Home ›› 03 Aug 2021 ›› Stock

With improved turnover, DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), on Monday hit a record high since its inception in 2013 as the enthusiastic investors went on buying spree following the expansionary monetary policy for fiscal year 2021-22.

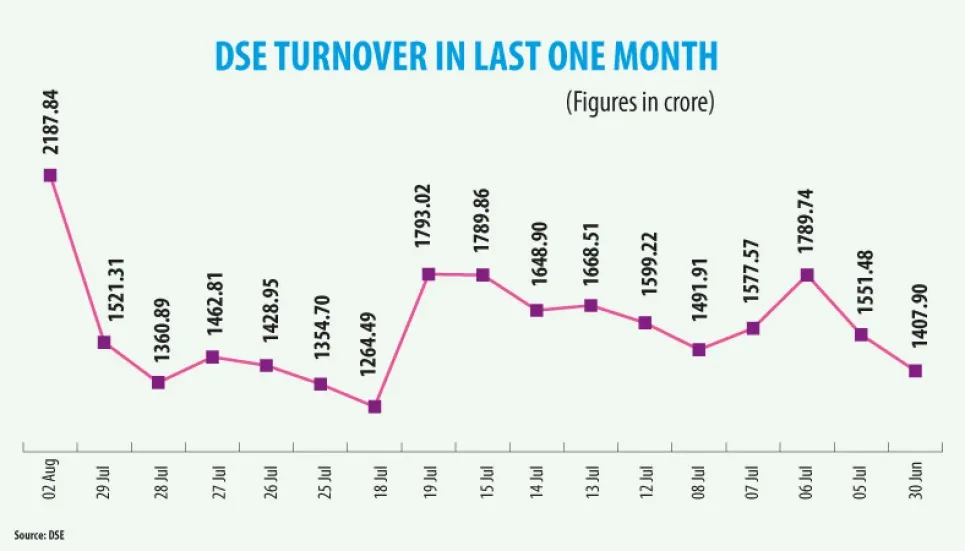

On the day, DSE’s turnover crossed Tk2,100 crore-mark after a span of one and a half months.

Investors were more positive in pouring funds to stocks following different types positive vibes in different sectors including textiles, engineering, pharmaceuticals and mutual funds.

The peak comes just after the Bangladesh Bank unveiled an expansionary monetary policy on July 28, focusing on recovery from the ongoing Covid-19- induced shocks which ravaged the country’s economy.

The DSEX, rose 56.31 points or 0.87 per cent to settle at 6,481 in the first trading day of the week, the highest since its inception in 2013.

The turnover stood at Tk2,188 crore, climbing by 43.81 per cent over the previous day’s transaction of Tk1,521 crore, which is huge jump in turnover within the two trading sessions.

The turnover is the biggest single-day transaction in the last 1.22 month since June 10 this year, when the turnover recorded Tk2,669 crore.

During the four-hour long trading on Monday, engineering sector dominated the turnover chart covering 17.08 per cent of the total turnover.

Other indices also ended higher with the DS30 index, comprising blue chips, advanced 16.22 points or 0.69 per cent to 2,344 and the DSE Shariah Index rose 11.10 points or 0.78 per cent to close at 1,412.

Of 375 issues traded, 232 advanced, 118 tumbled, and 25 remained unchanged in DSE.

Among major sectors, engineering, textile and services & real estate sectors experienced price appreciation while life insurance, general insurance and telecommunication sectors faced correction.

International Leasing Securities in its daily market commentary said the Dhaka stocks observed a superb session on Monday as the enthusiastic investors showed their buying appetite following the expansionary monetary policy stated by the central bank and gradual improvement of economic activities amid Covid-19 pandemic

The high-net-worth individuals and institutional investors preferred to inject money into the stock market as they hope the index will rise further as money flow in the banking sector may increase after the monetary policy statement which will help the market to get more liquidity, it said.

The brokerage house also said the bargain hunters took positions in sector specific issues especially in engineering, textile, financial institution, pharma, fuel & power and food sector stocks. Some others were reshuffling their portfolios based on the latest quarterly earnings disclosures and to book dividend income.

Another brokerage house, EBL Securities in its daily market commentary said that the continuation of expansionary monetary policy has turned investors positive on the bourse.

Moreover, the reopening of export-oriented factories has also stimulated investors’ buoyancy as they expect that the economy will resume normalcy riding on vaccine rollout in the country, it said. Beximco, the flagship company of Beximco Group, topped the turnover list with shares worth Tk 58 crore changing hands, closely followed by Saif Powertec, Orion Pharma, GPH Ispat and Fu-Wang Ceramic.

S Alam Cold Rolled Steels was the day’s best performer, posting a gain of 10 per cent while Prime Insurance was the worst loser, losing 9.89 per cent.

Meanwhile, the port city bourse, Chittagong Stock Exchange (CSE), also ended in positive terrain.

The selected indices (CSCX) and All Share Price Index (CASPI) advanced by 127.9 points and 223.3 points respectively.

The turnover value of Tk 73 crore in the CSE. Of the issues traded, 231 advanced, 69 declined and 23 issues remained unchanged on the bourse.