DBH Finance PLC, a non-banking housing finance institution, is grappling with fierce competition from the state-run Bangladesh House Building Finance Corporation (BHBFC), which offers home loans at significantly lower interest rates.

According to an equity note issued by EBL Securities Ltd, BHBFC's home loan interest rates range between 8.5 per cent and 10.0 per cent, while DBH Finance's rates are notably higher, ranging from 13.5 per cent to 15.5 per cent. This disparity is attributed to BHBFC's lower cost of funds, making it a more attractive option for borrowers.

In fiscal year 2023, DBH faced a cost of funds at 7.4 per cent, with deposits accounting for 83.3 per cent of its funding. While the loan portfolio of BHBFC expanded at a Compound Annual Growth Rate (CAGR) of 7.8 per cent, DBH's loan portfolio saw an average decline of 0.5 per cent from 2019 to 2023.

According to EBLSL equity note, DBH's business model is heavily reliant on the real estate sector, making it highly vulnerable to macroeconomic fluctuations. These fluctuations have negatively impacted the company's loan portfolio growth, especially during economic downturns. The rise in construction material prices further slowed the real estate sector, contributing to a 1.9 per cent decline in DBH's loan portfolio in 2023.

Although DBH has the edge in having better quality asset among the listed NBFIs, with a NPL ratio of just around 0.9 per cent, as the company is mainly engaged in mortgage-based lending, which is generally more financially secure compared to other types of lending.

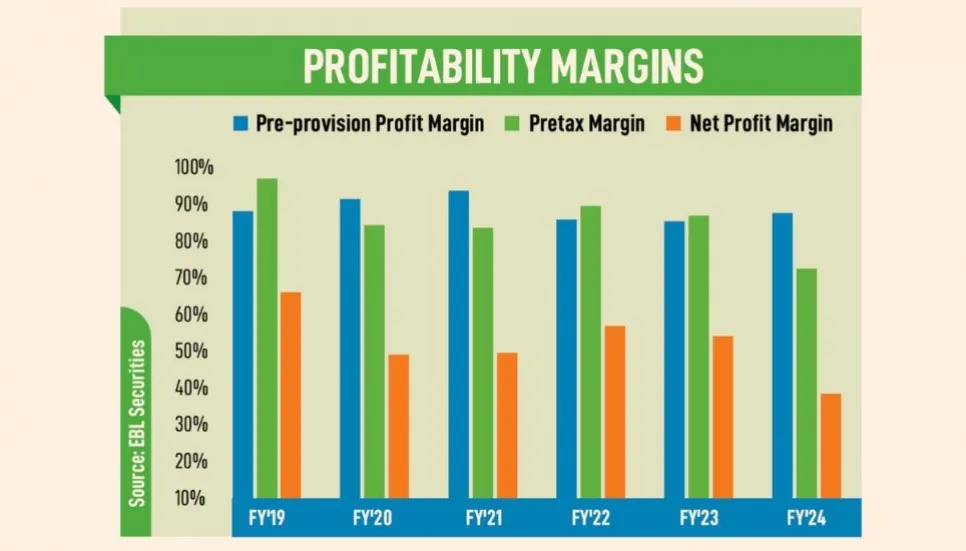

Declining YoY profit

BRAC, the largest NGO of the world, is one of the owners of DBH by owning 18.4 per cent stake as a sponsor-director. BRAC has the reputation for being the sponsor of well-managed and highly successful financial institutions like BRAC Bank, IPDC and bKash.

Currently, DBH is engaged in providing loans for the construction of houses, purchases of flats or houses, extensions and renovations of existing houses or flats and the purchase of housing plots. The publicly traded company also offers deposit schemes for its individual and corporate clients.

EBL Securities’ equity report also mentions that the net interest margin of DBH has been declining from 3.7 per cent since 2021 and stood at 2.4 per cent as on the first half of 2024, mainly due to an increase in deposit rate from 5.9 per cent to 9.5 per cent.

Meanwhile, DBH Finance received consent to raise Tk 550 crore by issuing non-convertible redeemable fixed coupon senior bond with a tenure of up to five years, through private placement. International Finance Corporation (IFC) will solely subscribe to Tk 350 crore of this bond.

DBH reported a year-on-year profit decline of 33.58 per cent in the first quarter of 2024 due to keeping up a provision, which is the company’s lowest in the last six years.

The housing institution posted Tk 17.24 crore in net profit in the January-March quarter this year, compared to Tk 26.10 crore recorded in the same quarter of the previous year. DBH stated that due to the lifting of floor price, share prices of some blue chip stocks significantly dropped, and the company has to keep a provision of Tk 8.64 crore against its capital market investments – which is 9.4 per cent of all investment in listed securities.

This move resulted in less profit after tax, and the profit has decreased for Q1’24, compared to the preceding year, it added. Besides, loan disbursement rose by Tk 50 crores in Q1 of 2024, compared YoY.

Q1’24 EPS fell

The listed company’s Earnings per Share (EPS) for the Q1’24 fell to Tk 0.87 from Tk 1.31 recorded for the Q1’23. However, its Net Asset Value (NAV) per share increased to Tk 44.50 at the end of March’24, from Tk 43.63 recorded at the end of December’23.

DBH’s Net Operating Cash Flow per Share (NOCFPS) was negative Tk 1.86 for the January-March quarter of 2024, compared to Tk 7.93 posted in last year’s same quarter.

Deposits have decreased by Tk 155 crores in Q1’24 compared to Q1’23 due to an increase in deposit rates from the end of 2023, caused by the deviation in NOCFPS.

According to the financial report, the company earned interest income of Tk 169.05 crore for 2023, compared to the income of Tk 133.93 crore in the same period of the previous year.

Income from investments totalled Tk 11.62 crore in the Q1’23, compared to Tk 3.09 crore in the same period of the preceding year. The company's investment data showed a total investment of Tk 847.73 crore, compared to Tk 516.50 crore recorded in the same period of the previous fiscal.

Among DBH’s gross investments, ventures in government securities was worth Tk 749.50 crore in 2023, compared to Tk 418.55 crore posted in the same period of the previous calendar year, and investment in other sectors totalled Tk 98.23 crore, compared to Tk 97.95 crore in the same period last year.

Since its inception in 1996, DBH Finance PLC has registered commendable growth in creating homeownership all over the country. Its share price stood at Tk 43.50 on the Dhaka bourse on Tuesday.