Home ›› 01 Nov 2021 ›› Back

Hit hard by the Covid-19 pandemic, the app-based ridesharing services are struggling to survive as a section of drivers avoid using the apps to evade paying the commission on fares.

On the other hand, many users negotiate fares with drivers to pay less than what the apps would have charged them.

Both acts are illegal according to the government rules.

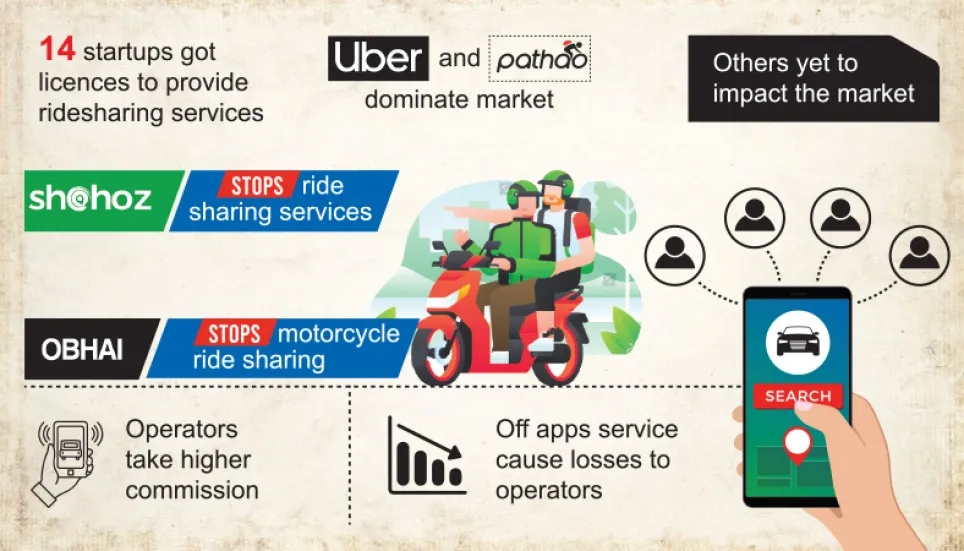

Shohoz, a major player in the market, has already stopped all ridesharing services while another key player Obhai closed its motorbike services as the number of users on both platforms has fallen drastically.

Stakeholders say the ridesharing industry that intended to offer faster transportations bypassing heavy traffic in megacities and create jobs for thousands still has potential.

But companies suspending ride-sharing operations several times since June 26 last year, in compliance with the government directive imposed to curb Covid-19 infections, have resulted in further revenue losses.

“Obhai has taken a financial hit during the pandemic, but we have had a strong rebound,” Syed Fakruddin Millath, senior manager for corporate and regulatory affairs at Obhai Solutions, told The Business Post.

“We are looking at brighter days ahead with over five lakh active users on our platform and rejuvenated strategies that fit the challenges of today’s market. As part of the strategies, Obhai has introduced complete digital payment systems for its car and CNG-run auto-rickshaw services,” he added.

Shohoz in a recent statement told The Business Post it had not resumed ridesharing services after last year’s lockdown as the industry had suffered much over time.

Many of its users and drivers have shifted to other platforms and they negotiate fares instead of using the app, thus hurting the company’s revenue.

Drivers say they do not receive a significant number of ride requests from users, and this discourages them from using platforms other than Uber and Pathao.

The remaining 10 government-listed digital ridesharing platforms have failed to gain popularity so far.

“Arranging trips without using the apps can raise multiple safety concerns for both users and drivers. We are constantly working with different government bodies to ensure the safety of both parties. Besides, we are arranging various training and campaigns to raise awareness among riders and passengers,” said Fahim Ahmed, president of Pathao.

According to him, the platform now caters to over seven million users, and three lakh drivers have registered with the app.

Bangladesh Association of Software and Information Services (BASIS) president Syed Almas Kabir told The Business Post it is essential to educate users about what their benefits are, such as making an organisation accountable for their safety, if they use the apps.

“They will not get the benefits if they beat the system to save some bucks.”

Discontent, chaos on the road

The crowd of incompetent and reckless drivers coupled with high fares have created discontent among drivers and passengers.

“A rider who works 14-16 hours a day can earn Tk 1,800 tops. 35 per cent of his income goes on petrol and maintenance while app-based platforms take a commission of 15 to 25 per cent. The situation is worse for car drivers as they have other expenses, such as maintenance,” said Belal Ahmed, general secretary of Dhaka Ride-sharing Drivers Union.

“Recently, Uber sent us a message, saying our earnings would be raised by 15 per cent, but this portion will be taken from passengers. The company is so greedy that it will take a 25 per cent cut from this too. We do not want to discourage passengers by charging them further. All we are asking of the platforms is to reduce their commission to 10 per cent,” he added.

Uber in a recent statement told The Business Post it follows the standard operating procedure globally to calculate fares, whether it is in Bangladesh or in India.

“Fares are always calculated in advance using an algorithm that considers the estimated trip time and distance between the source and the destination, local traffic patterns, and demand and supply in a given location. When there is a higher demand, fares may be higher as per the pricing model, which incentivises riders to drive during peak hours,” the statement added.

When asked if the company plans to reduce the current commission to the level demanded by the drivers, it said, “Maintaining a safe and reliable platform in Bangladesh requires significant investments. Our commission reflects the need for Uber to reinvest in tech and other solutions to ensure that drivers and passengers get the best service.”

Why take a gig as a profession

To explain why it is difficult for ridesharing drivers to be involved in a formal profession, Belal said, “The pandemic ousted many of them from previous professions and they plunged into debt.”

He claimed some four lakh drivers offer ridesharing services full-time, contrary to the initial idea of this sector.

His association is vocal about recognising ridesharing drivers as formal professionals and formulating a new policy to make the government safeguard the sector and drivers.

Exit is a startup culture

Industry insiders say it is common for ridesharing companies to take a significant amount of time to make profits. This phenomenon is global and not limited to local ridesharing companies.

To mitigate losses, companies in Bangladesh have laid off employees or diversified their businesses to offer food delivery and other services.

Controlling costs is of paramount importance in this industry, experts say.

The BASIS president said the amount of loss in Bangladesh is way high as there are too many market players in a small region like Dhaka, a breeding ground for the sector.

Explaining the exit of some market players, he said it is a global phenomenon for startups to make the company profitable or popular and then sell it to another company or secure further investment.

“Venture capitalists and angel investors who invest in these startups know that most companies will not achieve success. In the global startup arena, the success rate is less than 10 per cent while the remaining 90 per cent shut down in two years. But when one turns out to be a unicorn or a billion-dollar company, it can recoup any possible losses,” he explained.

Startups had incurred significant losses during the pandemic, he said, adding that, “If they fail to develop timely strategies, they are destined to fail.”