.

The financial company’s net operating cash flow per share (NOCFPS) was Tk 34.49 for the January-March quarter of 2024, compared to Tk 1.72 posted in the same quarter last year.

Pubali Bank

Pubali Bank PLC has reported a year-on-year profit increase of 30.82 per cent in the first quarter of 2024. The Profit stood at Tk 201.28 crore during the first quarter 2024, compared to Tk 153.85 crore recorded in the same period last year.

The listed bank’s earnings per share (EPS) for the first quarter of 2024 rose to Tk 1.74, compared to Tk 1.33 posted in the first quarter of 2023.

Even this figure of profit did not affect the share price of the bank. Rather, the share price has continued to fall since May. At the beginning of May, the bank's share price was Tk 29.4. But it fell to Tk 25.2 per share last Thursday.

Jamuna Bank

Jamuna Bank PLC profits stood at Tk 164.20 crore during the first quarter 2024, compared to Tk 133.31 crore recorded in the same period last year.

The bank also reported consolidated earnings per share (EPS) of Tk 2.02, consolidated net asset value (NAV) per share of Tk 24.67 and consolidated net operating cash flow per share (NOCFPS) of Tk 18.99 for the year ending on December 31, 2023, against Tk 1.95, Tk 24.20 and Tk 11.28 respectively for the year ending on December 31, 2022.

These profits did not have any positive effect on the share price of Jamuna Bank. Rather, the bank's share price has fallen from Tk 21.08 to Tk 20.8 since the beginning of May till Thursday.

Eastern Bank

Eastern Bank PLC profits stood at Tk 162.97 crore during the first quarter 2024, compared to Tk 120.87 crore recorded in the same period last year.

The bank has also reported consolidated earnings per share (EPS) of Tk 1.20 for January-March 2024, against Tk 0.89 for the January-March period of 2023.

Consolidated net operating cash flow per share (NOCFPS) stood at Tk 2.34 for the January-March period of 2024, against negative Tk 1.32 recorded year-on-year. Consolidated net asset value (NAV) per share was Tk 33.51 until March 31, 2024, and Tk 30.48 until March 31, 2023.

The bank's share price fell nearly 4 per cent after releasing unanticipated first-quarter financial reports.

Dutch-Bangla Bank

Dutch-Bangla Bank PLC profits stood at Tk 150.27 crore during the first quarter of 2024, compared to Tk 147.64 crore recorded in the same period last year.

The bank’s EPS stood at Tk 1.71 during the period, compared to Tk 1.68 recorded in the same period last year.

The bank has also reported net operating cash flow per share (NOCFPS) of Tk 27.89 for the January-March 2024 as against Tk 4.68 for January-March 2023. Consolidated net asset value (NAV) per share stood at Tk 66.03 until March 31, 2024 and Tk 57.35 until March 31, 2023.

Shares fell 8.38 per cent until Thursday after the bank's record dividend date of 2023 on May 9.

In the first quarter of 2024, Prime Bank PLC made a profit of Tk 131.34 crore, Shahjalal Islami Bank PLC made a profit of Tk 121.31 crore, and City Bank PLC made a profit of Tk 101.03 crore.

Al-Arafah Islami Bank’s EPS grew by 21.5 per cent to Tk 0.23 due to increased investment income compared to previous corresponding period, said in a disclosure published on the stock exchanges.

Global Islami Bank’s EPS grew by 39.65 per cent to Tk0.81, SBAC Bank's EPS grew by 41 per cent, Social Islami Bank's by 28.57 per cent, Trust Bank's by 31 per cent And Mutual Trust Bank's by 14.70 per cent.

While National Bank's EPS declined by 145.36 per cent and ICB Islamic Bank's by 31 per cent.