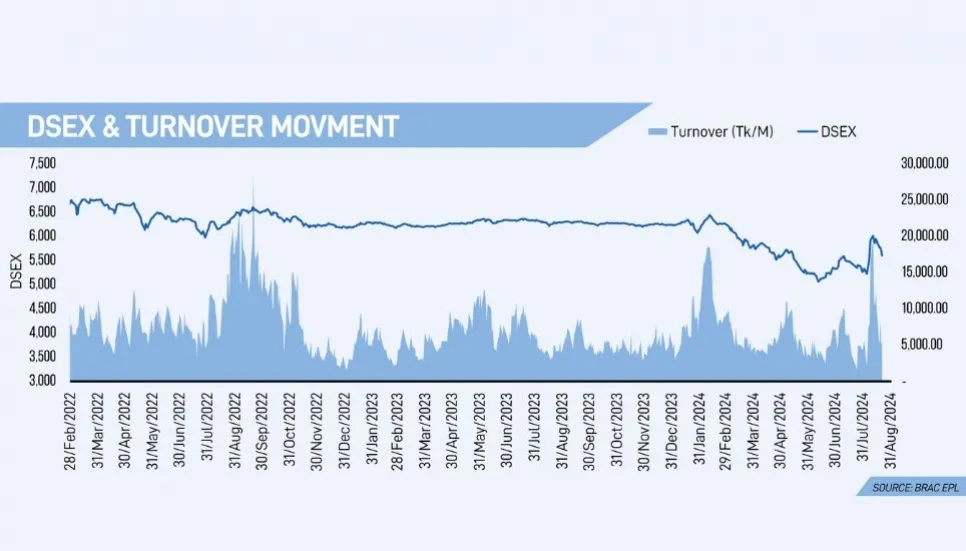

DSEX, the key index of the Dhaka Stock Exchange (DSE), plummeted by 108.4 points and settled at 5,607 points on Wednesday as the new leadership of the Bangladesh Securities and Exchange Commission (BSEC) is yet to take the reins of the situation.

Cautious investors opted to trim their exposure to capital market investments due to dwindling confidence amidst current market volatility, causing the broad index to extend its losing streak for five consecutive sessions.

DSEX lost 108.4 points, or 1.90 per cent, and closed at 5,606.96 on Wednesday. The blue-chip index, DS30, and the Shariah-based index, DSES, closed at 2,047.63 and 1,201.41 points, respectively. All the large-cap sectors also posted negative performances on the day.

However, market turnover slightly increased by 3.5 per cent to Tk 536 crore from the previous session’s Tk 518 crore. On the sectoral front, bank issues exerted the highest turnover, followed by the pharmaceutical and food sectors.

EBL Securities in its daily market review said that Dhaka stocks tumbled as investors went for heavy sell-offs right from the start of Wednesday’s session owing to uncertain market momentum with the new leadership in the stock market regulator yet to settle down.

The ongoing board reformation of particular companies and measures against certain influential figures also triggered fresh concerns across the trading floor, it said.

Of the 397 issues traded, 11 advanced, 369 declined and 17 remained unchanged at DSE.

Market insiders said that DSE extended its downbeat vibe for the fifth straight session as investors remained vigilant due to the prevailing volatility and weakened market strength, with confidence yet to rebound following the introduction of new leadership at BSEC.

Sellers remained predominant across the trading floor, causing the majority of scrips to extend their correction mode, they said.

BRAC EPL in its daily review said that Telecommunication experienced the highest loss of 2.97 per cent followed by Food & Allied, NBFI, Engineering, Fuel & Power, Pharmaceutical and Bank.

Block trades contributed 10.7 per cent of the overall market turnover. Square Pharmaceuticals, 1.2 per cent was the most traded share with a turnover of Tk 74.6 crore.

Meanwhile, the Chittagong Stock Exchange (CSE) also settled on red terrain on Wednesday, with the selected indices, CSCX, and the All Share Price Index, CASPI, losing 138.0 and 227.7 points, respectively.

Market insiders said that the lack of leadership at DSE has created uncertainty among investors. Due to this, investors are taking some caution when making new investments.

After the Sheikh Hasina-led government fell in a mass uprising on August 5, many of the investors who were active in the market took their profits and went back to the sidelines. Due to this, the sales pressure in the market has increased but there are fewer buyers, they said.

Hafiz Md Hasan Babu resigned as the DSE chairman citing personal reasons on Sunday night. He submitted a resignation letter to the Bangladesh Securities and Exchange Commission (BSEC) through an email, and a copy of the resignation was also sent to the top DSE officials.

The resignation came a week after the DSE Brokers Association (DBA) demanded his removal from the post.

On August 10, the then BSEC chairman Prof Shibli Rubayat-Ul Islam resigned along with two other commissioners — Prof Rumana Islam and Shaikh Shamsuddin Ahmed.

The Financial Institutions Division of the Ministry of Finance issued a circular last Sunday announcing the appointment of banker Khondoker Rashed Maqsood as the new chairman of the stock market regulator for the next four years.

Niaz/Awenim/