Bangladesh RACE Management PCL, which manages 10 closed-end mutual funds with holdings totalling approximately Tk 3,000 crore in the country’s capital market, has claimed that 100 per cent of its assets are secure and safe.

As much as 97 per cent of the assets are with custodians Investment Corporation of Bangladesh (ICB) and BRAC Bank.

The leading asset management company, with 49.2 per cent of the total mutual fund sector of the country, on Tuesday made the claim in a letter sent in response to an order issued by the Bangladesh Securities and Exchange Commission (BSEC) on Monday.

The fund’s manager assured the BSEC and all stakeholders that all listed and non-listed securities of mutual funds are securely held by the custodians, with 97 per cent of the assets under the supervision of respective custodians. The remaining assets are also managed under strict protocols to ensure their safety and integrity.

RACE in the letter said that various types of mutual fund accounts; including custodian Depository Participant (DP) Accounts, custodian DP and brokerage trading omnibus accounts, brokerage trading (parent) accounts, brokerage trading (link) accounts, brokerage suspense accounts, brokerage fractional accounts, serve distinct and valid purposes in the lawful management and settlement of mutual fund transactions.

These accounts ensure that all mutual fund operations are conducted with the utmost transparency and security, RACE said.

All mutual fund assets are held in custody by custodians ICB and BRAC Bank under the direct supervision of trustees of ICB and Bangladesh General Insurance Company Ltd (BGIC), which guarantees their security and makes misuse impossible, it said.

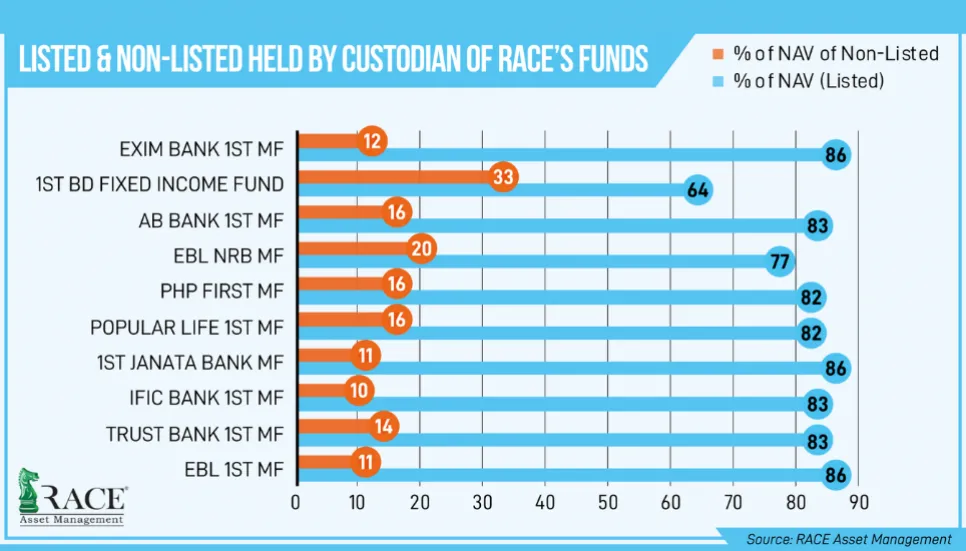

Listed shares, which constitute about 80 per cent of mutual fund assets, are held in custodian DP accounts as per trust deeds and custodian agreements, it added.

As evidence of the secure custody of these assets, DP A6 reports for closed-end mutual funds as of May 31, 2024, are being submitted to BSEC. These reports, along with mutual fund reports on listed and non-listed shares, demonstrate that ICB and BRAC Bank hold 97 per cent of mutual fund assets securely, including listed shares valued at Tk 2,496.54 crore (about 80 per cent of fund assets) and non-listed securities (about 17 per cent of fund assets).

The stock market regulator on Monday suspended several beneficiary owners’ (BO) accounts of RACE Asset Management to protect the interests of unitholders of the mutual funds.

BSEC said the asset manager opened and maintained BO accounts in different brokerage houses, namely Multi Securities, Smart Traders and Trust Bank Securities, for the mutual funds under its management.

This is a breach of rules, as securities under mutual funds are supposed to be kept in the safe custody of the approved custodian of the respective mutual fund.

According to the order, each concerned party of the mutual funds under the management of RACE will report to BSEC in detail about their steps and compliance status under this order within the next 10 working days from the issuance of the order.

Despite a court ruling, the bank accounts of RACE and its funds remain frozen. In response, RACE has applied to reopen these accounts, prioritising the interests of the concerned parties and investors.

A RACE Asset Management shareholder, allegedly acting in their own volition, reportedly claimed to be the authorised bank signatory for the company's mutual funds. However, RACE denied the request, citing regulations governing mutual funds.

The disgruntled shareholder, upset by the company's refusal, filed a complaint with BSEC. This prompted BSEC to freeze the company's fund accounts despite a prior court order to maintain the status quo.

In the last five years, RACE has paid Tk 683.43 crore to unitholders as cash dividends for all mutual funds.

RACE appreciates the investors' understanding and patience as it ensures full compliance with regulatory requirements and continues to safeguard the interests of its unitholders, it said.