When the main Dhaka Stock Exchange (DSE) index DSEX fell 32 points earlier this week and rose 21 points the next day, many assumed that the market correction had stopped the fall.

But consecutive declines during the week’s remaining three working days only increased investors' reluctance to make new investments.

Amidst such a decline, the capital market regulatory body reduced the rate of decline in the share prices of listed companies, but it has not improved investor confidence. Rather, the index fell by 60 points on Thursday after the Bangladesh Securities And Exchange Commission (BSEC) announced that decision on Wednesday.

Under the circumstances, market stakeholders say, the continued decline of the capital market index has left the investors with little confidence.

In particular, the inactivity of institutional investors after the index’s consecutive fall from April 15 to April 18 in the previous week has discouraged general investors from taking new investment decisions.

Between April 21 and April 25, the index rose only one day in 5 days of trading as investors were more focused on selling shares to protect their investment. As a result, the regulatory body initiative did not work as intended in the capital market.

The BSEC issued an order on Wednesday recalibrating the circuit breaker, saying that the stocks of listed companies would not be allowed to fall more than 3 per cent based on the previous day's closing price. It was previously 10 per cent.

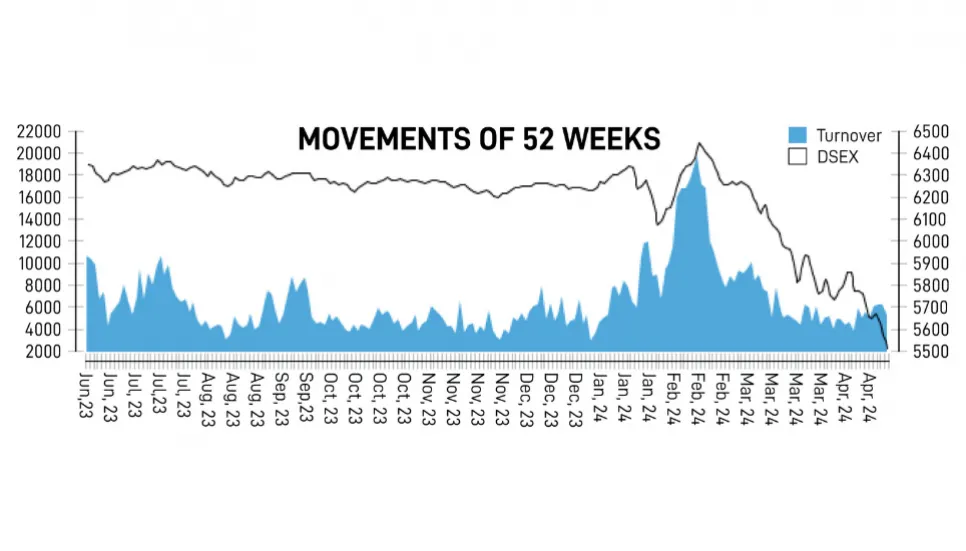

Last week started on a negative note at 0.58 per cent or 32.97 points on Sunday, 21 April.

Then it turned positive on Monday at 0.37 per cent or 21.15 points, On Tuesday, the market again ended negatively at 41.25 points or 0.73 per cent, on Wednesday at 0.97 per cent or 54.63 points, and Thursday 1.08 per cent or 60.48 points.

In last week's Dhaka Stock Exchange, 57 companies rose, 327 companies fell and 10 companies remained unchanged.

The benchmark index of the capital bourse extended its free fall, hitting its lowest point in three years, as investor sentiment failed to rebound despite several regulatory initiatives to improve investor confidence and clutch down the prolonged pessimism pervading the trading floor, EBL Securities, a stock brokerage said in its weekly market review.

However, the capital bourse concluded the week, experiencing some buying appetite from bargain hunters, particularly in small paid-up stocks, anticipating short-term gain opportunities following the prolonged correction in the market, it added.

Last week, the main index DSEX lost 2.96 per cent or 168.21 points, and closed the week at 5,518.48 points. The blue-chip index DS30 lost 0.51 per cent or 10.06 points and stood at 1,974.51 points.

The Shariah-based index DSES also lost 2.35 per cent or 29.29 points, and stood at 1,217.27 points.

The large cap index CDSET lost -28.60 points or -2.66 per cent and closed at 1,047.39 points. DSEX, DS30, DSES and CDSET showed YTD returns of -11.65 per cent, -5.70 per cent, -10.77 per cent, -12.92 per cent, respectively.

Investor's participation in the market has continued to increase as average turnover increased by 15.6 per cent to Tk 553 crore as compared to Tk 478.2 crore in the previous week.

Investors were mostly active in the pharmaceutical sector (22.9 per cent), followed by the food sector (13.4 per cent) and textile sector (12.0 per cent). Most of the sectors ended in red with the financial institutions sector (8.1 per cent) being the biggest loser.

The Chittagong Stock Exchange (CSE) last week also ended sharply lower with the CSE All-Share Price Index – CASPI – losing 2.63 per cent to settle at 15,815.75 and the Selective Categories Index - CSCX shedding 2.50 per cent to close at 9,521.92

Among the issues traded last week, 247 declined, 45 advanced and 15 issues remained unchanged on the CSE.

Last week, the port city's bourse traded 2.31 crore shares and mutual fund units with turnover value worth around Tk 81.57 crore.