The prospect of a war between Iran and Israel is believed to have affected Bangladesh’s capital market.

Due to the disruption of import trade in the country, triggered by the Russia-Ukraine war, the profits of most of the listed companies had already decreased during this economic recession, and this time, it has also spread fear in the capital market.

Market analysts say there is no direct trade with Iran in Bangladesh. As a result, listed companies are less likely to suffer financial losses similar to figures recorded during the Russia-Ukraine war.

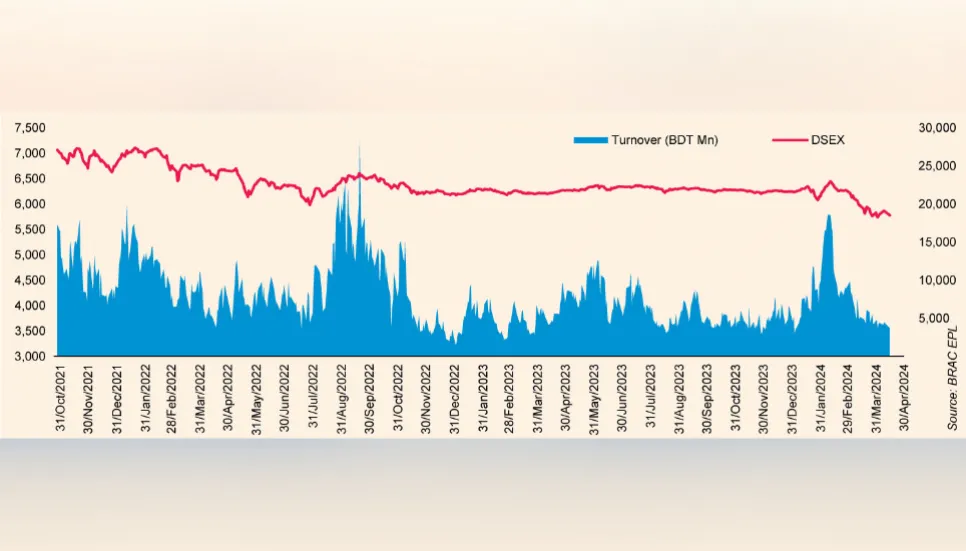

Apparently, the market turnover fell to a three-month low, declining by 17.2 per cent to Tk 367.53 crore as against Tk 443.84 crore posted in the previous session on Monday.

During the last 26 years, the exports of Iran to Bangladesh have increased at an annualised rate of 10.4 per cent, from $5.02 million in 1995 to $66.2 million in 2021.

In 2021, Bangladesh exported goods worth $29.7 million to Iran. There were no main exports from Bangladesh to Iran in 2021, according to the trade information.

DSEX, the prime index of the Dhaka Stock Exchange (DSE), has dipped by 85.32 points or 1.45 per cent to 5,778.77.

Two other indices also ended sharply lower with the DSE 30 Index, comprising blue chips, plunging 17.48 points to finish at 2,014.89, and the DSE Shariah Index (DSES) lost 16.28 points to close at 1,266.02.

Risk-averse investors preferred to reduce their capital market exposure owing to concerns regarding the market outlook, while most investors remained on the sidelines in order to observe the direction of the market trend, said EBL Securities in its daily market review.

The capital bourse of the country observed a major setback in the first session of the week after the Eid holiday as investors were rattled on the trading floor, being wary of the probable impact of the prevailing geopolitical crisis on the market's momentum, it added.

Out of the 396 issues traded, 31 advanced, 336 declined and 29 remained unchanged. Fu-Wang Food topped the turnover chart, followed by Malek Spinning Mills Ltd, Karnaphuli, Lovello and SP Ceramics.

Deshbandhu was the day's top gainer, posting 7.28 per cent gain while Anlimayarn Dyeing Ltd was the worst loser, losing 7.93 per cent. BRAC EPL Stock Brokerage, another market reviewer, pointed out that all listed large-cap sectors posted negative performance.

NBFI experienced the highest loss of 2.79 per cent, followed by Fuel & Power 1.99 per cent, Food & Allied 1.95 per cent, Engineering 1.85 per cent, Pharmaceutical 1.24 per cent, Bank 1.07 per cent, and Telecommunication 0.98 per cent, respectively.

Block trades contributed 6.9 per cent of the overall market turnover. Fu Wang Food Ltd. (+5.7 per cent) was the most traded share with a turnover of Tk 14.2 crore, BRAC EPL added.

On the sectoral front, Pharma 18.0 per cent issues exerted the highest turnover, followed by Textile 13.6 per cent and Food 13.3 per cent sectors.

All the sectors displayed dismal returns, out of which Ceramic 4.0 per cent, Financial Institutions 2.6 per cent and Life Insurance 2.4 per cent exerted the most corrections on the bourse Monday.

The Chittagong Stock Exchange (CSE) also ended sharply lower with the CSE All Share Price Index – CASPI – losing 189.38 points to settle at 16,543.78 and the Selective Categories Index – CSCX shedding 114.03 points to close at 9,945.30.

Of the issues traded, 135 declined, 30 advanced and 14 issues remained unchanged on the CSE. The port city's bourse traded 22.88 lakh shares and mutual fund units with turnover value worth about Tk 8.79 crore.