Although the export of hilsa is generally prohibited, Bangladesh makes an exception for India each year in the run-up to Durga Puja. For the past five years, Bangladesh has allowed the export of its prized fish to its neighbouring country.

This year, the interim government has approved the export of 3,000 tonnes, ensuring that Indian consumers, particularly in West Bengal, can enjoy the national delicacy ahead of the festival starting on October 8.

Many in Bangladesh believe that this export drives up the price of hilsa, making it inaccessible to the general public during its monsoon season, when the fish is typically abundant. However, a closer look at the data shows that hilsa exports account for less than 0.29 per cent of the country’s total production.

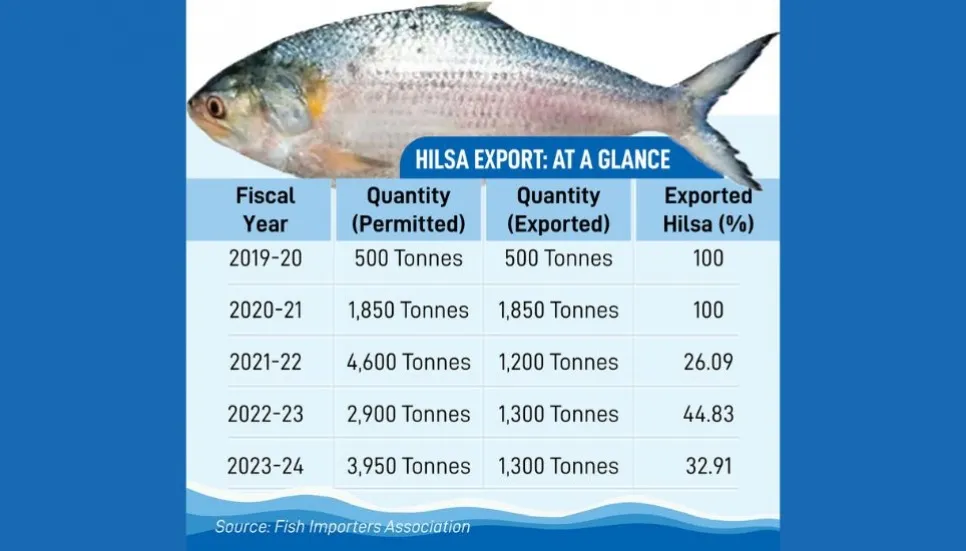

According to data from the Kolkata-based Fish Importers Association (FIA), Bangladesh approved the export of 3,950 tonnes of hilsa to India in the fiscal year 2023-24, but only 33 per cent of that quota was utilized, with 1,300 tonnes actually exported.

Yet, the price of hilsa continues to rise, leaving many to wonder — why are local prices still climbing, despite such minimal exports?

Rumours fuel price surge

Experts said that the price surge is driven by two key factors. First, the price of hilsa rises as it changes hands multiple times throughout the supply chain. Second, the mere rumour of exports is enough for some traders to inflate prices, even when actual export volumes are minimal.

Hilsa, recognized as Bangladesh’s Geographical Indication (GI) product since 2017, has been under an export ban since 2012, except for limited exports to India during religious festivals.

However, hilsa was conditionally included in Bangladesh's list of exportable products under the Bangladesh Export Policy 2015-2018, published on September 6, 2015. This inclusion has remained unchanged through the following two export policies. Since 2019, hilsa exports to India have resumed annually during Durga Puja, largely as a goodwill gesture.

According to a commerce ministry official, in recent years, only about half of the approved export quantities of hilsa have actually been shipped to India. According to government and non-government data, in the first two years of approval, 100 per cent of the allotted hilsa was exported, but since then, exports have consistently fallen short of the permitted volumes. Over the past three years, only 26-44 per cent of the approved quota has been exported.

Limited export window

The FIA data shows that in fiscal year 2019-20, the Bangladesh government approved the export of 500 tonnes of hilsa to India, all of which was imported while 1,850 tonnes were approved and exported in full in fiscal year 2020-21.

However, in fiscal year 2021-22, only 1,200 tonnes, or 26.09 per cent of the approved 4,600 tonnes, were exported. In fiscal year 2022-23, around 1,300 tonnes were exported, representing approximately 44.83 per cent of the 2,900-tonne approval. Last fiscal year 2023-24, 1,300 tonnes were exported out of an approved 3,950 tonnes, which is 32.91 per cent of the total quota.

Exporters and importers of hilsa have blamed time limitations for the shortfall in exports, claiming the limited export window hampers their ability to fulfil the approved quota. They said the government typically grants only 15 days for exports, making it difficult for traders to complete the process in such a short time frame.

‘Hilsa should not be a diplomatic tool’

An analysis of the past five years' data reveals that hilsa exports account for just 0.29 per cent of Bangladesh's total production. According to the Ministry of Fisheries, Bangladesh produced 5,71,000 tonnes of hilsa in fiscal year 2023-24.

Data from the National Board of Revenue (NBR) shows that Bangladesh earned $3.95 million from hilsa exports in FY2019-20. This figure rose to $16.4 million in FY21, followed by $12.4 million in FY22 and $13.8 million in FY23. Last fiscal year, FY24, hilsa exports generated $8 million, with the average export price per kilogram being $10.

Syed Anwar Maqsood, secretary of the Fish Importers Association (FIA), said, "The hilsa season lasts for three to four months, yet we have never imported more than 5,000 tonnes in any season. My question is—Bangladesh produces millions of tonnes of hilsa each season. If only 5,000 tonnes are exported to India, how does this significantly impact prices in Bangladesh?”

“Hilsa should not be used as a diplomatic tool, considering the vast needs of India. Rather, we should focus on enhancing its availability through other means," he added.