Home ›› 28 Oct 2021 ›› Front

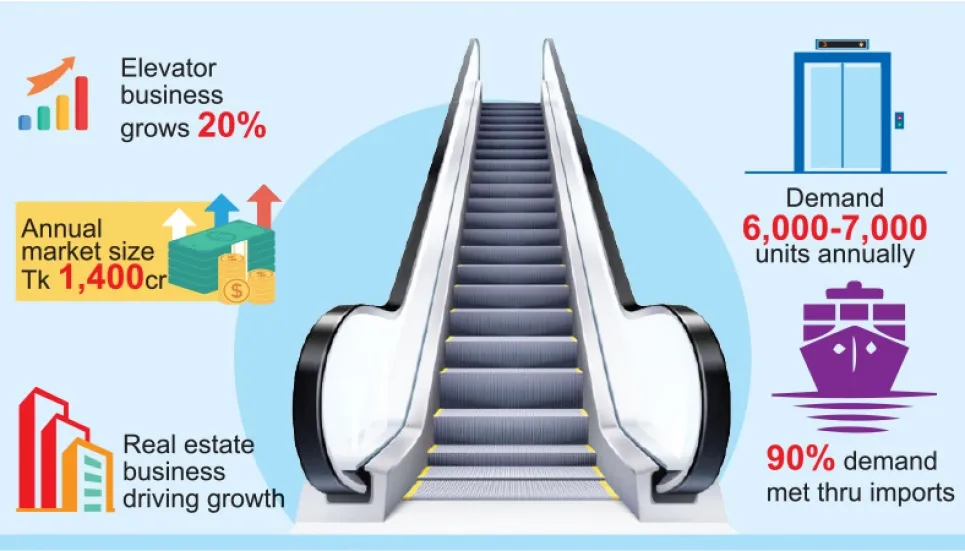

Riding on the growth of mid-rise and high-rise infrastructures along with industrial development across the country, the market size of lifts or elevators has increased twofold over the past three years.

The annual demand for lifts is now 6,000 to 7,000 units, up from 3,000 units just three years ago, according to the Lift and Escalator Association of Bangladesh.

The market is growing by 20 per cent annually, and business insiders say they are optimistic about 40 per cent growth in 2021, hoping to cover up pandemic-induced losses of the previous year.

Industry insiders estimated that the market size is now Tk 1,400 crore which was just half three years ago and the sector employs 20,000 people directly and indirectly.

Though the business is now highly import-dependent, local manufacturers are also producing elevators and many entrepreneurs are mulling over investment in the sector.

Nearly 90 per cent of the local demand for lift is met through imports from China, Italy, Korea, Turkey, Spain and Thailand and the remaining 10 per cent is met by the local manufacturers.

The Lift and Escalator Association of Bangladesh data shows that 950 companies supply elevator and escalators of nearly 300 brands across the country.

Now most office complexes, shopping malls, hospitals, banks, hotels, residential buildings, and government and private institutions have lifts.

Apart from the commercial and industrial infrastructures, elevators now became a mandatory utility in residential buildings that also boosted the market in the real estate sector.

Elevators also left an important socio-economic impact. In the crammed city of Dhaka, the upper levels of buildings which previously were harder to reach via stairways, and were, therefore, inhabited by people with low-income. After the installation of lifts, they became attractive to the wealthier class.

The luxury apartments which previously were on lower levels, for easier access, kept growing up which offer better views and more natural light.

Joynul Haq, a house owner in Dhanmondi, said lifts had become an essential part of the high-rise and mid-rise buildings.

He explained that anyone looking for renting a flat now first inquires about lift facility and they are ready to pay more for it.

Same is the situation in the tourism sector. A hotelier in the beach town of Kuakata said guests avoid three to four-storied hotels without lifts.

“Most of the hotels here have already installed lifts and the rest will follow suit to meet guests’ requirement,” said Gazi Mohammad Hanif, owner of Hotel Gazi Palace at Kuakata.

In the market, various types of elevators are available including hydraulic elevator, capsule lift, building lift, passenger lift, freight elevator and residential elevator.

Among the categories, the passenger elevators are the best seller products due to the increasing demand for residential and commercial spaces while the next fastest-growing segment is freight elevators to transport goods to different floors of the same buildings.

Market players

Maan Bangladesh Ltd, Property Lifts, a sister concern of Pran-RFL Group, Walton Lift of Walton Group, Euro Elevator (BD) Ltd,

Creative Engineers Ltd, Thyssen Krupp Elevator (BD) Pvt Limited, Electro Power Engineering Company Ltd, Sigma Elevator Bangladesh Ltd, Kone Lifts & Escalators Bangladesh, Crest Lift Ltd, Capital Lift Limited are among the prominent companies in the market.

Ahammed Ali, Managing Director of Capital Lift Limited, said the elevator market is growing faster at the rate of 20 per cent per annum and this year the market would see a significant growth.

“The pandemic hit the market as it did for other businesses, but this year we expect it to grow by 40 per cent as construction activities resumed with the ease of restrictions,” he added.

Kamruzzaman Kamal, director of marketing at Pran-RFL Group, said they supplied 300 lifts to residential buildings, commercial offices, mills and factories in 2021-21 financial year.

The products of Walton got popular in the market as their prices are 30 to 50 per cent lower compared to imported items, claimed Md Jakibur Rahman Sezan, Brand Manager of Walton Group.

Mohibur Rahman Khan, General Manager of Concord City Development Ltd, said passenger and freight elevators have the highest demand in the market and real estate developers purchase most of the lift.

“As people are becoming fancier, we hope to sell more lifts than the target in the coming days,” hoped Mr Khan.

State of the local manufacturers

Local tech-giant Walton invested more than Tk 50 crore for manufacturing elevators following European technology and standards.

As per the data of Lift and Escalator Association of Bangladesh, 25 companies are making instruments and accessories for elevators including cabin, mechanical items, motor base, sheet, cabin, and cop and lop.

Walton Brand Manager Md Jakibur Rahman Sezan said they are making elevators with the locally made sheet, cabin, cop and lop and supplied at least 31 units in September and most of them were passenger elevators.

Walton usually produces 500 units of elevators a year but it has a capacity to produce 1,500 units annually.

Accordign to Araf Ahamed, owner of Crest Lift, they are now selling imported elevators in the market but are planning to manufacture elevators for the local market.

“We have the capacity to produce elevators for the local market. Officially, we will go for formal manufacturing within six months. The local manufacturing will decrease import dependency and boost the economy,” he pointed out.

Sub-sectors like servicing and upkeep come along

With the growth of lift market, sub-sectors like servicing and repairing have also developed and are ensuring significant employment.

Most lift sellers provide customers with after-sales service for a certain period and when that period expires, customers need to rely on local mechanics for servicing and maintaining the lifts. Some institutions also appoint full-time staff to maintain their lifts.

People related to servicing and maintenance said they earn a handsome amount by providing their clients with services.

According to Ahammed Ali, Managing Director of Capital Lift Limited, there is a vast opportunity for employment in elevator maintenance; some companies are now providing services only instead of selling lifts.

“We are now providing services to some 200 clients while most of them are commercial institutions,” said Ali.

The elevator companies are providing free service for one year from the date of sale, but they have to pay a bill for further services beyond the stipulated period.

“We are providing services to 600 lifts and for this, we charge Tk 3,000 to Tk 4,000 per month,” said Mohibur Rahman Khan.

Mahbub Alam, General Manager of City Elevator, asserted that they earn a significant amount of money through servicing lifts.