Home ›› 02 Aug 2021 ›› Stock

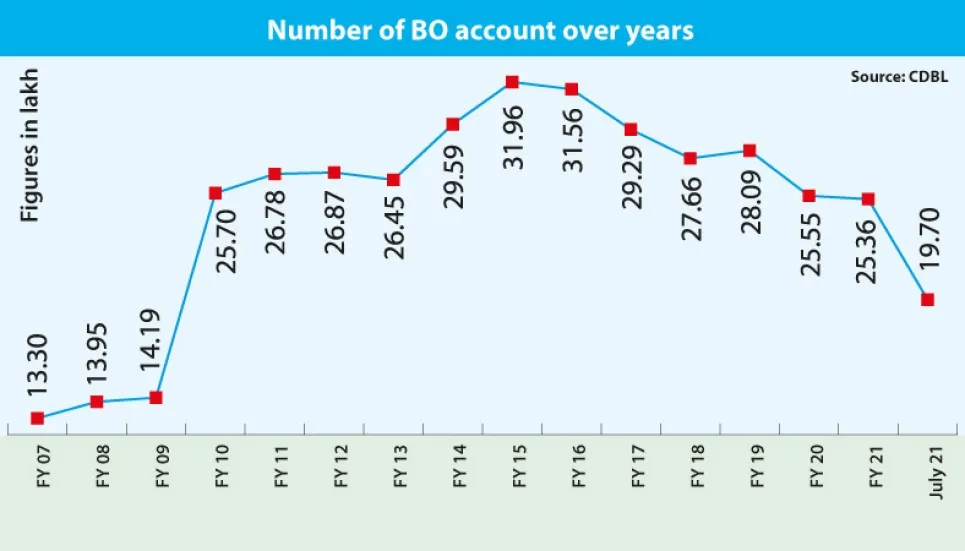

Despite having an upward trend in the country’s stock exchanges, Beneficiary Owners (BO) accounts came down to 19.70 lakh as of July 31, which was 25.36 lakh in June, amid ongoing Covid-19 pandemic.

The number is the lowest figure since the stock market crashed in 2010.

According to the Central Depository Bangladesh Ltd (CDBL) data, more than 2.14 lakh beneficiary owner (BO) accounts have closed in the first two and a half months of the ongoing 2020-21 fiscal year and another 5.66 lakh BO accounts were closed in the last month of the ongoing year.

The number of active BO accounts was 25.36 lakh on June 30 this year, which fell to 19.7 lakh on July 31.

DSEX, the key index of the Dhaka Stock Exchange (DSE), touched 6,424 points on July 25 in this year, which was highest since its introduction in 2013, as investors continued to pour in funds hoping for a better return.

Talking to The Business Post, stakeholders said a significant number of BO accounts have been closed due to non-payment of those renewal fees by the stock investors during the Covid-19 pandemic.

The number of active beneficiary owner (BO) accounts was 31.95 lakh in 2015, which was highest in the country.

Besides, in June, the stock market regulator the Bangladesh Securities and Exchange Commission (BSEC) has introduced pro rata basis allotment of initial public offerings (IPO).

Under the pro rata system, each IPO applicant gets shares if they have a minimum secondary market investment of Tk 20,000. Before, investors were used to offer Tk 5,000 when they subscribe to an IPO. A lottery is held with winners getting a set of shares.

Market insiders say the investors usually open new BO accounts to apply for IPOs. Only a small number of BO account holders are typically involved in the secondary market.

The IPO systems contributed to the exodus of investors who did not bother to renew their accounts by paying the annual fee, they said.

Abu Ahmed, stock market analyst and an honorary professor at the Dhaka University, told the Business Post, “Due to the newly introduced pro-rata system, there should be Tk 20,000 in a BO account. As such, the number of BO accounts has declined. Apart from this, I don’t see any other reason to reduce so many accounts in a month.”

He also said, maximum BO accounts were opened for IPO applications. They were not actually stock investors.

“By the numbers that we see now, we can call them real investors. They are the ones who will trade in the market regularly,” Ahmed added.

Former president of DSE Brokers Association of Bangladesh (DBA) Mostak Ahmed Sadek told The Business Post that the number of BO accounts had decreased due to the pro rata system for IPO.

Earlier, an investor used to maintain 10 to 20 BO accounts under different names to get an IPO. Now, a minimum investment of Tk 20,000 has been made for each account in the secondary market. It is not possible for one person to maintain more than one account under the new IPO system, he said.

According to the CDBL data, total BO account was 13.03 lakh in June 2007, 13.95 lakh in 2008, 14.19 lakh in 2009, 25.70 lakh 2010, 26.78 lakh in 2011 and 26.86 lakh in 2012.

While the BO account was 26.45 lakh in June in 2013, 29.58 lakh in 2014, 31.95 lakh in 2015, 31.55 lakh in 2016, 29.28 lakh 2017, 27.66 lakh in 2018, 28.09 lakh in 2019 and 25.55 lakh in 2020.

Currently, out of the total 1,970,333 accounts, 1,461,542 were being held by males and 494,374 by female investors.

A total of 1,865,175 BO accounts were owned by Bangladeshi investors and 90,741 accounts by non-resident Bangladeshis (NRBs), according to the CDBL data.

As per the existing rule, a person can open only a single BO account using his/her national identity card, bank account, and phone number.

Opening a BO account with the CDBL through a depository participant is mandatory for trading shares at stock exchanges. Back in 2016, BSEC also reduced the renewal fee to Tk450 from Tk500 for each BO account.

Earlier in February this year, the stock market regulator inaugurated the online beneficiary owners account opening system. The system allows stock investors, including non-resident Bangladeshis (NRBs), to open BO accounts from the convenience of their homes.