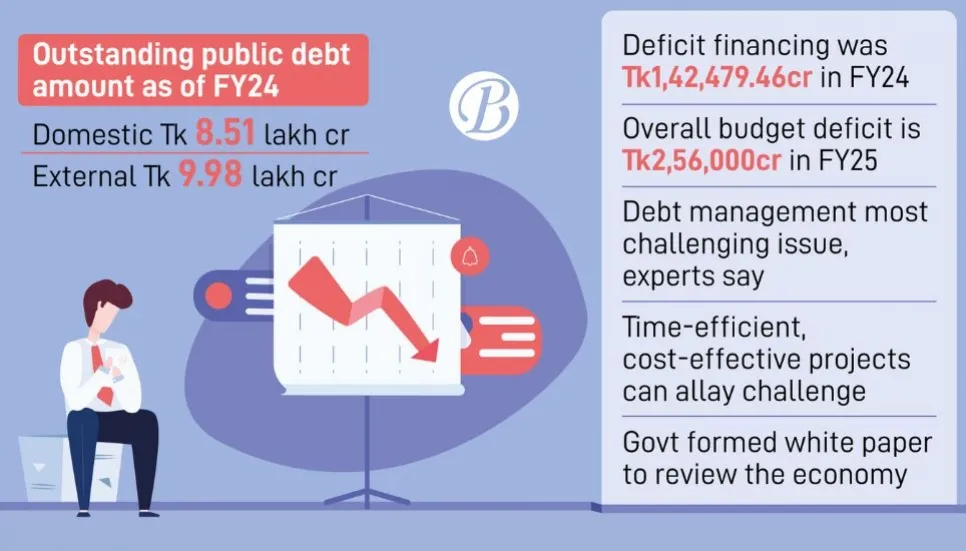

Bangladesh’s total public debt, comprising both foreign and domestic liabilities, reached Tk 18.5 lakh crore at the end of FY24, placing a significant financial burden on the population. Of this, $83,215.06 million, or Tk 9,98,580.72 crore, accounts for external debt, while domestic debt stands at Tk 8,51,219.32 crore, according to the latest figures released by Bangladesh Bank.

When combined, the total public debt amounts to Tk 18,49,800.04 crore at the close of FY24. With Bangladesh Bureau of Statistics (BBS) data indicating a population of 172.92 million, the per capita debt stands at Tk 1,06,974.32.

Analysts note that during Sheikh Hasina’s regime, the government undertook numerous mega projects that contributed to the country's mounting debt burden. Following the Boishommo Birodhi Chhatra Andolon movement, the Hasina administration collapsed on August 5, prompting her swift departure to India.

Before fleeing, Hasina left Bangladesh's economy in a dire state, grappling with a prolonged shortage of USD and a steady depletion of foreign reserves. This economic strain triggered a sharp rise in exchange rates, which subsequently pushed up the prices of essential commodities, further escalating inflation and the overall cost of living.

A challenging period ahead

Professor Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue (CPD), told The Business Post, “We are facing a very challenging situation as the grace period for many loans is coming to an end. Now, we must start repaying the principal amounts, which will significantly increase the debt burden.

“For example, once the grace period of the Rooppur Nuclear Power Plant (RNPP) loan ends, principal repayments will begin in 2026. This is why the interim government has initiated discussions on how to extend the repayment period,” said the eminent economist, who is also a member of the committee responsible for drafting a White Paper on Bangladesh's economy.

The interim government has established a 12-member committee, chaired by Debapriya Bhattacharya, another distinguished fellow of CPD, to draft the White Paper on the current economic situation.

Budget financing

According to data from Bangladesh Bank, the government financed a total of Tk 1,42,479.46 crore in the last fiscal year to cover the budget deficit. Of this amount, Tk 37,563.80 crore was borrowed from the banking sector and Tk 12,893.94 crore from non-banking sources, with Tk 92,021.72 crore sourced from net foreign financing.

The revised budget for FY24 was set at Tk 7,14,418 crore, down from the initial Tk 7,61,785 crore. The revised budget deficit was projected at Tk 2,32,918 crore. Of this, net foreign financing was estimated at Tk 76,293 crore, while domestic financing was pegged at Tk 1,56,625 crore, including Tk 1,55,935 crore from the banking sector.

Prof Mustafizur Rahman said most of the revenue collected was spent on recurrent expenditures, leaving the entire development budget reliant on borrowing. Therefore, the loans taken to cover the budget deficit were used for the implementation of development projects.

“It is crucial to ensure that the loans are invested in time-efficient and economically viable projects. If that is done, debt will not feel like a burden to us,” he added.