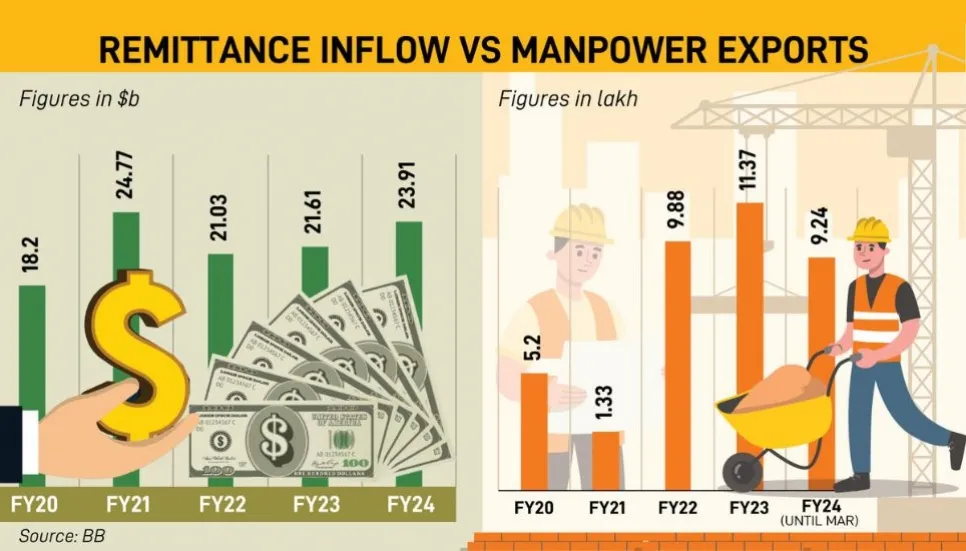

Bangladesh’s remittance inflow for the just concluding financial year (FY24) is on the upswing, certainly a blessing for an economy suffering from persistent USD shortages. The country received $23.915 billion remittance income in FY24, a year-on-year rise of 10.64 per cent.

The figure is also the second highest in the country’s history, training just behind the Covid-19 era. During the pandemic in FY21, Bangladesh earned $24.77 billion remittance, which remains the highest ever for the country.

This figure was $21.03 billion in FY22 and $21.61 billion in FY23.

For the single month of June FY24, the country received $2.542 billion in remittance, which is 47-month high and 15.59 per cent higher compared to the same month previous year, Bangladesh Bank spokesperson Mezbaul Haque confirmed the matter on Monday.

Experts point out that the boost was mostly caused by the Eid-ul-Azha celebrations in June. Besides, as the country is under significant inflationary pressure, remitters are sending more remittance than before due to increased expenses of their families at home.

Speaking to The Business Post, Centre for Policy Dialogue Distinguished Fellow Mustafizur Rahman said, “It is true that the country’s June remittance jumped, but the inflow has been significant throughout the whole FY24, when compared year-on-year.

“I personally believe that the leap in inflow is a direct result of a lessening gap between the official and unofficial markets, made possible by quite generous incentives.”

Experts believe that after the Covid-19 pandemic, the amount of manpower exported was bigger than the period preceding this crisis. So, more remittance should have arrived through legal channels. But this is not the case.

Bangladesh had exported 5.2 lakh manpower in FY20, 1.33 lakh during the pandemic year FY21, which later jumped to 9.88 lakh in FY22. Moreover, this number stood at 11.37 lakh in FY23, and 9.24 lakh during the first nine months [July-March period] of FY24.

Addressing this particular issue, Mustafizur said, “In the last three years, nearly 26 lakh Bangladeshis went overseas to work, which contributed positively in boosting remittance. However, remittance from Saudi Arabia – our single biggest source of inflow – has dipped.

“If the Bangladesh Bank scrutinises why the remittance is dipping from Saudi Arabia, and takes necessary steps, I believe the inflow will go up again.”

According to the Bangladesh Bank, the country received $4.54 billion from KSA in FY22, which declined to $3.76 billion in FY23. The latest figures, recorded during the July-May period of FY24, put the amount at $2.42 billion.

Although the government and the bank are providing 2.5 per cent incentive against remittance each, it is still not enough to curb hundi – an illegal channel of cross border transactions. Besides, different exchange rates for goods exports, imports and remittance is also choking remittance inflow against manpower exports.

To alleviate this situation, the central bank introduced the Crawling Peg system to set the exchange rate in the first week of May, in line with the International Monetary Fund’s (IMF) direction.

As a result, the value of the USD increased by Tk 7 in a day. Currently, the official rate of the USD is Tk 118, but unofficially, this rate exceeds Tk 120.

Remittance a boon for reserves

Remittance income plays a key role in strengthening Bangladesh's reserves. Because a large part of the income from exports is spent on imports. Only remittances add up to the full amount. This also stabilises the country’s balance of payment (BoP).

Although FY24 recorded the second highest remittance inflow in the country’s history, the reserves did not increase much due to an acute shortage of USD. However, the fall is slightly less because of this remittance inflow, experts say.

On this issue, Mustafizur said, “The reserves have gone up slightly. I have heard that the figure stands at $22 billion under the BPM-6 method. Of course remittance is the largest contributor behind this increase.

“We received some foreign loans, which add up to the reserves. But we spend those funds on imports for implementing projects. Remittance inflow is totally ours.”

The gross reserve position stood at $24.62 billion on June 26, but as per the IMF BPM-6 method, such amount was $19.47 billion on the same day, according to Bangladesh Bank data.

But after recently receiving $1.15 billion from the IMF, the final position of gross reserves stood at $27.15 billion on June 27. As per the IMF’s $4.7 billion loan programme, Bangladesh has to meet a net reserves position of $14.769 billion by June 30.

The central bank however does not disclose the net reserves position, but several media reports say it is around $13 billion at the end of June this year.