Dhaka Stock Exchange’s (DSE) market capitalisation-to-gross domestic product (GDP) ratio declined significantly in the just concluded FY2023-24 as the key index continued to plunge, taking a cue from the weak macroeconomic front.

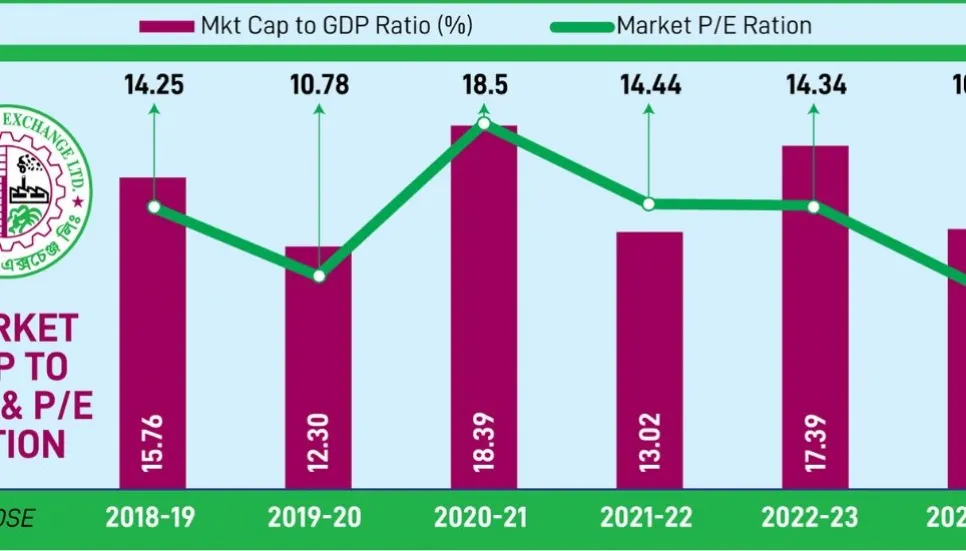

The prime bourse’s market cap-to-GDP ratio stood at 10.22 per cent as of the end of FY24, down from 17.39 per cent in the previous FY2022-23. It had climbed to its peak at more than 50 per cent in 2010 just ahead of the market crash. It was 24 per cent in 2014.

Meanwhile, the overall price-earnings (P/E) ratio of DSE reached rock bottom at 10.22 at the end of FY24, an eight-year low amid the freefall of stock prices, which was 14.34 in FY23.

The PE ratio is a valuation ratio of a company's current share price compared to its earnings per share. It also determines the time an investor needs to wait to get back the invested amount. It is an indicator for considering the extent of risks an investment might entail.

In FY24, it was a complete mess for the stock business and a year of disappointment for the capital market as the average turnover and foreign investment hit rock bottom, which had never been encountered by investors at such a bad time since the 2010 collapse.

Market capitalisation, or market cap, is calculated by multiplying the total number of a company’s outstanding shares by the current market price of shares.

The market capitalisation of DSE was Tk 6,62,155 crore at the end of FY24, which was Tk 7,72,078 crore at the opening market cap of the fiscal year. In the last year, the market capitalisation of the DSE fell by 14.24 per cent.

DSEX, the key index of DSE, ended at 5,328.40 points on the last trading session of FY24, which was 6,344.09 points on the first trading day of the year.

In FY24, DSEX fell by 16.01 per cent, compared to 0.52 per cent in FY23.

Meanwhile, in FY24, the DSE’s average daily turnover fell by 21.57 per cent to Tk 621 crore. It was Tk 792 crore in FY23.

The market has been unable to maintain its early upward momentum because investors started dumping equities, taking every bounce back as an opportunity to exit the bearish market, said a top executive of a leading brokerage house.

However, investors should not look at the market cap-to-GDP ratio in isolation, as there are a few mitigating factors for the rise and fall of the market, he said.

“The stock market is a good source of funds. But its true potential still remained untapped. To attract entrepreneurs, the government needs to set an example by offloading shares of state-owned companies,” he added.

Attracting good companies, simplifying the listing process and bringing in government and multinational companies will help the market grow, said a stock market analyst.

Market analysts attributed investors’ worries over the country’s weak macroeconomy and the global economic outlook due to the Russia-Ukraine war to the market’s recent sharp downturn.

Although the stock market regulator, the Bangladesh Securities and Exchange Commission (BSEC), has taken many initiatives to correct the market’s behaviour, the market has remained unstable for a long time.

Despite the capital market almost moving in an isolated manner, the Russia-Ukraine war has affected the Dhaka bourse rudely. However, a newly added macroeconomic challenge arose from tightened money market conditions following the latest policy rate hike, which hampered the market’s recovery and led to the misposition of a new tax on capital gains.

On July 28, 2022, the BSEC imposed floor prices on all securities to prevent shares from falling beyond a certain level amid domestic and global macroeconomic strains.

Because of the unstoppable market fall, investors are now afraid of making long-term investments, causing a severe liquidity crunch in the prime market.

On January 18, 2024, BSEC rescinded the floor price for all listed companies and mutual funds, except for 35 companies’ shares, complying with a long-standing demand from stakeholders. The floor price for the remaining 35 companies was removed later in phases as well.

Then in April, BSEC issued an order recalibrating the circuit breaker, saying that stocks of listed companies would not be allowed to fall more than 3 per cent from 10 per cent based on the previous day's closing price.

Other reasons are sell-offs by foreign investors and investors' lack of confidence because of disappointing data on major macroeconomic indicators.

A leading stock broker, requesting anonymity, told The Business Post that the big problem in the market was the floor price imposed by the stock market regulator. “This resulted in low-volume trades in the market for the last two years. There was no new investment and no return. The incomes of all stakeholder groups in the market have declined.”

Market insiders said that the market endured continuous volatility throughout the year, while the pre- and post-budget negative sentiment among investors caused the benchmark index to extend its correction mode for back-to-back sessions.

Stock market analyst Abu Ahmed, an honorary professor at Dhaka University’s economics department, said, “If our capital market was three to four times bigger than the current size of our capital market, then there would be no reason to impose a capital gain tax on this market.

“The market has shrunk from being blown to 12 per cent of the GDP ratio. That market was once above 30 per cent. I think it’s right not to hit on it again.”